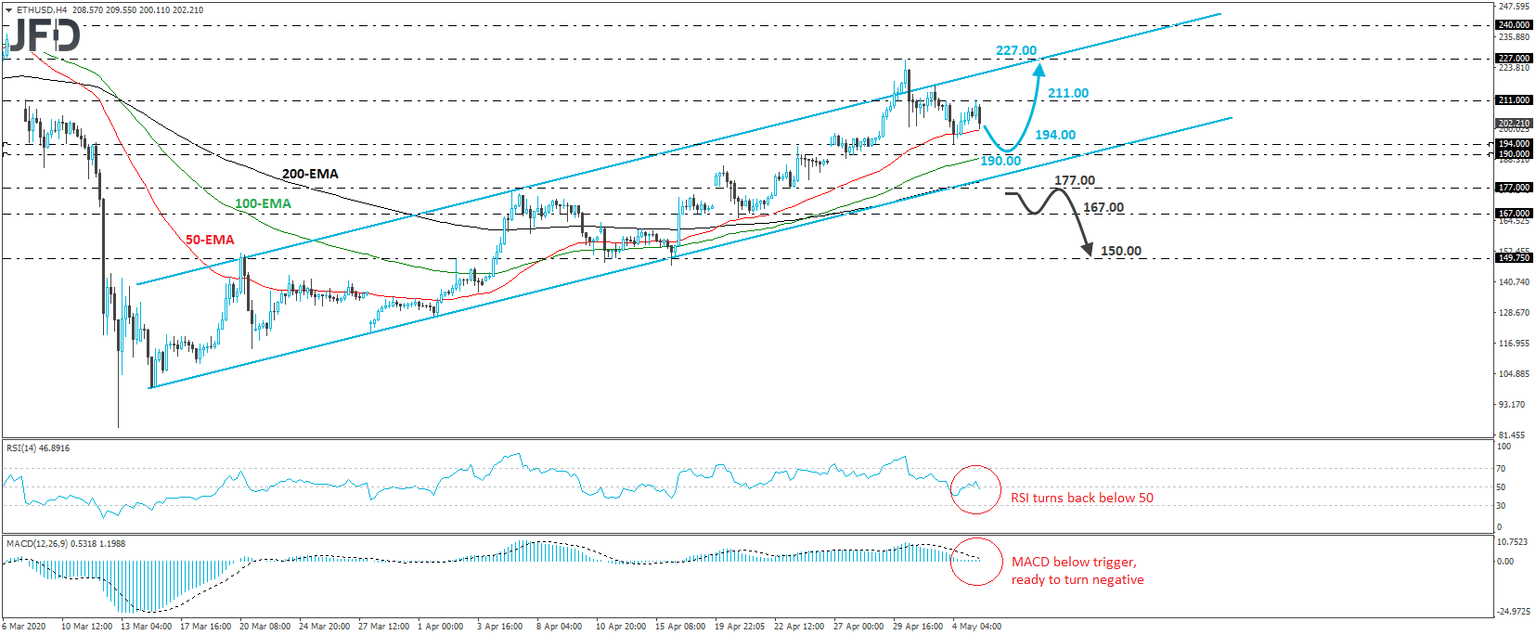

Will Ethereum stay within the upside channel?

Ethereum traded lower today, after hitting resistance near the 211.00 barrier. However, despite the current setback, the crypto continues to trade within an upside channel, within which the price has been mostly trading since mid-March. Therefore, even if the slide continues for a while more, as long as Ethereum is trading within the upside channel, we will hold a bullish stance.

As we already noted, the setback may continue for a while more, and the price may eventually challenge yesterday’s low, of 194.00, or the 190.00 barrier. It could even decline slightly more to challenge the lower bound of the channel. The bulls may take charge from near one of the aforementioned support areas, and perhaps push the price back up for another test at the 211.00 hurdle. If they are strong enough to overcome that barrier this time around, we may see the advance extending towards the crossroads of the 227.00 level, which is the high of April 30th, and the upper end of the channel.

Looking at our short-term oscillators, we see that the RSI turned down and just crossed back below its 50 line, while the MACD, although fractionally positive, lies below its trigger line and points south. It could obtain a negative sign soon. Both indicators suggest that the price may start gaining downside momentum soon, which supports the idea of further declines within the upside channel before, and if, the bulls decide to take the reins again.

In order to start examining the case of a possible reversal to the downside, we would like to see Ethereum falling below 177.00, which is the low of April 23rd. The price would already be below the lower end of the upside channel and the bears may initially aim for the 167.00 zone, which prevented the price from drifting lower between April 17th and 21st. Another dip, below 167.00, may encourage further declines, perhaps towards the psychological zone of 150.00, which also acted as a decent support, between April 10th and 16th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD