XRP/USD outlook: limited pullback from new record high anticipated

XRP/USD

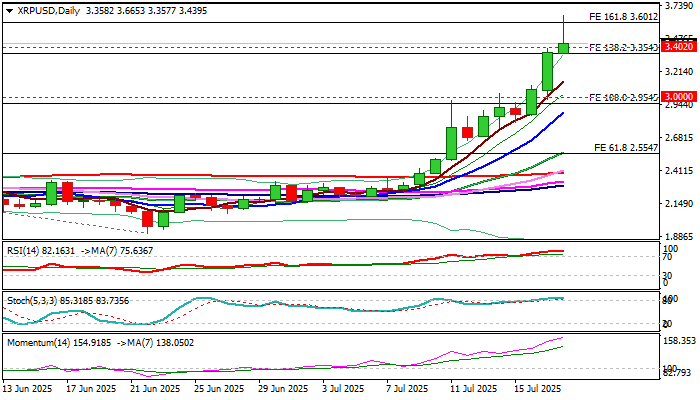

XRP remains the top performer among crypto assets and extended steep ascend to new record high ($3.66) following nearly 10% advance on Friday.

The sentiment has improved strongly after the US House of Representative has eventually passed three pieces of crypto legislation, which was the main driver of the crypto’s this week.

The XRP reached two milestones this week, the first was break of psychological $3.00 barrier and the second was rise above former top ($3.4020).

It is also on track for the fourth consecutive weekly gain (up over 20% this week) as bull-leg from $1.9411 (June 22 low) strongly accelerated in past two weeks.

The XRP price is currently running on extended third wave (of five-wave cycle from 1.6088, Apr 6 low, which hit over 161.8% of Fibo expansion today.

However, overbought daily studies and profit-taking at the end of the week and after strong rally, may temporarily deflate the price, with daily candle with long upper shadow contributing to the scenario.

Broken former top ($3.4020) reverted to solid support which should ideally contain dips and guard next supports at $3.3577 (today’s low) and $3.2506 (Fibo 23.6% of $1.9080/$3.6653 rally).

Only returning below $3.00 zone (psychological / Fibo 38.2%) would neutralize bulls.

Res: 3.5000; 3.5465; 3.6428; 3.6653.

Sup: 3.4020; 3.3577; 3.3000; 3.2506.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.