AUD/JPY Price Analysis: Conquers the 50-day EMA, reclaims 95.00 on upbeat mood

- AUD/JPY has climbed for two-straight days after the Bank of Japan (BoJ) intervention and is up by 0.87% in the week.

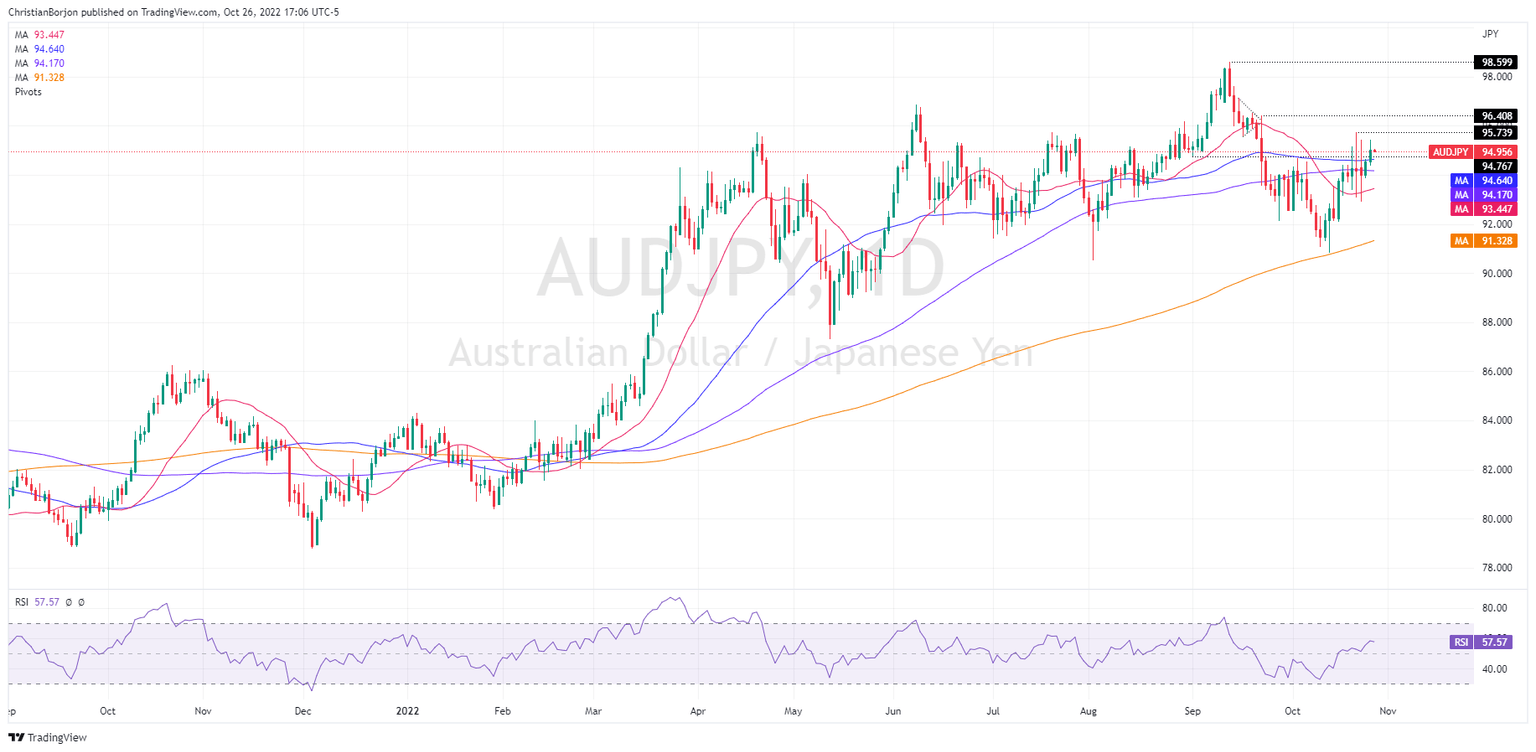

- The AUD/JPY daily chart is upward-biased, and if it clears 95.44, a retest of 96.40 is on the cards, ahead f the YTD high at 98.60.

The AUD/JPY rebounded at the 50-day Exponential Moving Average (EMA) and rose to Wednesday’s daily high at 95.44 before trimming some gains. However, the cross-currency finished the day with a half-percentage point gain. As the Thursday Asian Pacific session begins, the AUD/JPY is trading at 95.03, flat.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart delineates the pair trading upwards, as the upward bias remains intact. Worth noticing that on its way toward 95.00, the cross-currency pair cleared the 50-day EMA, shifting the bias from neutral-upwards to upwards, opening the door for further gains. Also, the Relative Strength Index (RSI) is in bullish territory, and the slope turned flat, meaning that the AUD/JPY might consolidate before resuming the ongoing uptrend.

Upwards, the AUD/JPY’s first resistance would be October’s 26 daily high at 95.44, followed by the 96.00 figure, and the September 22 daily high at 96.40. Conversely, the AUD/JPY’s first support would be the 50-day EMA at 94.64. A breach of the latter will send the cross sliding towards the 100-day EMA at 94.17, followed by the 20-day EMA at 93.45.

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.