AUD/USD Technical Analysis: pinging a three-year low at the 0.7000 level

- The Aussie-Dollar pairing is dropping further, sending the AUD into the 0.7000 handle as the bearish pair shakes loose of this week's early support levels.

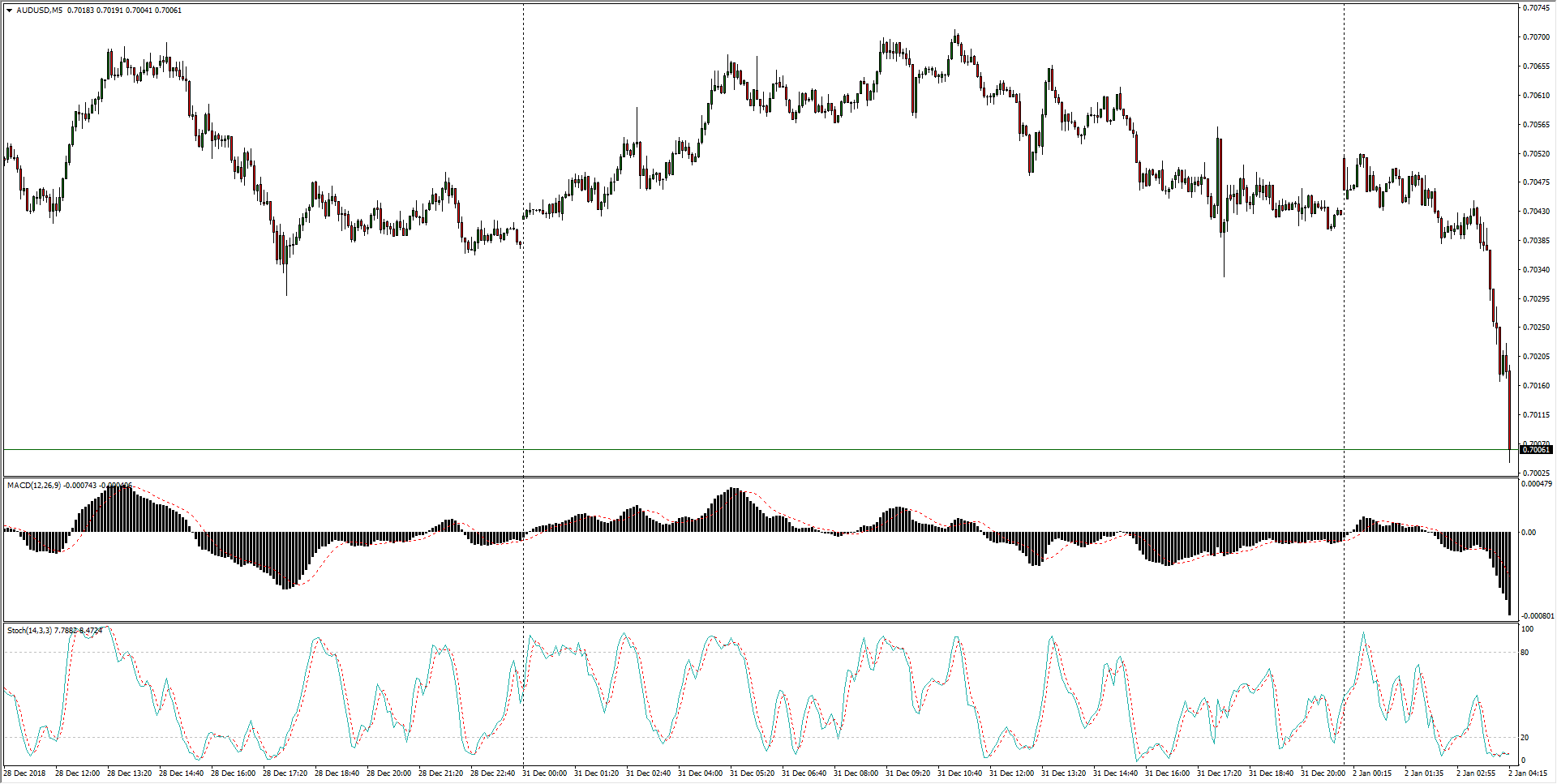

AUD/USD. 5-Minute

- Wednesday's early decline sees AUD/USD geared for another freefall as long as sellers can clear the 0.7000 major barrier, with nothing in the way of near-term support to impede declines.

AUD/USD, 30-Minute

- AUD/USD is dropping into a fresh three-year low as the Aussie's confidence continues to evaporate in the Pacific sector, and 2019 opens on a firmly bearish note for the Antipodean.

AUD/USD, 4-Hour

AUD/USD

Overview:

Today Last Price: 0.7025

Today Daily change: -31 pips

Today Daily change %: -0.439%

Today Daily Open: 0.7056

Trends:

Previous Daily SMA20: 0.7134

Previous Daily SMA50: 0.7186

Previous Daily SMA100: 0.7192

Previous Daily SMA200: 0.7354

Levels:

Previous Daily High: 0.7072

Previous Daily Low: 0.6996

Previous Weekly High: 0.7078

Previous Weekly Low: 0.7014

Previous Monthly High: 0.7394

Previous Monthly Low: 0.7014

Previous Daily Fibonacci 38.2%: 0.7043

Previous Daily Fibonacci 61.8%: 0.7025

Previous Daily Pivot Point S1: 0.7011

Previous Daily Pivot Point S2: 0.6965

Previous Daily Pivot Point S3: 0.6935

Previous Daily Pivot Point R1: 0.7087

Previous Daily Pivot Point R2: 0.7117

Previous Daily Pivot Point R3: 0.7163

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.