AUD/USD Price Analysis: Recaptures 50-HMA after bouncing off critical support

- AUD/USD finds support once again just above 0.7700.

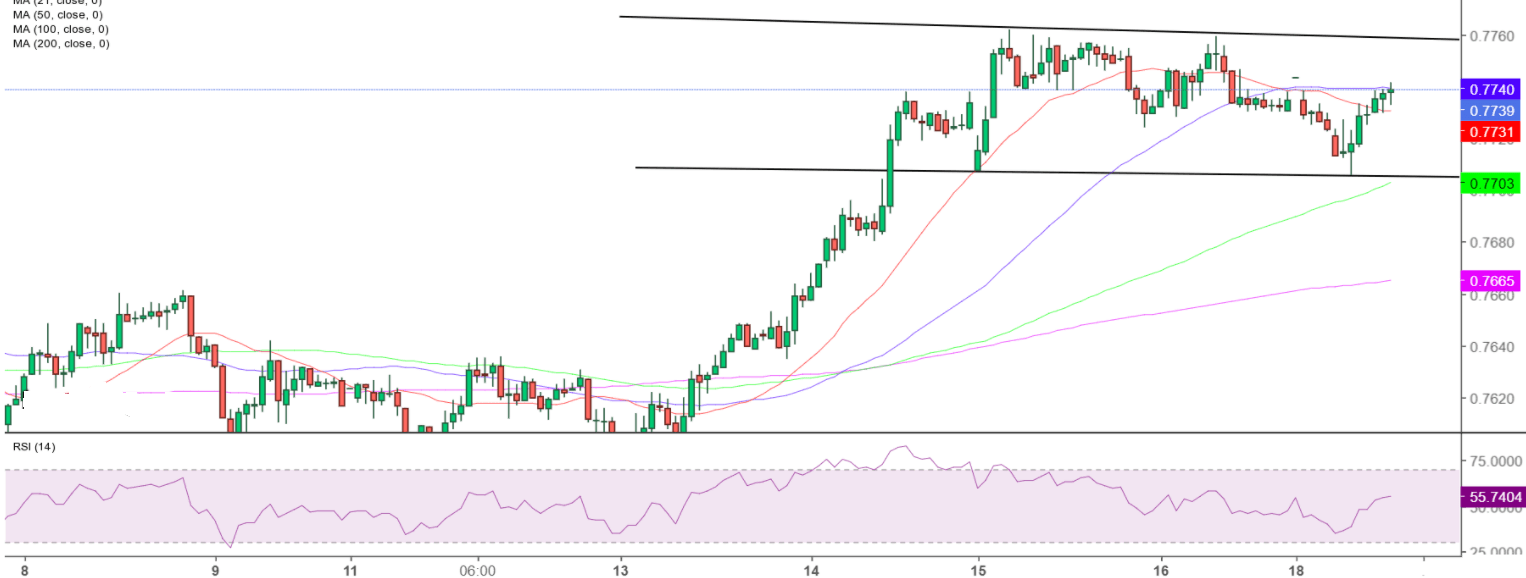

- The aussie hovers in a horizontal channel on the 1H chart.

- RSI points north, looks to test 0.7760 channel resistance.

AUD/USD is staging a robust recovery from just above the 0.7700 level, as the US dollar resumes decline after a brief Asian bounce.

The further upside appears likely as the renewed weakness in the US Treasury yields is likely to aggravate the pain in the greenback.

From a near-term technical perspective, AUD/USD is wavering in a horizontal channel on the hourly chart since Thursday. The upside is capped near 0.7760 while the bulls continue to find support around 0.7705.

With the Relative Strength Index (RSI) pointing upwards, near 57.00, the AUD bulls could likely challenge the abovementioned channel resistance.

Acceptance above the latter could set the stage towards the 0.7800 mark.

AUD/USD hourly chart

At the time of writing, the spot has recaptured the critical upward-sloping 50-hourly moving average (HMA) resistance now support at 0.7740.

If the sellers regain control below that level, the aussie could drop back to retest the 0.7705 support area.

A firm break below the latter could yield a channel breakdown, exposing the 200-HMA support at 0.7665.

AUD/USD additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.