AUD/JPY Price Analysis: Climbs towards the 95.50 figure, following a bullish-engulfing pattern

- AUD/JPY rises and prints a new weekly high of 95.50 but remains within the 93.00/96.40 consolidation range.

- Immediate resistance for AUD/JPY stands at 95.50, followed by the 96.00 psychological level.

- Key supports are located at the top of the Kumo at 94.31 and 94.00.

The Australian Dollar (AUD) registers solid gains against the Japanese Yen (JPY) after minutes of the latest Reserve Bank of Australia (RBA) showed the central bank kept the door open for further tightening. The AUD/JPY is trading at 95.33, up 0.54%.

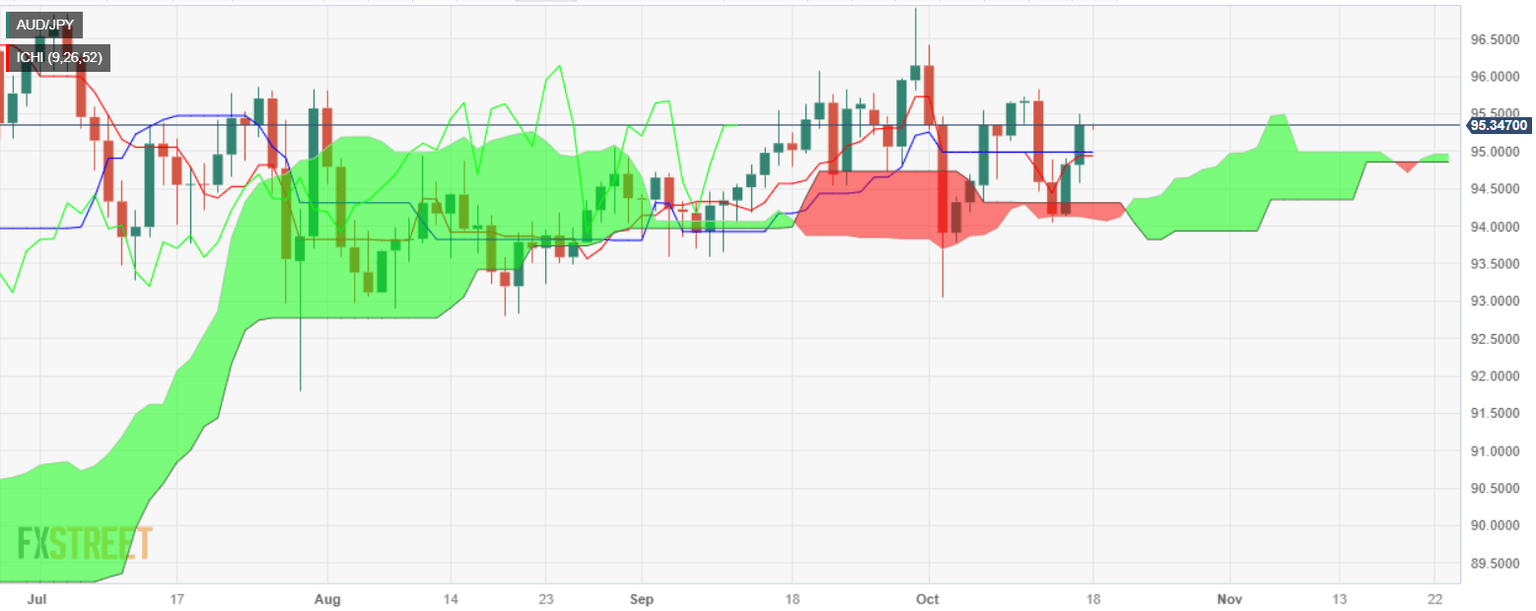

Despite rising towards a weekly high of 95.50, the AUD/JPY pair remains consolidated but unable to break below/above the 93.00/96.40 range, though as price action remains above the Kumo, the bias is mildly bullish. Therefore, the first resistance would be 95.50, Tuesday’s high, followed by the psychological 96.00 mark. A breach of the latter would expose the top of the aforementioned resistance level at 96.40 and the year-to-date (YTD) high of 97.67.

On the flip side, the AUD/JPY first support would be the top of the Kumo at 94.31, followed by the 94.00 figure. Once cleared, the cross would die towards the October 3 daily low of 93.01.

AUD/JPY Price Action – Daily chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.