Earnings preview: What to expect from Alphabet Google and Microsoft results

- Alphabet (GOOGL) to report earnings after the close along with Microsoft (MSFT).

- GOOGL stock is down 15% year to date, MSFT stock is down 16% for 2022.

- Huge weak for earnings with 170 companies from the S&P 500 reporting.

This week earnings move into overdrive with as mentioned 170 of the S&P 500 companies up for earnings releases. But more importantly, this is a mega-tech week with some huge names set to give us direction for the coming months. The stock market has been nervous and range-bound for the past month as it got to terms with the Ukraine situation and soaring inflation. Yields have moved inexorably higher which has put added pressure on tech stocks.

Google earnings preview: What to expect from GOOGL?

Google (or Alphabet – let's face it who calls it that!) is to report after the close. Revenue is expected to reach $67.8 billion for the quarter with earnings per share (EPS) due to reach $25.55. This compares with revenue in the previous quarter hitting $75.3 billion and EPS reaching $30.69. A conference call is scheduled for 22:00 GMT, 18:00 US Eastern Standard Time. Ad spending will be closely watched now that we are looking at inflationary pressures. However, the increase in travel should support search, maps, and other local ad revenue sources.

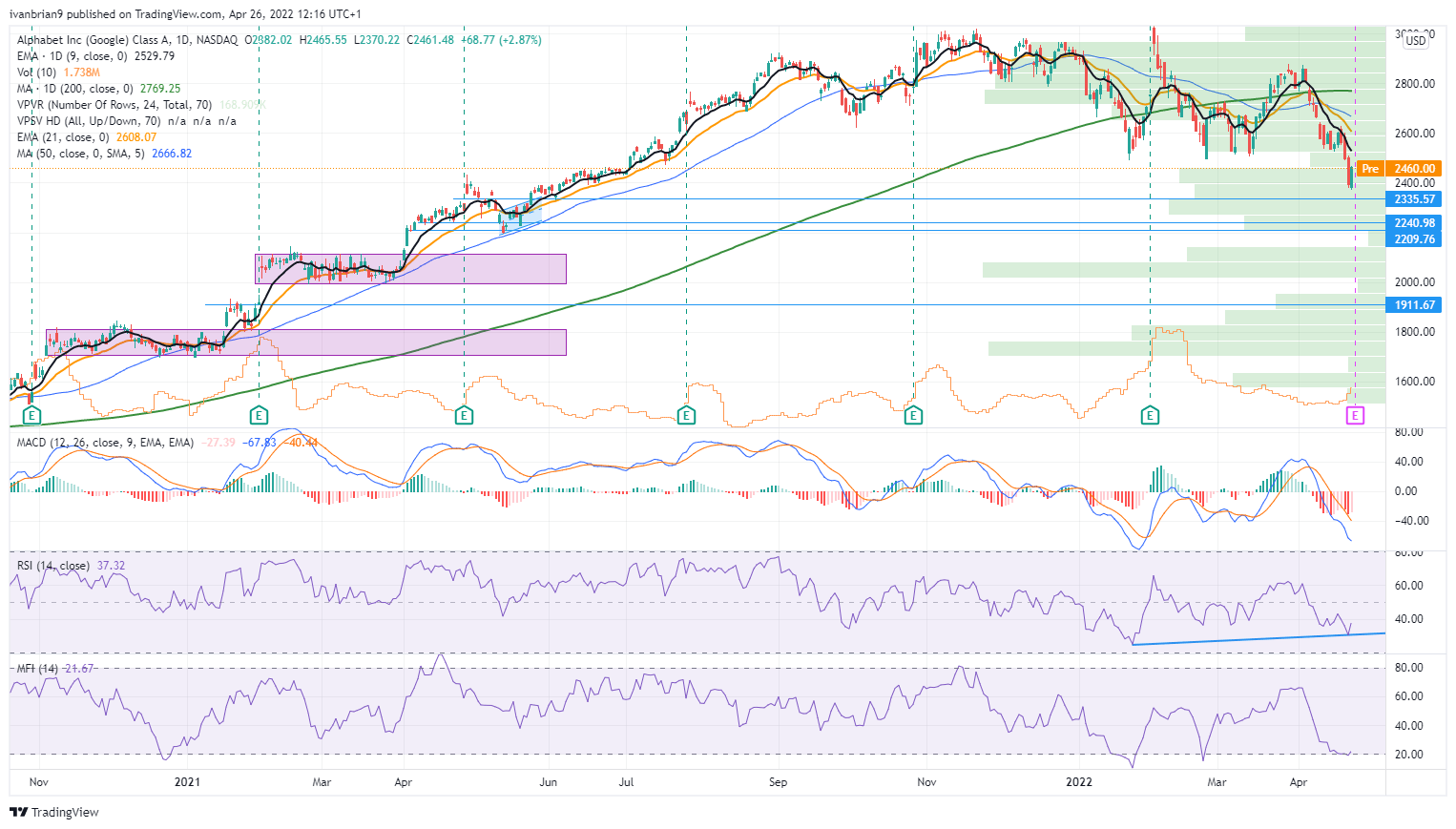

GOOGL stock forecast

GOOGL stock remains in a bearish downtrend with a series of lower lows and highs. Right now the stock is near the year-to-date low but despite yearly lows, we have a bullish divergence from both the MFI and RSI. So the risk-reward is skewed to the upside in our view. A strong set of earnings should see a greater reaction than a weak number.

Google (GOOGL) stock chart, daily

Microsoft earnings preview: What to expect from MSFT?

Microsoft is also up after the close on Tuesday. Microsoft is expected to post earnings per share (EPS) of $2.20 and revenue of $49.05 billion. These numbers would represent growth rates of 13% for EPS and 17% for revenue versus last year. Cloud revenues grew strongly for all cloud entities during the pandemic, notably Amazon Web Services (AWS) and Microsoft Azure. So this metric will likely dominate. Microsoft still dominates the cloud business with Amazon the number two in the sector.

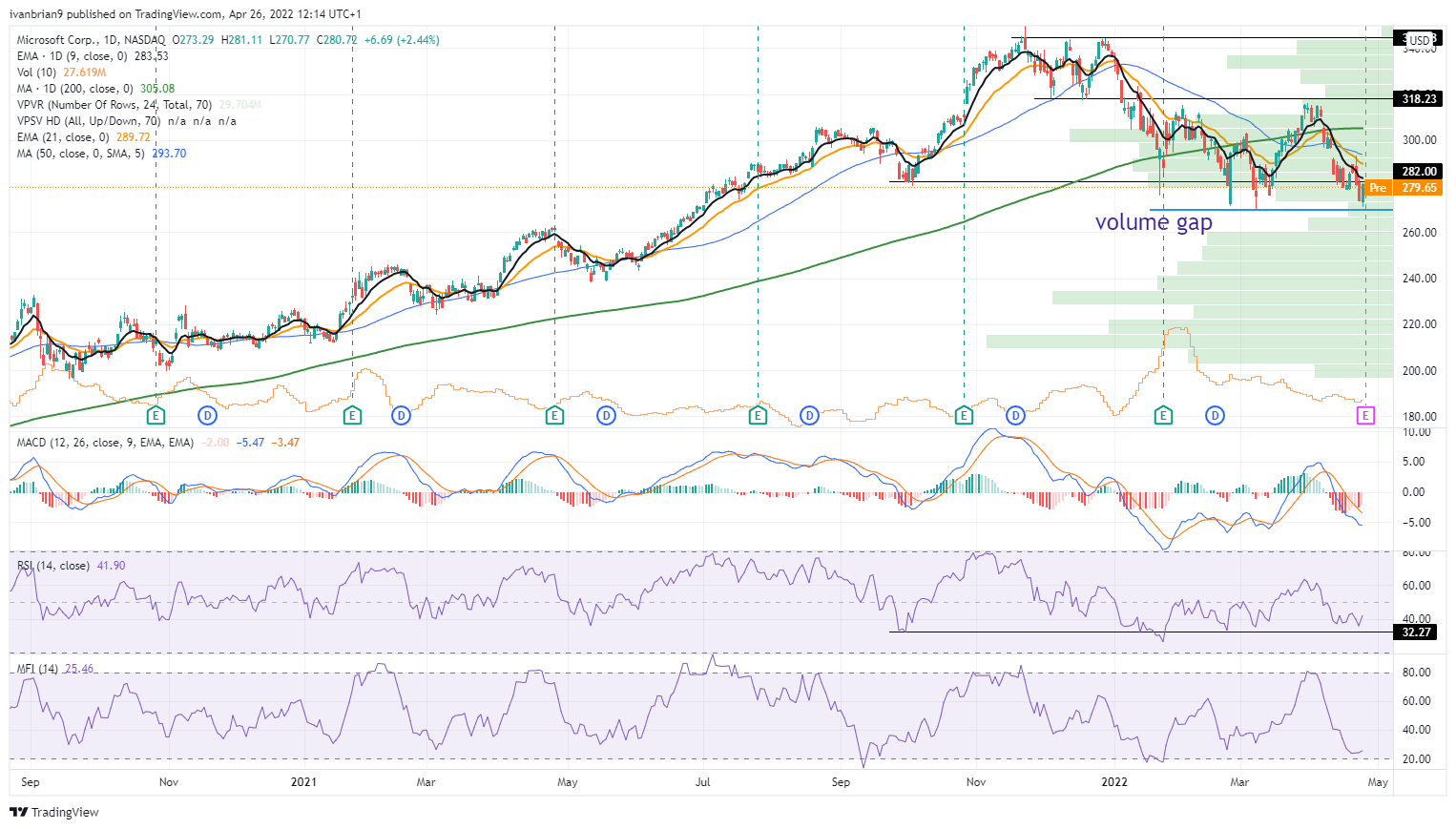

Microsoft (MSFT) stock forecast

MSFT stock is down 17% year to date. Notably from the chart below, MSFT stock is right on key support so this earnings release is more noteworthy from a technical perspective than previous. $270 is therefore huge support. Strong earnings should push MSFT up to $300 and above. The 200-day moving average at $305 will also provide some resistance.

Microsoft (MSFT) stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.