AUD/USD slips as strong USD and Fed expectations weigh

- The Australian Dollar slips in response to the strength of the US Dollar.

- AUD/USD falls ahead of FOMC and Fed Chair press conference.

- AUD/USD respects resistance by rising ascending triangle.

AUD/USD is trading lower after failing to hold above the 0.6600 psychological level, slipping back toward support following a sharp rejection at the recent high of 0.6625.

The pair is now retreating within a well-defined ascending wedge with momentum tilting to the downside.

The AUD/USD pair is under pressure on Monday, trading back below the 0.6600 handle as the US Dollar strengthens.

After touching a year-to-date high at 0.6625 last Thursday, the Aussie has retreated, with profit-taking and broader risk aversion contributing to the pullback.

Markets are also digesting cautious commentary from Federal Reserve (Fed) officials ahead of the Federal Open Market Committee's (FOMC) decision on Wednesday. While no rate change is expected, the Fed is likely to reiterate a “higher for longer” stance, supporting the USD.

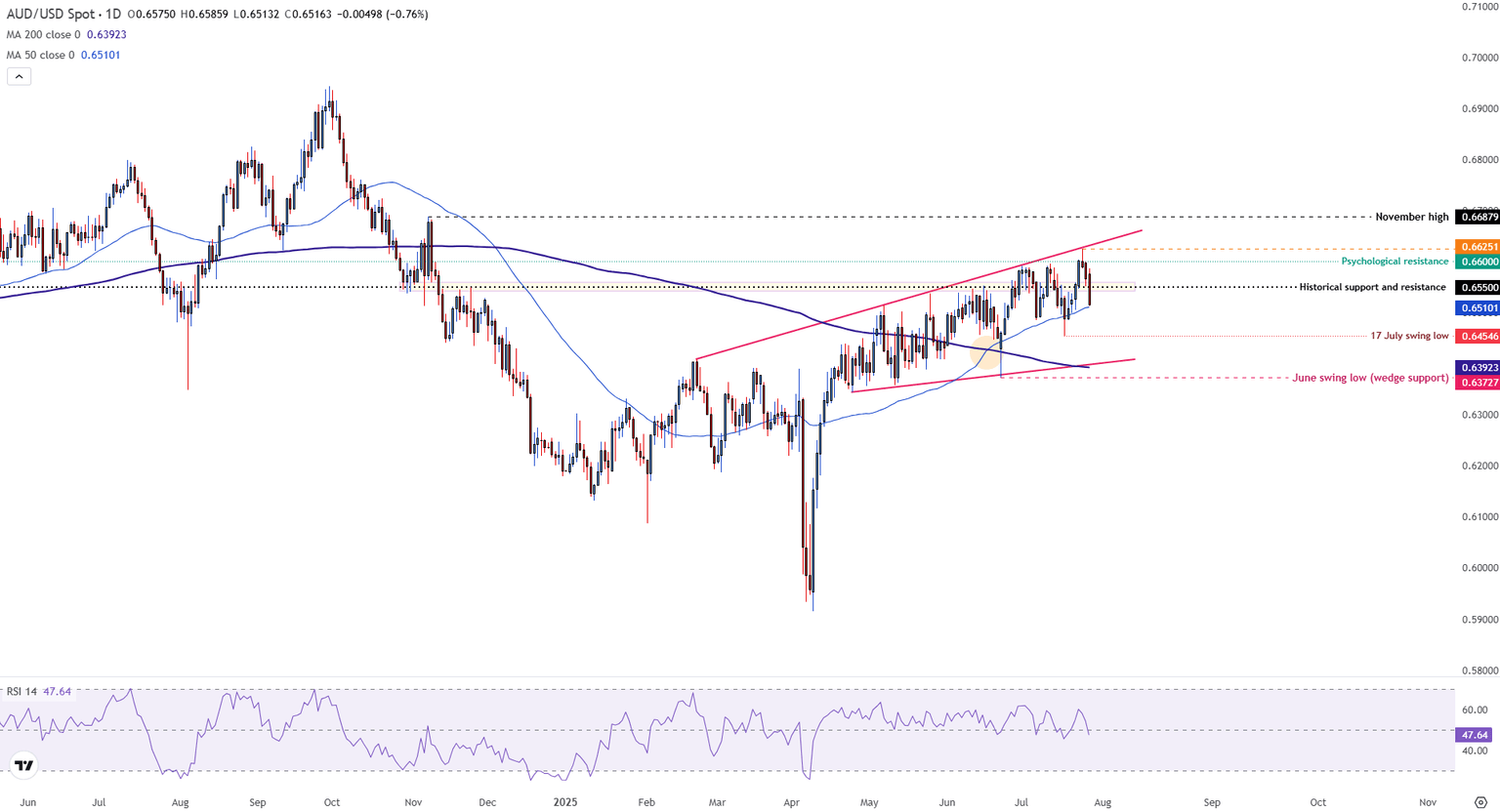

AUD/USD daily chart

AUD/USD rejected wedge resistance at 0.6625, forming a long upper wick before slipping back below the 0.6600 psychological level. The pair is now testing support at 0.6550, with further downside targets at the 50-day SMA (0.6508) and July swing low (0.6454).

A break of the wedge base near 0.6372 would signal a bearish reversal.

The Relative Strength Index (RSI) has turned lower, currently near 53, signaling weakening but neutral momentum. Resistance stands at 0.6600, then 0.6625, with the November high at 0.6687 as a longer-term level to watch.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.