Australia’s Unemployment Rate steadies at 4.1% in May vs. 4.1% expected

Australia’s Unemployment Rate steadied at 4.1% in May from 4.1% in April, according to the official data released by the Australian Bureau of Statistics (ABS) on Thursday. The figure came in line with the market consensus.

Furthermore, the Australian Employment Change arrived at -2.5K in May from 87.6K in April (revised from 89K), compared with the consensus forecast of 25K.

The participation rate in Australia decreased to 67.0% in May, compared to 67.1% in April. Meanwhile, Full-Time Employment increased by 38.7K in the same period from 58.6K in the previous reading (revised from 59.5K). The Part-Time Employment decreased by 41.2K in May versus 29K prior (revised from 29.5K).

Sean Crick, ABS head of labour statistics, said with the key highlights noted below

Despite employment falling by 2,000 people this month, it’s up 2.3 percent compared to May 2024, which is stronger than the pre-pandemic, 10-year average annual growth of 1.7 per cent.

The employment-to-population ratio fell 0.1 percentage points to 64.2 per cent, and the participation rate fell 0.1 percentage points to 67.0 per cent.

Despite the slight fall in the employment-to-population ratio this month, the female employment-to-population ratio rose 0.1 percentage points to a record high of 60.9 per cent.

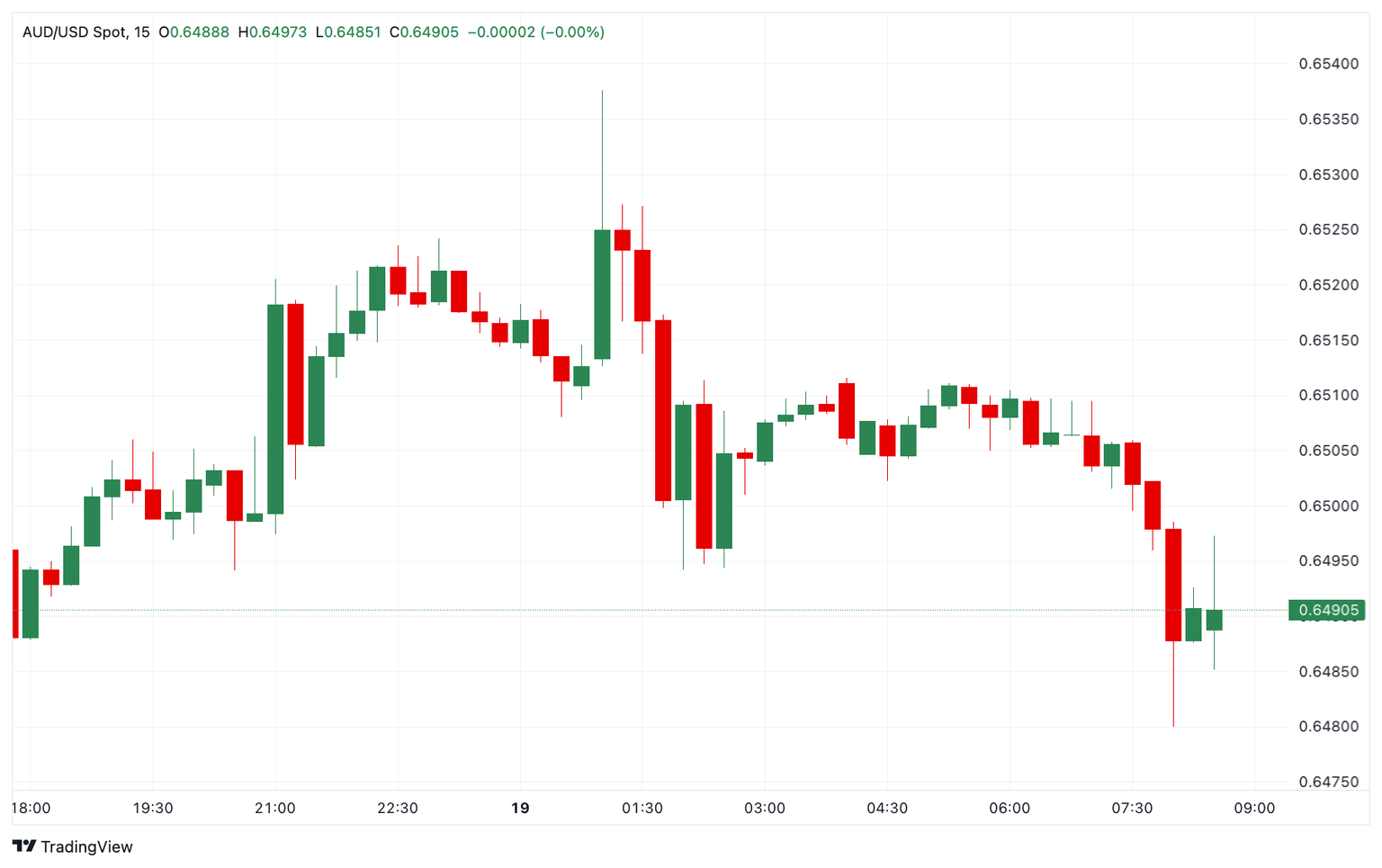

Market reaction to the Australia’s employment data

The employment data has little to no impact on the Australian Dollar (AUD). At the time of writing, the AUD/USD pair is trading 0.28% lower on the day to trade at 0.6490.

Australian Dollar PRICE This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.64% | 1.18% | 0.32% | 0.88% | -0.12% | 0.14% | 0.96% | |

| EUR | -0.64% | 0.42% | -0.32% | 0.24% | -0.63% | -0.48% | 0.32% | |

| GBP | -1.18% | -0.42% | -0.72% | -0.18% | -1.04% | -0.90% | -0.10% | |

| JPY | -0.32% | 0.32% | 0.72% | 0.53% | -0.74% | -0.53% | 0.22% | |

| CAD | -0.88% | -0.24% | 0.18% | -0.53% | -0.90% | -0.70% | 0.08% | |

| AUD | 0.12% | 0.63% | 1.04% | 0.74% | 0.90% | 0.14% | 0.96% | |

| NZD | -0.14% | 0.48% | 0.90% | 0.53% | 0.70% | -0.14% | 0.81% | |

| CHF | -0.96% | -0.32% | 0.10% | -0.22% | -0.08% | -0.96% | -0.81% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

This section below was published at 21:30 GMT on Thursday as a preview of the Australia Employment report

- The Australian Unemployment Rate is forecast to have held steady at 4.1% in May.

- Employment Change is expected to post a modest 25K advance after a 89K gain in April.

- The Australian Dollar should benefit from upbeat figures regardless of the market’s sentiment.

The Australian Bureau of Statistics (ABS) will release the May monthly employment report at 01:30 GMT on Thursday. The country is expected to have added 25K new job positions, while the Unemployment Rate is projected to hold steady at 4.1%. Ahead of the announcement, the Australian Dollar (AUD) retains its overall strength, and the AUD/USD pair trades near the 2025 high at 0.6545.

The Australian April employment report was upbeat, as the economy added 89K new job positions, including 59,5K full-time positions and 29,5K part-time ones.

The ABS Employment Change separately reports full-time and part-time jobs. According to its definition, full-time jobs imply working 38 or more hours per week and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally offers higher hourly rates but lacks consistency and benefits. This is why full-time jobs are given more weight than part-time ones when it comes to measuring the health of the labour market.

Australian Unemployment Rate seen steady in May

The Australian Unemployment Rate is expected to have remained unchanged at 4.1% in May, marking a third consecutive month of stability.

Employment data is relevant as it’s part of the Reserve Bank of Australia (RBA) mandate. The Monetary Policy Board sets the monetary policy “in a manner that it believes best contributes to both price stability and the maintenance of full employment in Australia.”

The minutes of the May meeting showed policymakers’ concerns revolved around the United States (US) President Trump's tariffs, and “how a persistent increase in trade barriers would affect the global economy.”

Regarding the labour market, the Board noted it had remained in line with the previous forecasts. “The unemployment rate had been around 4.1 per cent since the middle of 2024, while the underemployment rate had declined a little over that period. “Employment had recovered from the surprising fall recorded in February,” the document shows.

Other than that, some policymakers questioned whether this might see wages growth slow more noticeably than currently forecast.

Meanwhile, recent data showed that wage growth in the country has increased to 3.4% in the year to March, marking the first time wage growth has risen since the June quarter of 2024. Wages grew 0.9% on a quarterly basis in Q1 2025, up from the 0.7% posted in the previous quarter, according to the ABS.

Generally speaking, the upcoming Australian employment report, if the outcome matches expectations, is expected to have a limited impact on the Australian Dollar (AUD), as it is unlikely to affect future RBA monetary policy decisions. The central bank is scheduled to meet again in July.

Finally, financial markets may not pay much attention to data amid the ongoing Middle East crisis. The escalation of the Iran-Israel conflict and the involvement of the US maintain speculative interest in a risk-off mood. Additionally, the lack of progress in trade negotiations adds to the dismal sentiment.

When will the Australian employment report be released and how could it affect AUD/USD?

The ABS will publish the May employment report early on Thursday. As previously stated, Australia is expected to have added 25K new job positions in the month, while the Unemployment Rate is foreseen at 4.1%. Finally, the Participation Rate is expected to hold at 67.1%.

A better-than-anticipated employment report will likely boost the AUD, even if the more significant increase comes from part-time jobs. However, the advance could be more sustainable if the increase comes from full-time positions. The opposite scenario is also valid, with soft figures weighing on the Australian currency.

Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair trades near a recently achieved 2025 high at 0.6552, while posting higher highs on a weekly basis, keeping the dominant bullish trend alive. Given concerns about US economic progress within the trade war and its involvement in the Middle East crisis, the US Dollar (USD) seems poised to remain under pressure. In such a scenario, the AUD/USD pair may quickly find buyers should a discouraging employment report push it lower.”

Bednarik adds: “An upbeat employment report, on the other hand, can push the AUD/USD pair towards fresh 2025 highs, with the 0.6600 threshold in sight."

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

Unemployment Rate s.a.

The Unemployment Rate, released by the Australian Bureau of Statistics, is the number of unemployed workers divided by the total civilian labor force, expressed as a percentage. If the rate increases, it indicates a lack of expansion within the Australian labor market and a weakness within the Australian economy. A decrease in the figure is seen as bullish for the Australian Dollar (AUD), while an increase is seen as bearish.

Read more.Next release: Thu Jun 19, 2025 01:30

Frequency: Monthly

Consensus: 4.1%

Previous: 4.1%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) publishes an overview of trends in the Australian labour market, with unemployment rate a closely watched indicator. It is released about 15 days after the month end and throws light on the overall economic conditions, as it is highly correlated to consumer spending and inflation. Despite the lagging nature of the indicator, it affects the Reserve Bank of Australia’s (RBA) interest rate decisions, in turn, moving the Australian dollar. Upbeat figure tends to be AUD positive.

Author

FXStreet Team

FXStreet