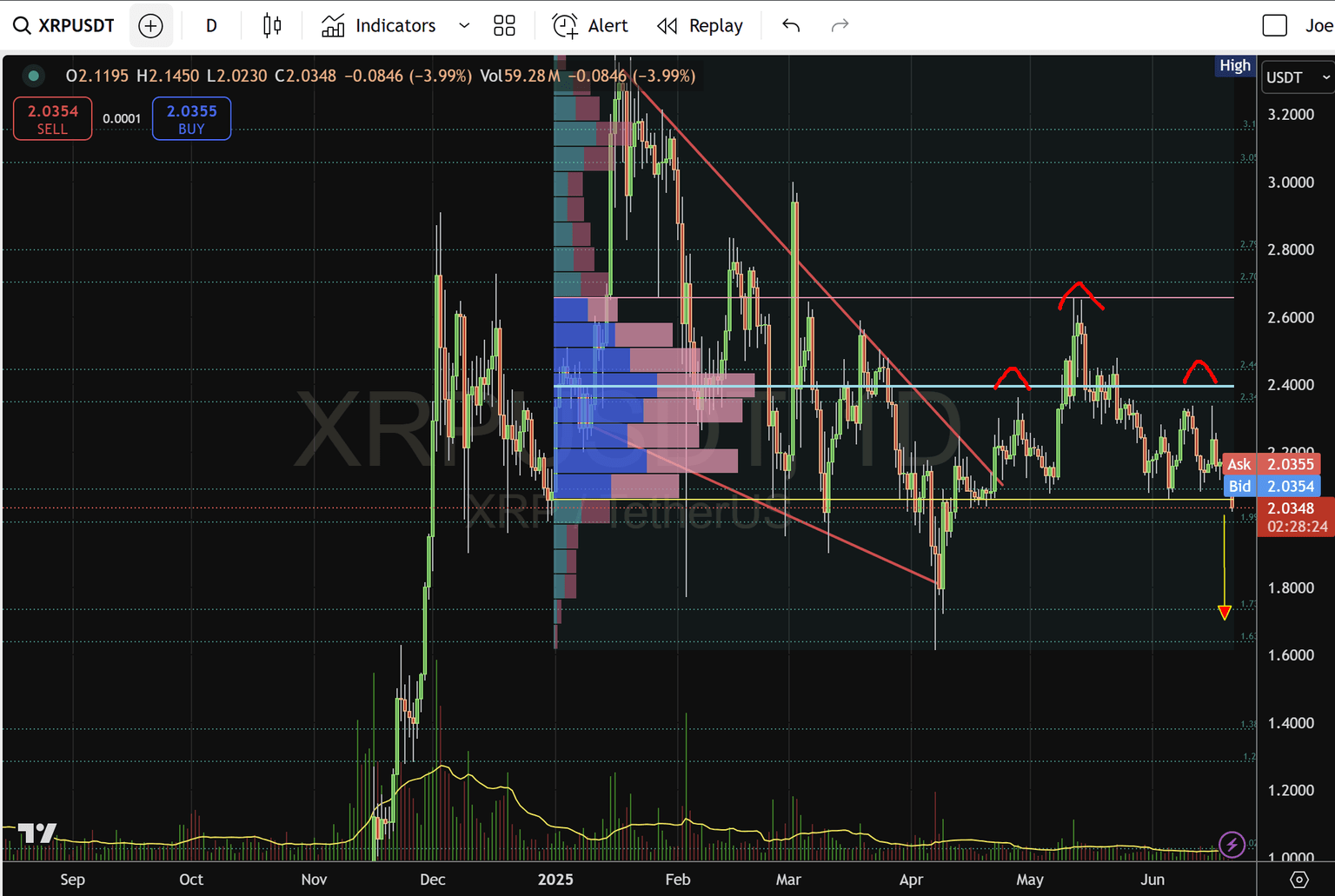

XRP/USDT faces break below $2.00 demand: H&S breakdown could drive price to $1.73

Failure to defend the $2.00 zone on the daily chart would complete a bearish Head & Shoulders pattern, projecting a 12% slide back toward prior lows near $1.73.

Technical analysis

- Key demand zone: The $2.00 area has acted as critical daily support since March, aligning with the 1.9940 low and a high-volume node on the volume profile. A decisive close below this zone would confirm distribution and open the way lower.

- Head and Shoulders pattern: Left Shoulder near $2.34 (May rally peak); Head at $2.67 (early June high); Right Shoulder around $2.34 (late June retest); Neckline at ~$2.00 (connecting the lows from March and June); Measured Move: Head-to-neckline distance of ~$0.27 projects a drop to $1.73 upon breakdown (a ~12% decline from $2.00).

- Support levels on a breakdown: $1.99 – daily low (neckline); $1.87 – next high-volume node and Fibonacci 38.2% of 2025’s swing; $1.73 – H&S target (measured move); $1.64 – April swing low.

- Resistance on recovery: $2.13 – prior reaction high; $2.34 – shoulders; $2.44 – April consolidation high.

Fundamental context

- Regulatory overhang: Ongoing SEC litigation remains a major catalyst for XRP’s volatility. Any adverse ruling risks further selling pressure, while positive developments could trigger short-covering rallies.

- Crypto market sentiment: Correlation with Bitcoin’s performance (~0.85 on a 30-day basis) means that a broader risk-off move in equities or BTC could exacerbate XRP’s decline.

- Network activity: On-chain metrics (daily active addresses, transaction volume) have cooled since May, suggesting waning demand amid profit-taking at higher prices.

- Macro drivers: With Fed rate-cut expectations pushed into 2025, risk assets remain vulnerable to US Treasury yields holding above 4.2%. A hawkish surprise could spill into crypto markets.

Conclusion and trading plan

- Bearish scenario: A daily close below $2.00 should be met with sell orders targeting $1.87 and $1.73, with stops just above $2.13.

- Bullish reversal: Only a reclaim of $2.34 (shoulder level) on strong volume would invalidate the bearish H&S and open a retest of $2.44–2.67.

- Risk management: Use tight position sizing, given the heightened volatility around regulatory news.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.