AUD/USD Price Analysis: Flat lined below mid-0.7200s, focus remains on Powell’s speech

- AUD/USD surrendered modest intraday gains amid a pickup in the USD demand.

- Hawkish comments by various Fed officials acted as a tailwind for the greenback.

- The bias remains tilted firmly in favour of bearish trades ahead of Powell’s speech.

The AUD/USD pair struggled to preserve its modest intraday gains and was last seen trading in the neutral territory, around the 0.7235 region.

The US dollar gained some positive traction during the early North American session after various Fed officials added to market speculations that the Fed will begin tapering its asset purchases in 2021. This, in turn, was seen as a key factor that acted as a headwind for the AUD/USD pair.

That said, a generally positive tone around the equity markets continued lending some support to the perceived riskier aussie. Investors also seemed reluctant to place aggressive bets ahead of Fed Chair Jerome Powell's speech, which, in turn, helped limit the downside for the AUD/USD pair.

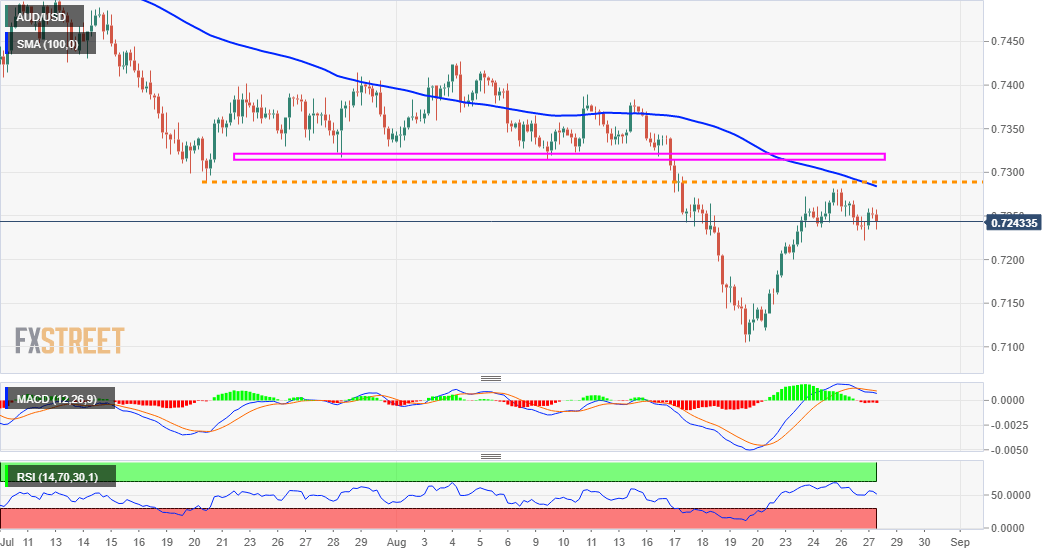

From a technical perspective, this week's strong recovery move from the vicinity of the 0.7100 mark, or YTD lows stalled near the 0.7280 region. This coincides with the previous YTD lows and is closely followed by the 0.7300 mark and a strong horizontal support breakpoint, around the 0.7330 region.

Given the overnight pullback, the AUD/USD pair's inability to gain any meaningful traction suggests that the near-term bearish trajectory might still be far from over. The negative outlook is reinforced by the fact that technical indicators on the daily chart are still holding in the bearish territory.

A subsequent decline below the daily swing lows, around the 0.7220 area, will reaffirm the bearish bias and turn the AUD/USD pair vulnerable. The downward trajectory could then drag the major below the 0.7200 mark, towards testing the next relevant support near mid-0.7100s en-route the 0.7120 area.

On the flip side, any meaningful move up might continue to confront some resistance near the 0.7280 zone and might be seen as a selling opportunity near the 0.7300 mark. This, in turn, might keep a lid on any further gains for the AUD/USD pair near the 0.7330 support breakpoint, now turned resistance.

AUD/USD 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.