AUD/JPY Price Analysis: Delivers a triangle breakdown after steady RBA policy

- AUD/JPY dropped vertically after the RBA announced a steady interest rate decision.

- Investors expect that the Japanese economy grew by 1.3% in Q2, slower than the growth rate of 1.5% reported for Q1.

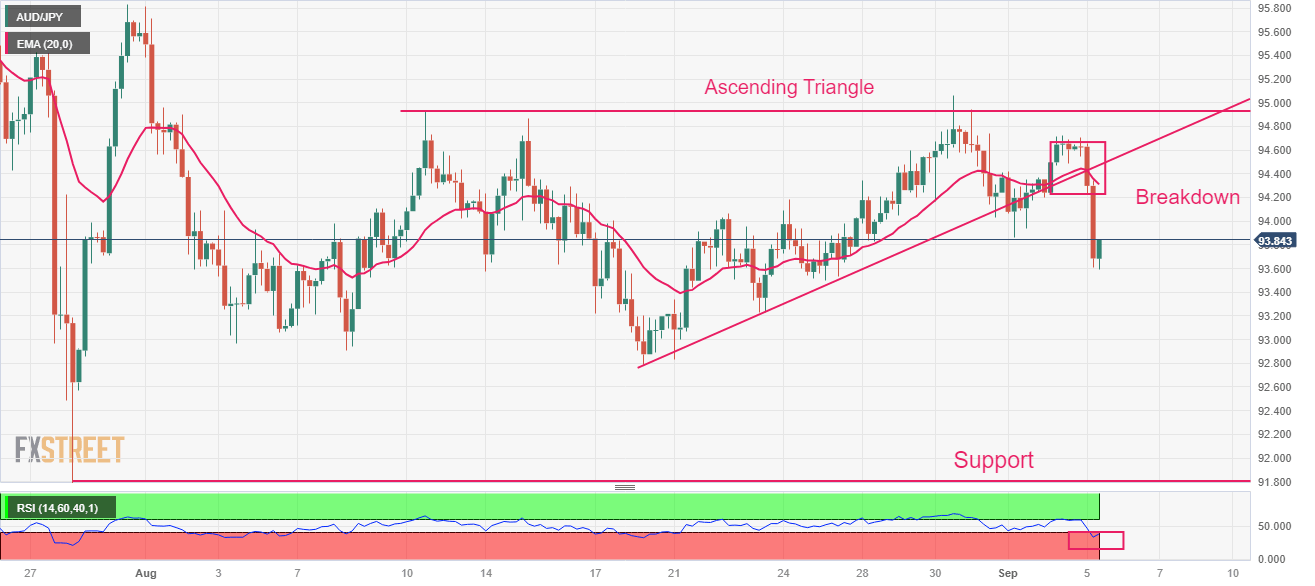

- AUD/JPY delivers a breakdown of the Ascending Triangle chart pattern, which opens the door for a fresh downside.

The AUD/JPY pair finds an intermediate cushion near 93.60 after a vertical fall inspired by the steady interest rate decision from the Reserve Bank of Australia (RBA). The RBA kept the Official Cash Rate (OCR) unchanged at 4.10% but warned that some further tightening of monetary policy may be required as inflation is still too high and will remain so for some time yet.

Market participants expect that the RBA is done with hiking interest rates as uncertainty over the Chinese economic outlook increases due to faltering prospects.

Meanwhile, the Japanese Yen remains on tenterhooks as investors await the April-June quarter report. As per the estimates, the Japanese economy grew by 1.3%, slower than the growth rate of 1.5% reported for Q1.

AUD/JPY delivers a breakdown of the Ascending Triangle chart pattern formed on a four-hour scale, which opens the door for a fresh downside. For the time being, the asset is expected to remain well-supported above the horizontal support plotted from July 21 low at $91.79. The 20-period Exponential Moving Average (EMA) at $94.30 continues to act as a barricade for the Australian Dollar bulls.

The Relative Strength Index (RSI) (14) skis into the bearish range of 20.00-40.00, which indicates that the bearish momentum has been activated.

Further downside below August 14 low at $93.57 would expose the asset to August 18 low at $92.79 followed by July 21 low at $91.79.

In an alternate scenario, a recovery move above the previous week's high at $95.00 will drive the asset toward July 25 high at $95.86. Breach of the latter would further drive the asset towards July 4 high at $96.83.

AUD/JPY four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.