Zeus Capital LLP accuses Chainlink of price manipulation, LINK/USD continues to go up

- Asset management firm Zeus Capital LLP has accused Chainlink of artificially pumping the coin’s price.

- The firm has claimed that it has all evidence related to the alleged price manipulation.

- Zeus Capital Limited, an investment bank, has clarified that it has no affiliation with Zeus Capital LLP.

Zeus Capital LLP, an asset management company, has publicly accused Chainlink of artificially pumping the price of its coin. The firm has also published a report that says that Chainlink has been making fake partnerships and using them as a marketing scheme. The asset management firm stated that Chainlink is created to enrich the founders.

Zeus Capital LLP took to Twitter to say that they have "unlimited resources to go after LINK" and documented everything related to the alleged price manipulation.

We’ve unlimited resources to go after $LINK.

— Zeus Capital (@ZeusCapitalLLP) August 2, 2020

You can’t short squeeze us.

The attempt to manipulate the market and save LINK from today’s flash crash is being documented and added to the lawsuits.

Everyone involved will face the consequences.$LINK will drop to $0.0001 as in March pic.twitter.com/OHQe7Kz63H

The screenshots included in the tweet claim that “LINK marines" pumped the coin to liquidate Zeus Capital's short position.

A few days back, Zeus Capital Limited, a popular investment bank, published a post in which it clarified that it has nothing to do with the Zeus Capital LLP that is accusing and threatening Chainlink of bad acting. An excerpt from the post reads:

For the avoidance of doubt we would like to state that Zeus Capital Limited has not produced or published research on this subject and has no relationship or affiliation with Zeus Capital LLP whatsoever.

Zeus Capital LLP also published an interview with an anonymous “industry professional who held a senior position at Callisto Network.” This person said that after Callisto offered to enter a partnership with Chainlink, the latter immediately agreed and published a press release to that effect. However, the person has claimed that no actual collaboration took place and Callisto did not integrate Chainlink oracles, according to a CryptoComes report.

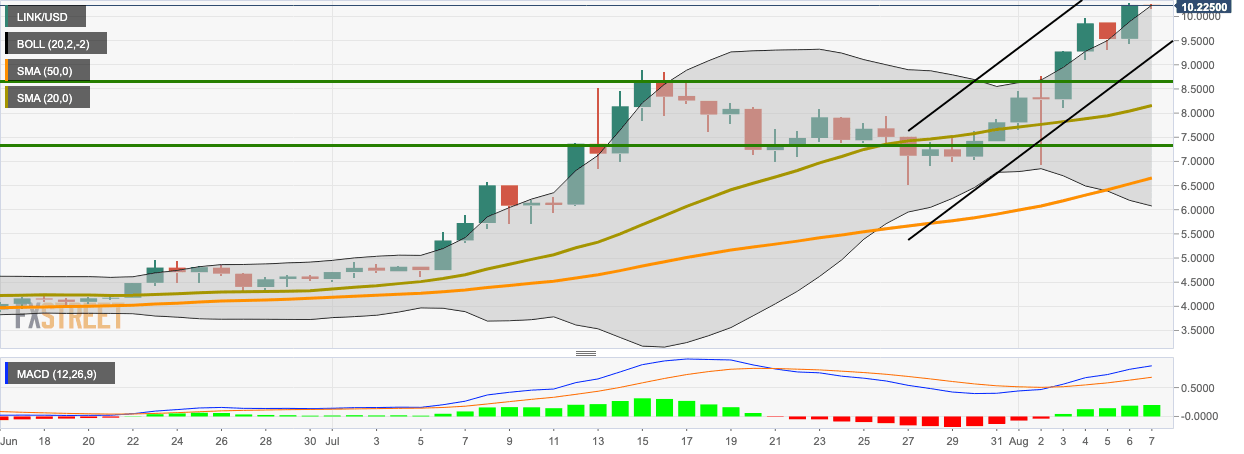

LINK/USD daily chart

LINK/USD had a heavily bullish Thursday, wherein it jumped from $9.492 to $10.25. Currently, the bears have taken the price down a bit to $10.21 in the early hours of Friday. The price is trending above the 20-day Bollinger Band, showing that it is currently overvalued. The MACD shows increasing bullish momentum. We have healthy support levels at $9.492, $8.66 and $8.17 (SMA 20).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.