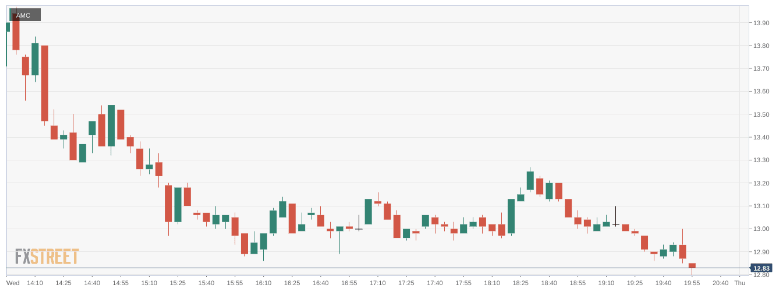

AMC Stock News: AMC Entertainment and meme stocks fall ahead of GameStop earnings

- NYSE: AMC fell by 10.53% during Wednesday’s trading session.

- AMC has seen little momentum from major box office releases.

- GameStop is set to release its earnings report after the close.

NYSE: AMC fell for the second straight session and kicked the month of June off firmly on the back foot. On Wednesday, shares of AMC tumbled by 10.53% and closed the first trading day of the month at $12.83. Despite a mini squeeze at the end of May, shares of AMC are still down by 16% during the past month of trading. It was a choppy session for the broader markets as all three major indices fell lower to start the month. The Dow Jones fell by 176 basis points, the S&P 500 dropped by 0.75%, and the NASDAQ posted a 0.72% loss during the session.

Stay up to speed with hot stocks' news!

Fresh off another record-breaking weekend at the box office, AMC stock has seen little change from the latest major release. Top Gun: Maverick set a record for a Memorial Day weekend opening, but the stock saw little momentum following the debut. It goes without saying that Hollywood blockbusters will continue to do well at the box office, but companies like AMC need smaller films to sell more tickets. Unless we see a return to pre-pandemic numbers at movie theaters, it is likely we won’t see AMC turn profitable anytime soon.

AMC stock forecast

Meme stocks were trading lower ahead of the much anticipated earnings call from GameStop (NYSE: GME). The company managed to beat revenue estimates but reported a wider than expected loss for the quarter as GameStop continues to spend on its digital transformation. As of the time of this writing, shares of GME were up about 5.0% during extended hours trading.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet