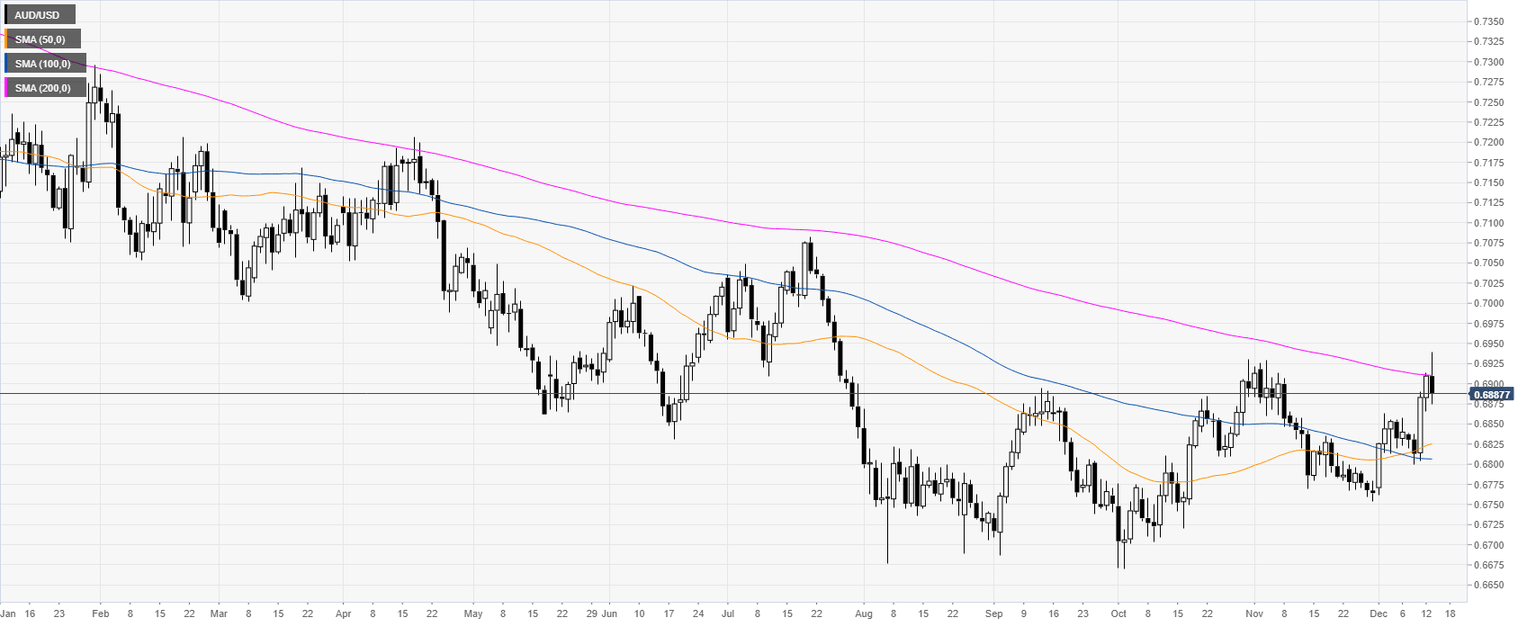

AUD/USD Price Analysis: Aussie eases from 2.5-month highs, trades below 0.6900 handle

- AUD/USD is trading at session’s lows as bulls have stepped out on Friday.

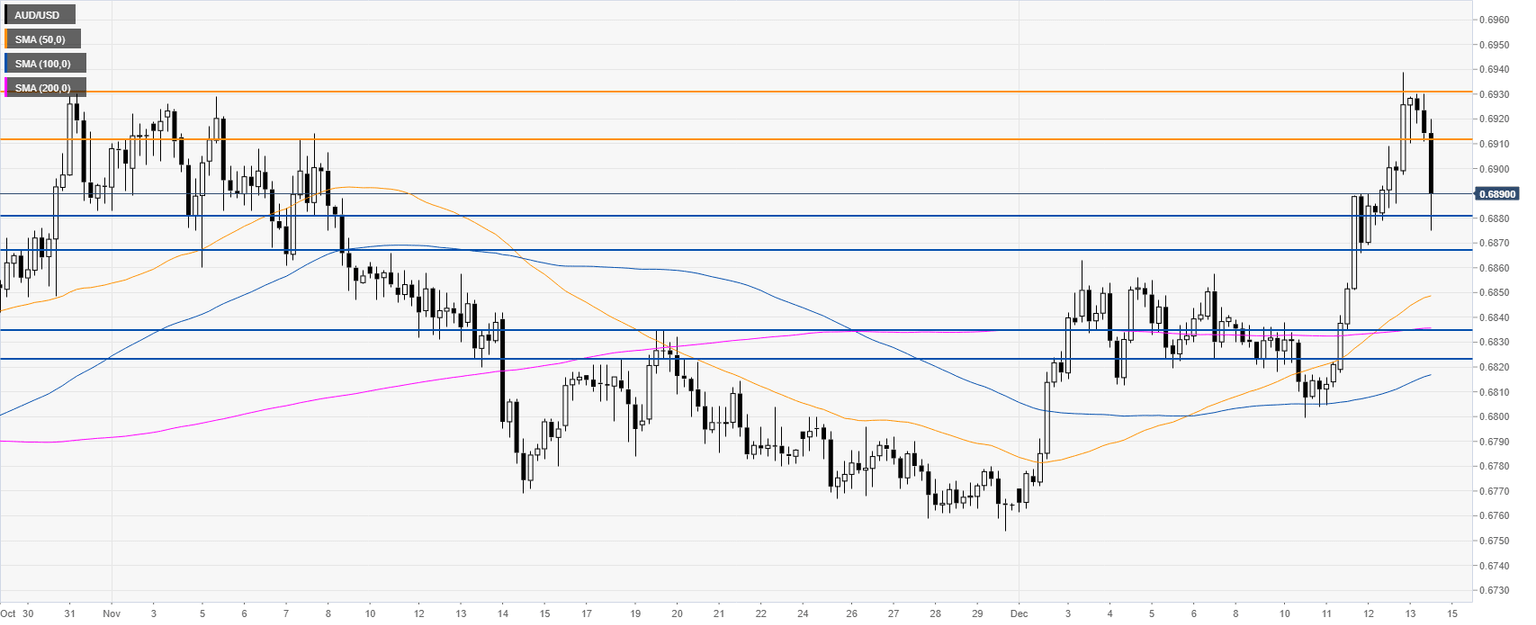

- The market is challenging the 0.6838/0.6824 price zone.

AUD/USD daily chart

AUD/USD four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst