XRP, Dogecoin and Mantra traders punished for bullish bets, will altcoins recover?

- XRP, Dogecoin and Mantra observed a large volume of long-position liquidations in the last 24 hours.

- Derivatives traders betting on price rally in XRP, DOGE and OM are paying for shorts as the three tokens recover slightly on Tuesday.

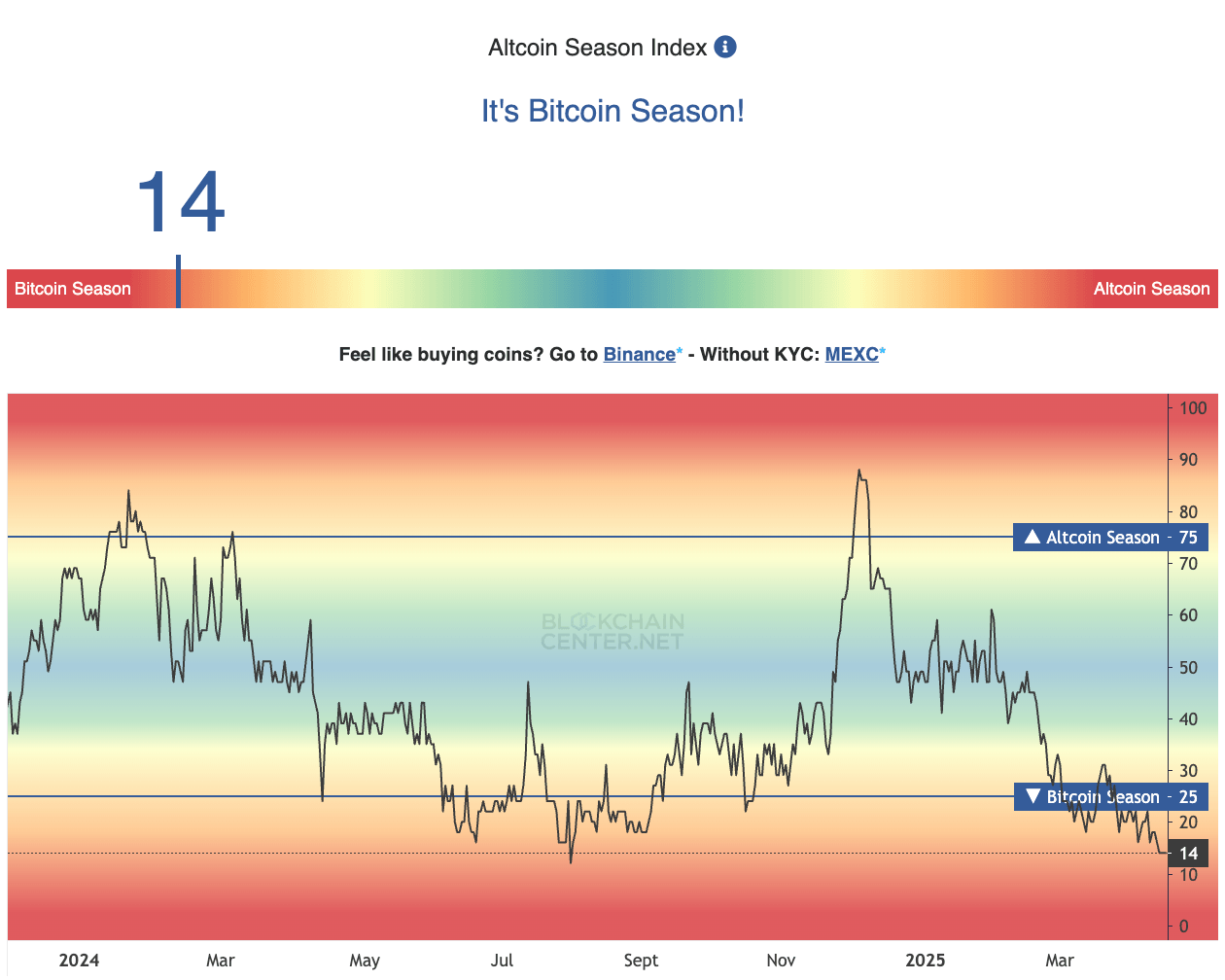

- Altcoin season index points at more pain for traders in the short term.

Altcoins are recovering on Tuesday as the dust settles on US President Donald Trump’s tariff announcements last week. The President has repeatedly changed his mind on several tariff-related concerns, ushering volatility in Bitcoin and altcoin prices.

Mantra (OM) rallies nearly 5%, while Dogecoin (DOGE) and XRP gains slightly at the time of writing on Tuesday.

XRP, DOGE, OM derivatives traders’ long bets suffer

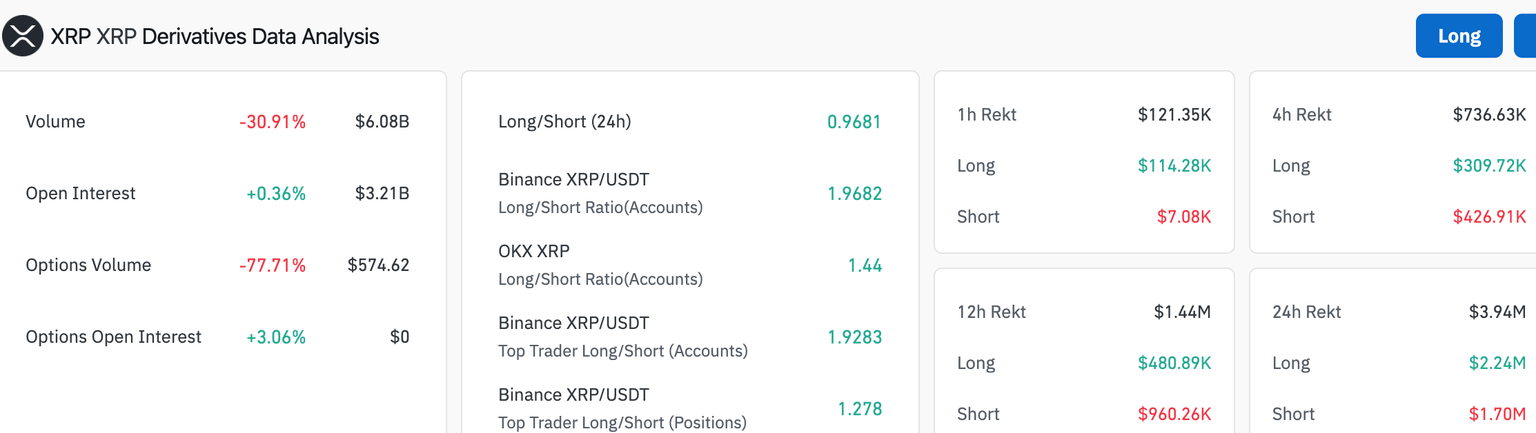

XRP derivatives analysis on Coinglass shows that $2.24 million in long positions were liquidated in the last 24 hours against $1.70 million in shorts.

Meanwhile, XRP Open Interest (OI), the net value of all open positions in the token, is up to $3.21 billion, as XRP gains and adds nearly 1% to its value and trades at $2.1478, above key support at $2, at the time of writing on Tuesday.

XRP Derivatives Data Analysis | Source: Coinglass

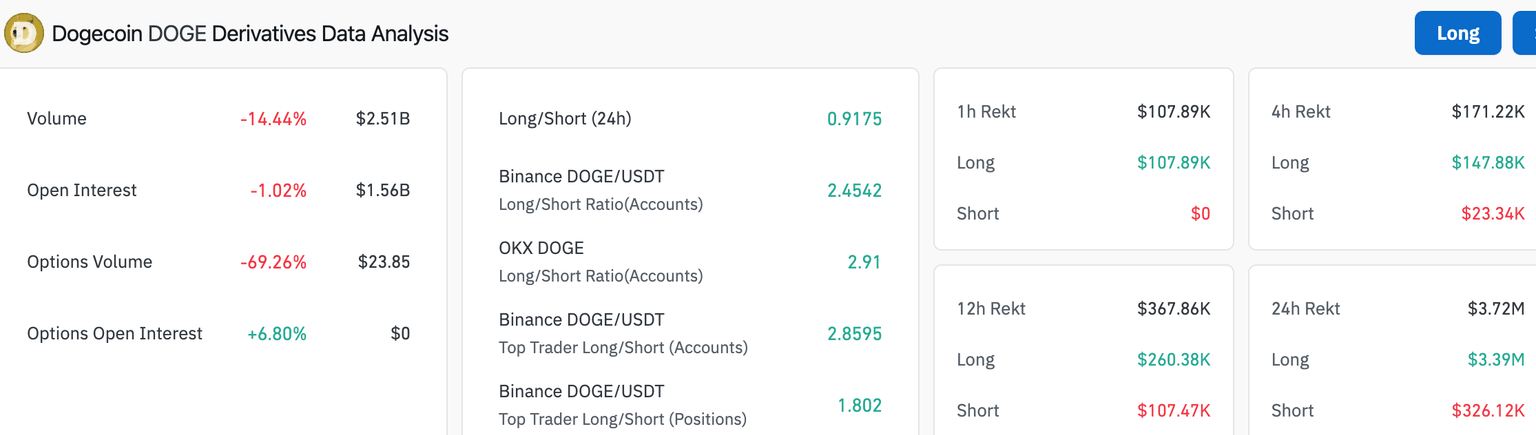

Dogecoin observed $3.39 million in long liquidations compared to $326,120 in shorts in the past 24 hours. Coinglass data shows DOGE’s bullish bets suffered even as the meme coin climbs on Tuesday.

Dogecoin Derivatives Data Analysis | Source: Coinglass

At the time of writing on Tuesday, DOGE trades at $0.15912, up 0.32% on the day.

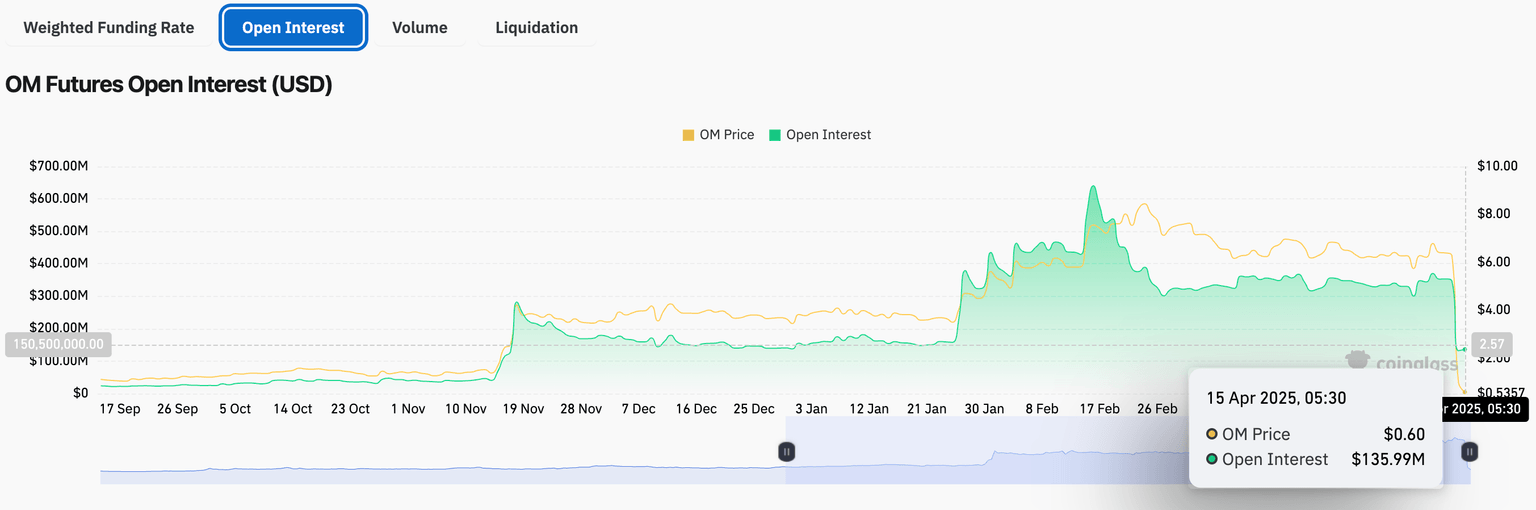

Mantra’s OM token noted $8.85 million in long liquidations in the last 24 hours; a total of $17 million in derivatives positions were liquidated according to Coinglass data. There was a significant decline in OM’s Open Interest, down from $345.66 million on Sunday to $135.99 million.

The long/short ratio is under one, meaning traders expect a correction in OM, and derivatives data analysis supports a bearish thesis for the token.

OM Futures Open Interest (USD) | Source: Coinglass

Altcoin season likely delayed, Bitcoin dominance headed towards four-year peak

Bitcoin holds steady above the $85,000 support and defies the uncertainty of global markets. BTC dominance is 63.85%, climbing towards 64%, a level previously observed in January 2021. As Bitcoin dominance inches towards a four-year high, altcoin season is likely delayed.

Altcoin season refers to a period where 75% of the altcoins ranked within the top 50 cryptocurrencies by market capitalization outperform Bitcoin in a 90-day timeframe.

Altcoin season index | Source: Blockchaincenter.net

XRP, DOGE and OM gain amidst the ongoing market uncertainty even as altcoin season is delayed.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.