AUD/USD Price Analysis: Prone to sheer downside below 0.6700 despite hawkish RBA

- AUD/USD has failed to capitalize on the hawkish RBA policy.

- The RBA continued the 25 bps rate hike spree and pushed the OCR to 3.60%.

- Australia’s monthly CPI indicator suggests that inflation has peaked.

The AUD/USD pair is displaying a sideways auction in the early European session after a Reserve bank of Australia (RBA)’s monetary policy-inspired volatility. The Aussie asset looks vulnerable above the 0.6700 support despite the upbeat market mood.

In the interest rate decision, RBA Governor Philip Lowe pushed the Official Cash Rate (OCR) by 25 basis points (bps) consecutively for the fifth time to 3.60% to sharpen monetary tools in the battle against persistent Australian inflation. RBA’s Lowe cited “The monthly CPI indicator suggests that inflation has peaked in Australia,” as reported by Reuters.

Further downside in the US Dollar Index (DXY) looks likely amid the absence of recovery signs after printing a fresh day low near 104.16. S&P500 futures have reported more gains, indicating that investors have underpinned the risk-appetite theme.

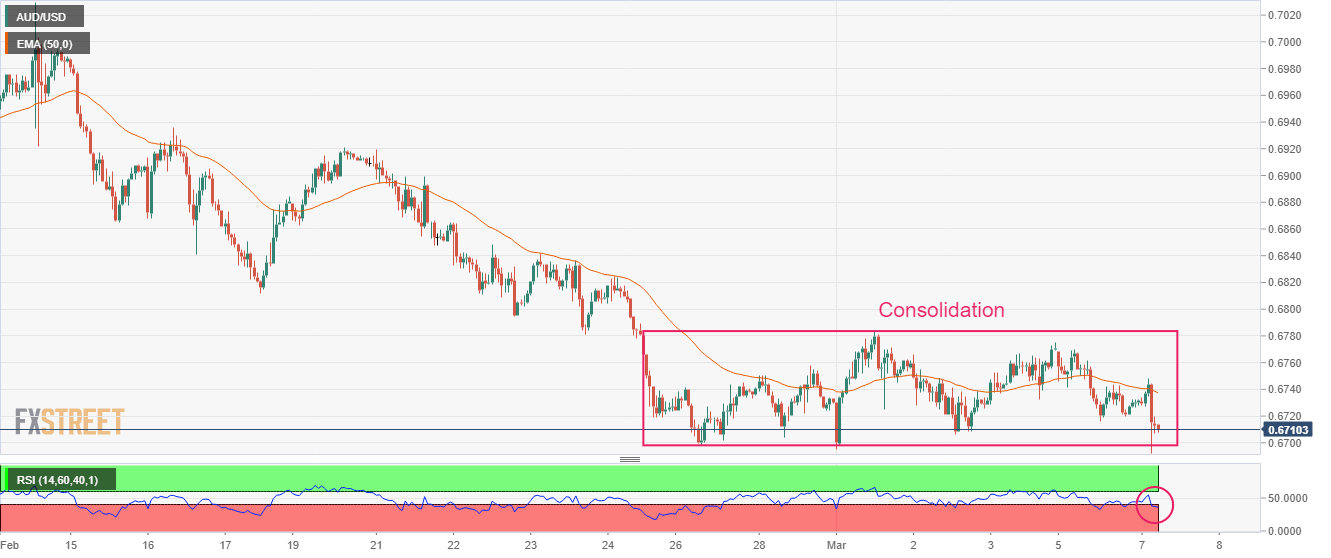

AUD/USD is showing a tad longer consolidation in the range of 0.6700-0.6784 on an hourly scale. The 50-period Exponential Moving Average (EMA) at 0.6737 is acting as a major barricade for the Australian Dollar.

A slippage by the Relative Strength Index (RSI) (14) in the bearish range of 20.00-40.00 is indicating a downside momentum ahead.

A downside move below March 01 low around 0.6700 will drag the Aussie toward December 07 low at 0.6669 and December 20 low at 0.6629.

In an alternate scenario, a confident break above March 01 high at 0.6784 will send the asset toward the round-level resistance at 0.6800 followed by February 06 low at 0.6855.

AUD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.