AMC Stock News: AMC Entertainment gains following GameStop earnings beat

- NYSE:AMC gained 3.83% during Thursday’s trading session.

- AMC is set to open a new style of theater on Thursday night.

- Top Gun: Maverick could see some competition from another blockbuster.

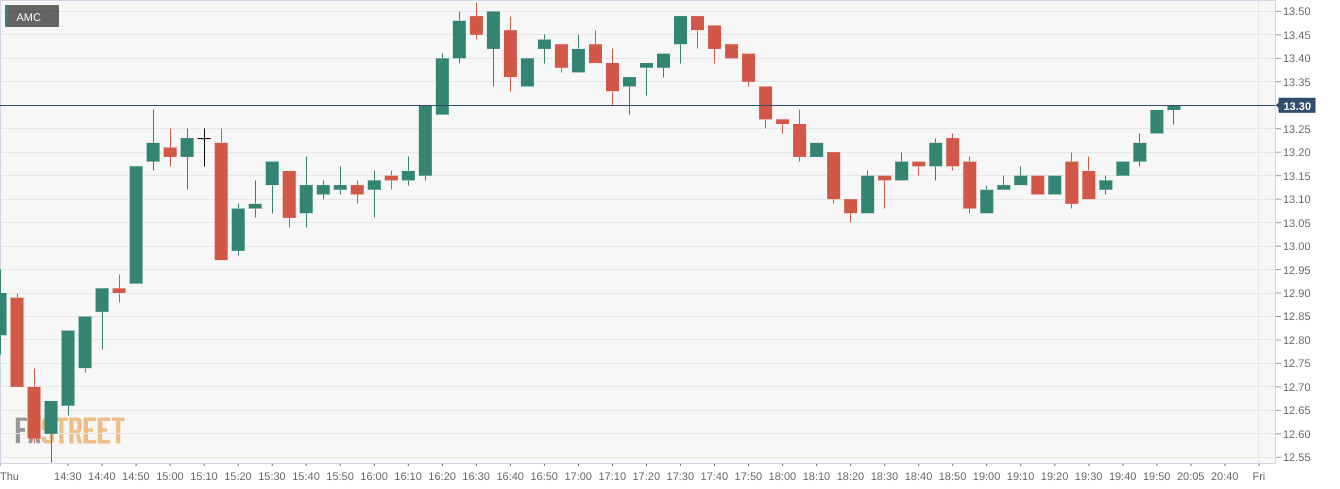

NYSE:AMC continued its volatile behavior as the leading movie theater chain climbed higher alongside the broader markets. On Thursday, shares of AMC jumped by 3.83% and closed the trading session at $13.30. The markets were choppy once again although all three major averages snapped their two-day losing streaks and posted a positive day across the board. The Dow Jones, which was down by as many as 300 basis points earlier in the session, added 435 basis points, while the S&P 500 and NASDAQ rose by 1.84% and 2.69% respectively. Tech stocks in particular had a strong showing as investors clearly believe that many high growth names have been oversold.

Stay up to speed with hot stocks' news!

On Thursday night, AMC is set to open a new movie going experience for its customers. The AMC Dine-in Topanga 12 in Canoga Park, California will open its doors for the upcoming weekend. The Topanga 12 features all recliner seating, IMAX lasers, dine-in options, and even a full alcoholic beverage menu which will be added in the coming weeks. AMC has opened several new locations this year and has continued to seek growth through acquisitions of theaters from smaller competitors. AMC operates approximately 950 theater locations around the world.

AMC stock forecast

While Top Gun: Maverick has officially hit $200 million globally as of Thursday, its reign atop the box office could come to an end as early as next week. Early numbers from the Mexican debut of Jurassic World: Dominion shows the film has already hit franchise-best sales for an international preview. Jurassic World premieres in the domestic box office on June 10th.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet