XRP price goes under extreme manipulation by new Telegram group

- XRP price is up more than 140% since January 30.

- The recent upswing seems to be inspired by GameStop’s price action, which was mainly manipulated by the infamous WallStreetBets Reddit community.

- Despite the hype around Ripple, on-chain metrics forecast a bearish outlook as whales continue dumping their holdings en masse.

XRP price shows a substantial uptick per a Telegram group's plan to pump the cryptocurrency on February 1. Although the pump is planned at 13:30 GMT, the price has already surged a whopping 30% today. Whales appear to be taking advantage of the rising price action to sell or redistribute their holdings, thereby indicating mounting downward pressure.

XRP price faces a WallStreetBets-inspired pump and dump

The “PumpXRP” Telegram group has managed to grow and reach the limit of 200,000 subscribers since January 30 when it was created. XRP price reacted quickly to the group's call to pump the token towards new yearly highs.

Indeed, the cross-border remittances token surged by more than 80% in less than 16 hours after the so-called “XRP army” rushed to exchanges to get a piece of the rising price action.

PumpXRP on Telegram

Even though XRP has seen substantial gains over the past few days, the real pump is scheduled to kick off at 8:30EST or 13:30 GMT. Perhaps, the price might see an even more enormous surge at the scheduled time as it coincides with the European markets' open.

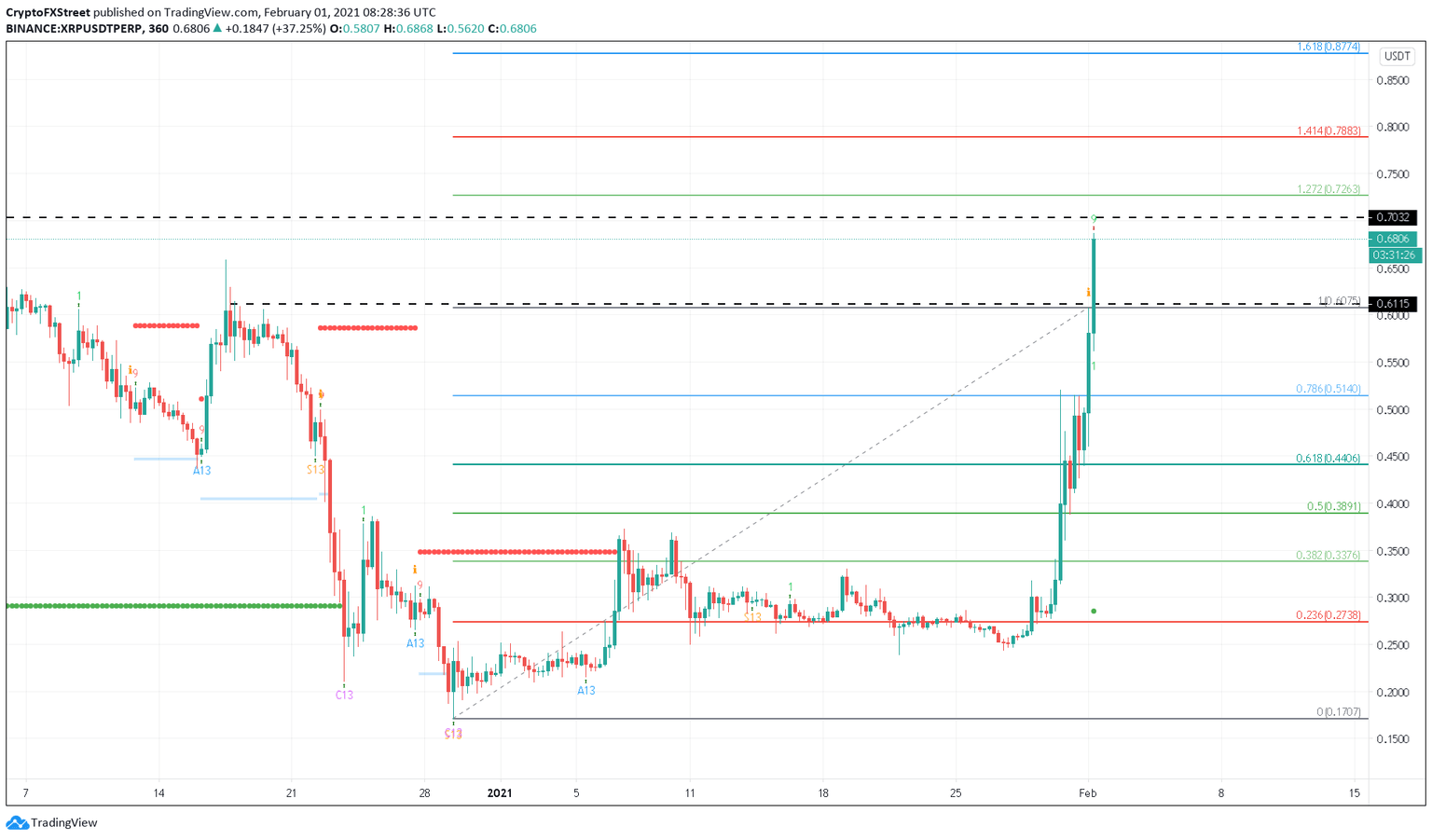

XRP/USD 6-hour

Despite the high probability that speculators will join the call to pump XRP, the TD Sequential indicator forecasts that a steep correction is underway. This technical index flashed a sell-signal in the form of a green 9-candlestick on both the 4-hour and the 6-hour time frame.

If validated, the price action seen today might cool-off before prices head higher. A potential spike in sell orders could see XRP price enter a consolidation phase or pullback towards the $0.60 level before the uptrend resumes.

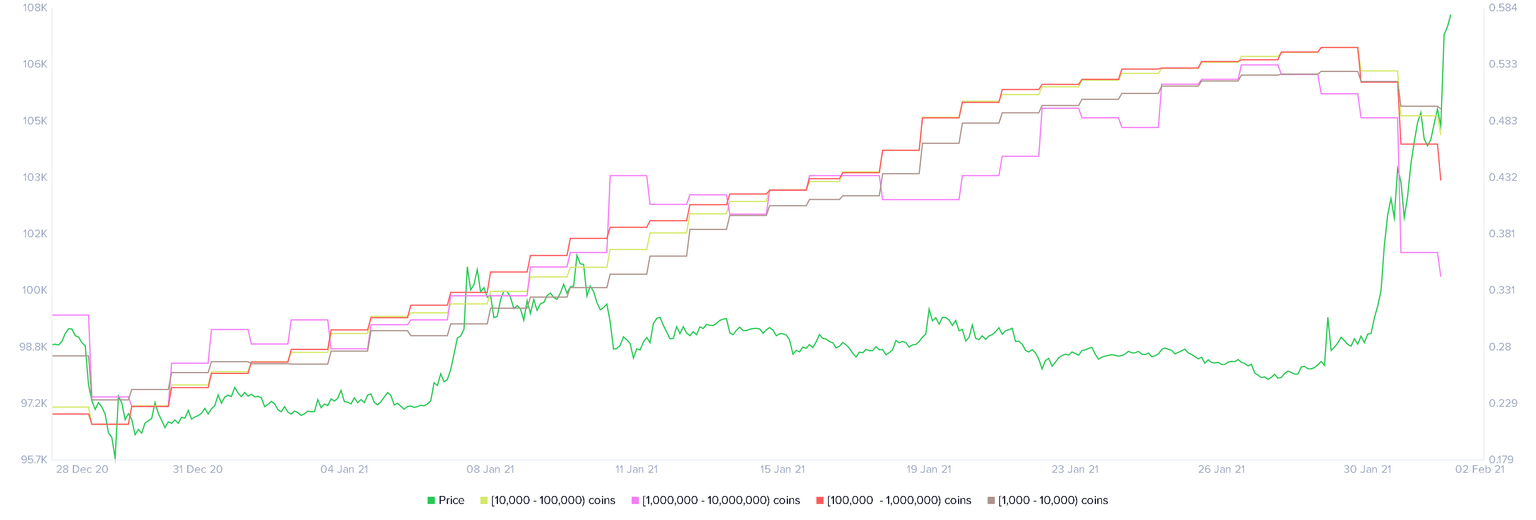

On-chain metric hints at increasing downward pressure

XRP whales activity on the network adds credence to the bearish outlook. Santiment’s holders distribution chart shows that the number of addresses holding 1,000 to 10,000,000 XRP has been dropping fast ever since prices began rising on January 30.

XRP Holders Distribution chart

As of February 1, the smallest decrease in holdings was 0.7% and was noticed among whales holding 1,000 to 10,000 XRP. Meanwhile, those with 100,000 to 1,000,000 XRP took a 3.7% nosedive.

Both technical and on-chain indicators suggest that a drop might be on the cards for XRP and will be confirmed by a close below $0.60. In this case, XRP can head towards the next area of support at $0.51.

It is worth noting that XRP price currently sits under a critical supply barrier at $0.70, just below the 127.2% Fibonacci level at $0.72. A close above the $0.72 level provides the cryptocurrency with a path of minimum resistance up to $0.78. Following this level, the 161.8% Fibonacci level at $0.87 would be the next supply barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.