AUD/JPY Price Analysis: Approaching key resistance at 72.00 area

- AUD/JPY approaches multi-month highs at 71.90 buoyed by a positive market mood.

- The pair faces an important resistance area at 72.05/15.

The Australian dollar has retraced Wednesday’s losses and appreciated about 0.5% through the day to return towards the upper range of 0.7100. The pair has been buoyed by the risk-on mood on hopes of a post-COVID-19 recovery as the main economies re-open, which has weighed the safe-haven yen.

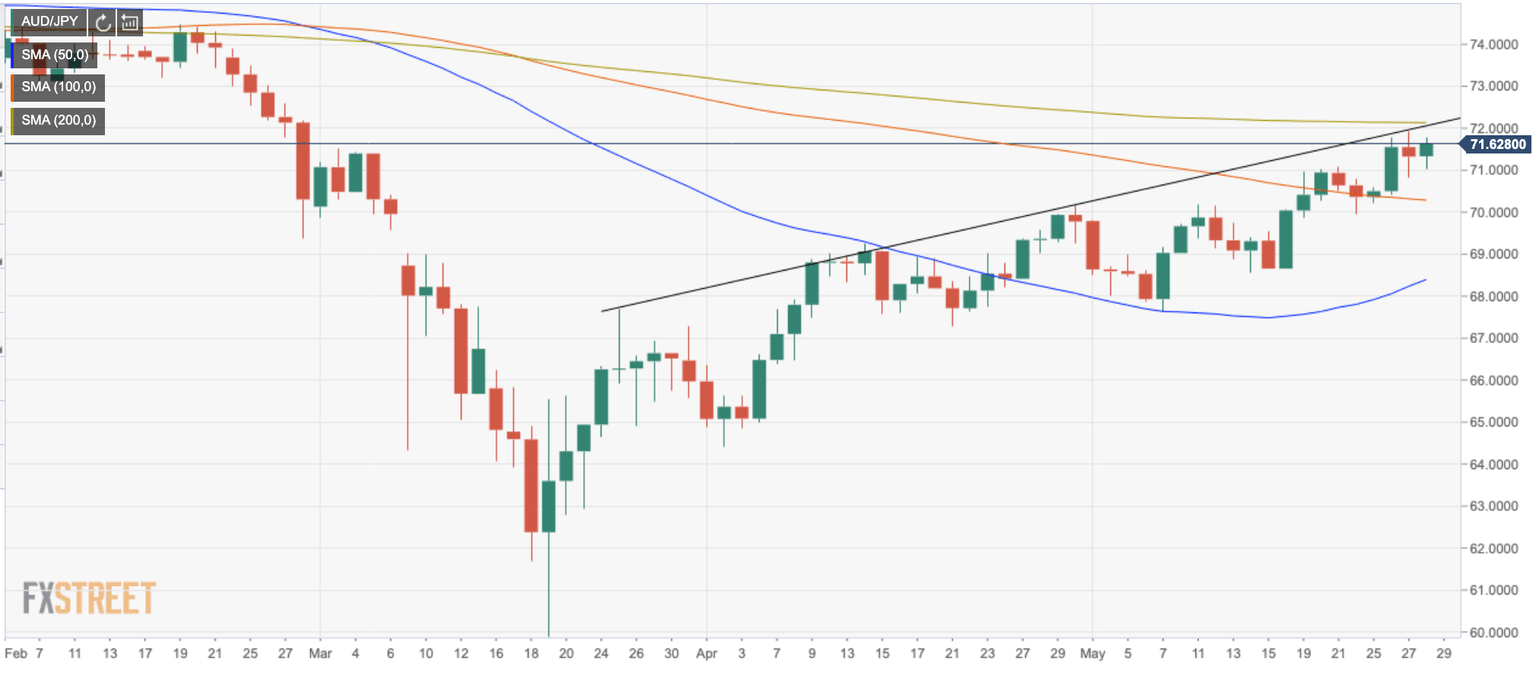

Daily charts show the AUD/JPY trading just a handful of pips below 2, ½-month highs, at 71.90 and approaching a key resistance hurdle, where the trendline resistance from March 25 high meets the 200-day SMA at 72.05/15. A daily close above here might increase buying pressure, pushing the aussie towards 72.45 (Jan. 31 low) and 73.10/15 (Feb 7, 18 lows).

On the downside, immediate support lies at 70.80/00 (May 27 low, intra-day low) and below here, the 100-day SMA at 70.30 before 70.00 psychological level.

AUD/JPY daily chart

AUD/JPY key levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.