AMC Share Price: Stock trades lower as surging delta variant cases could stall reopening

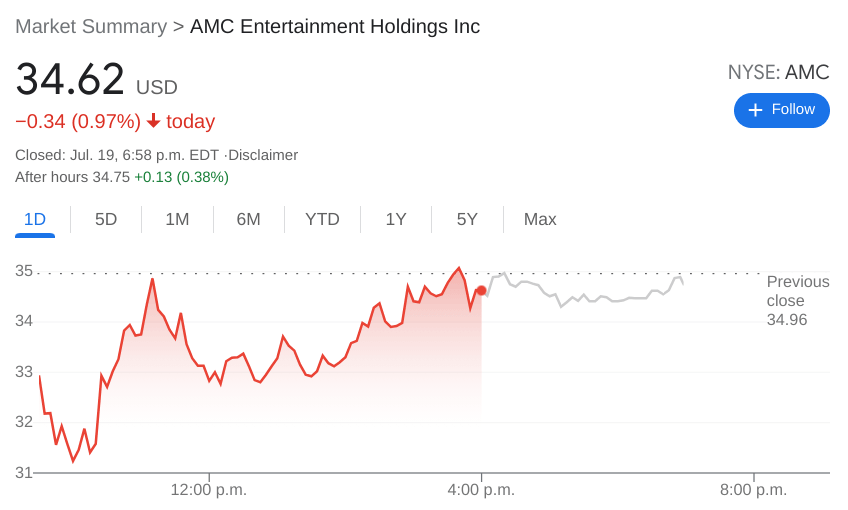

- NYSE:AMC dips 0.97% as reopening stocks were hammered on Monday to start the week.

- AMC business could suffer as investors fear potential new restrictions.

- Ticket sales at theaters plunged this past weekend, after hitting pandemic highs the week before.

NYSE:AMC seems to have the deck stacked against it right now, and surging cases of the COVID-19 delta variant caused the single largest sell off since October of 2020. Shares of AMC fell 0.97% on Monday, to close the tumultuous day at $34.62. Reopening stocks took the worst of the damage as COVID-19 cases rose in all 50 states for the fourth consecutive day, the first time that has happened since spring of 2020.

Stay up to speed with hot stocks' news!

Movie theaters would be an obvious loser if any sort of new restrictions were imposed again, and AMC’s stock may not be strong enough to withstand another stretch without any movie goers buying tickets. At the beginning of the pandemic, AMC nearly filed for bankruptcy and if it weren’t for Redditors saving the business, who knows where the company would be today. Can AMC count on another retail investor rally? Or would further restrictions spell the end for the theater chain? Either way, AMC shorts may be celebrating now, after losing billions of dollars since June during the latest short squeeze.

AMC stock forecast

Just one week after Black Widow opened to pandemic record ticket sales, the numbers plunged this past weekend. Ticket sales fell by 67%, which represents the single worst second weekend at the box offices for any Marvel Universe film. A group of movie theater lobbyists are protesting Disney’s day-and-date release strategy that sees new movies launching simultaneously on its Disney+ streaming service. The group believes that the Black Widow was a prime example of how the dual release will seriously affect movie theater revenues moving forward. Shares of Disney (NYSE:DIS) also tumbled on Monday as new restrictions could lead to the closure of its theme parks once again.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet