AUD/USD struggles around 0.6950, but will RBA’s minutes push bulls to reclaim 0.7000?

- Bad China’s economic data paints a gloomy environment for Australia’s largest trading partner, a headwind for the AUD.

- A risk-off mood boosts the prospects of the US dollar.

- AUD/USD Price Forecast: The major could be subject to a mean-reversion move towards 0.7029 before resuming its downtrend.

The Australian dollar records decent gains, despite weaker-than-expected Chinese economic data ahead of the release of the Reserve Bank of Australia’s (RBA) last meeting minutes. In the North American session, the AUD/USD is trading at 0.6945 at the time of writing.

The market sentiment keeps weighing on riskier assets, as witnessed by European and US equities trading mixed. Also, a reflection of China’s Covid-19 zero-tolerance policy is worse-than-expected economic data, with Industrial Production contracting 2.9% YoY and Retail Sales plummeting 11.1% YoY, which painted a cloudy economic outlook for the second-largest economy in the world. That is a headwind for the Aussie dollar, as China is its largest trading partner.

ING: RBA minutes to hint at size and timing of monetary policy

Regarding the RBA minutes, ING analysts wrote in a note that “the minutes from the Reserve Bank of Australia’s May meeting will be scanned closely for hints about the timing and size of additional monetary tightening. On Wednesday, the long-awaited wage data for 1Q will be released. On Thursday, the employment figures for April will be published, with a chance the jobless rate will fall below 4.0%.”

They added that “some recovery in global equities is surely needed at this point for AUD/USD to climb back above 0.7000, while another risk-off wave could send the pair to the 0.6600-0.6700 area in the near-term.”

Before Wall Street opened, the New York Fed President John Williams said that the number one issue to resolve is inflation, and it is running far too high and stubbornly persistent. He added that 50-bps rate hikes make sense at upcoming meetings.

The US docket would feature additional Fed speaking in the week ahead, led by Chief Jerome Powell on Tuesday. Data-wise, April’s Retail Sales, Industrial Production, Building Permits, and Initial Jobless Claims would shed some light regarding the actual economic status of the United States.

On the Australian side, the AUD/USD traders would take cues from the RBA’s Minutes, alongside Employment data and the Australian Federal Elections.

AUD/USD Price Forecast: Technical outlook

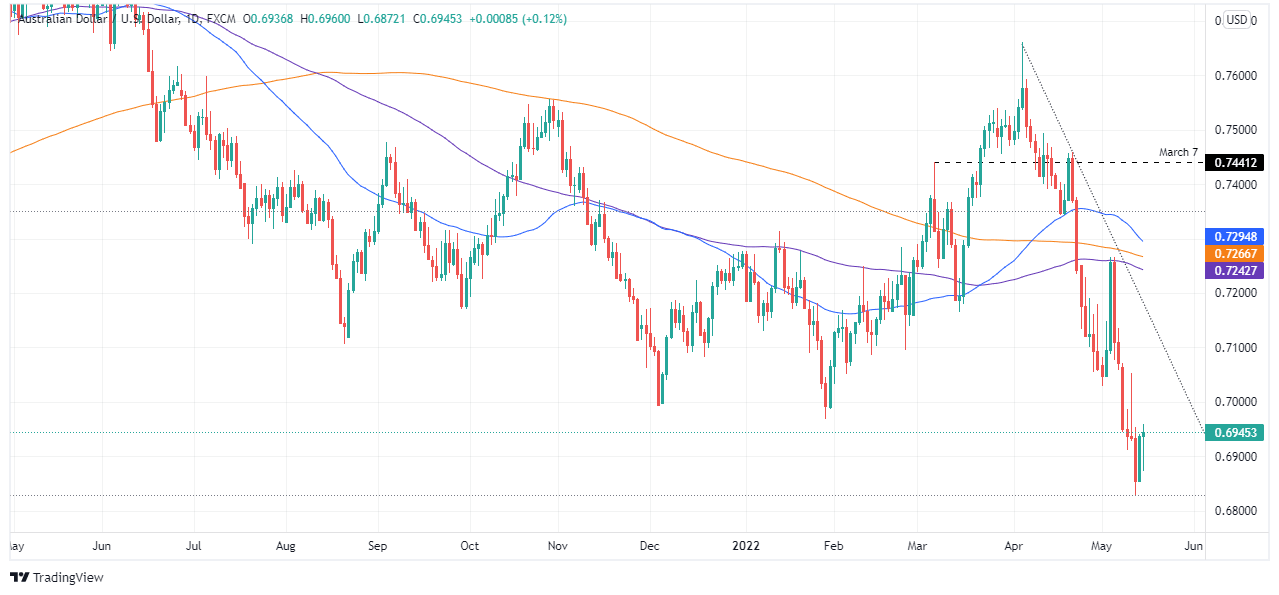

The AUD/USD remains defensive, below the daily moving averages (DMAs). A downslope trendline drawn from April 2022’s highs could give AUD/USD bears a line in the sand to lean on, but the speed of the drop from 0.7600 to 0.6820s suggests that a mean reversion move lies ahead, having May 2 daily low at around 0.7029 as a target, before extending its losses.

If that scenario plays out, the AUD/USD first resistance would be 0.7000, followed by May 2 daily low at 0.7029. A break above would expose the downslope trendline around the 0.7100 area.

Failure at the abovementioned would exert downward pressure on the AUD/USD. The first support would be 0.6900. A breach of the latter would expose the YTD low at 0.6828, followed by the 0.6800 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.