XTZ price eyes 50% upswing while Tezos searches for launching platform

- XTZ price rose 71% from September 29 to October 4, breaking out of an ascending triangle.

- Now Tezos is looking for a safe foothold to launch 50% to $11.37.

- A breakdown of the $5.34 support floor will invalidate the bullish thesis.

XTZ price is hovering around the ascending triangle’s base after failing to sustain the rally’s gains before it. As investors continue to book profit, Tezos will likely reenter the setup and find a stable barrier to break out again.

XTZ price looks for stable grounds

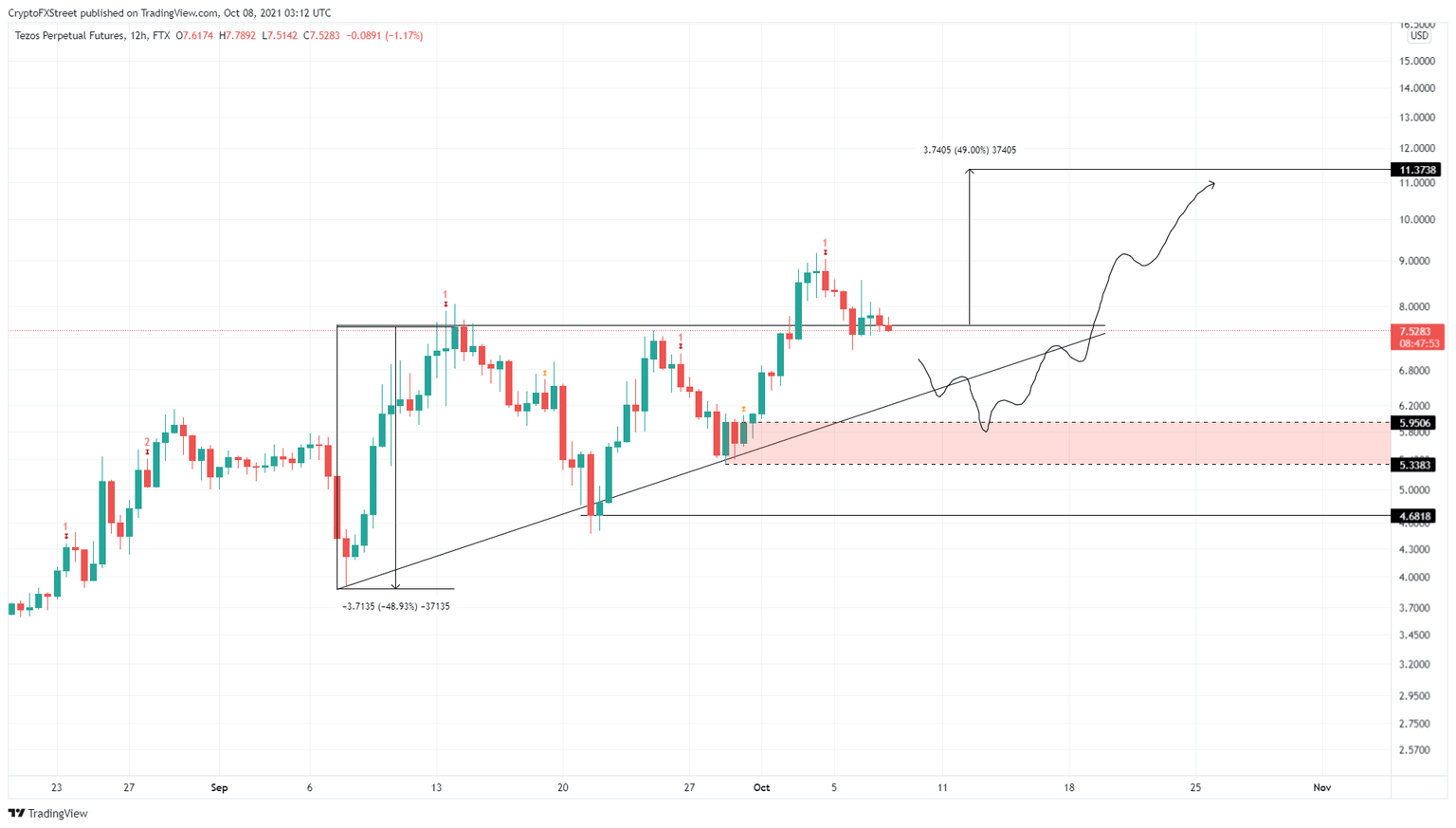

XTZ price set up three higher lows and two equal highs since September 7. Connecting these swing points using trend lines shows the formation of an ascending triangle. This pattern forecasts a 49% upswing, determined by measuring the distance between the horizontal resistance level and the first swing low. Adding this measure to the breakout point at $7.63 reveals a target of $11.37.

While this development would have been straightforward if Tezos managed to stay above the $7.63 support floor. However, from its looks, XTZ price will likely dip below it and look for a stable launching pad.

The contenders for such a platform include the $6.75 and $5.95 barriers. In an unlikely scenario, XTZ price might dip below $5.95, but as long it recovers the bullish thesis will remain intact.

XTZ/USDT 1-day chart

On the other hand, if XTZ price slices through $5.95 and continues to pierce through the support area, producing a decisive close below $5.34, it will invalidate the bullish thesis.

Such a move will create a lower low, likely drag Tezos lower and retest the $4.68 demand barrier, where it can give the uptrend another try.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.