Will Bitcoin bulls support Crypto.com price to rally 34%

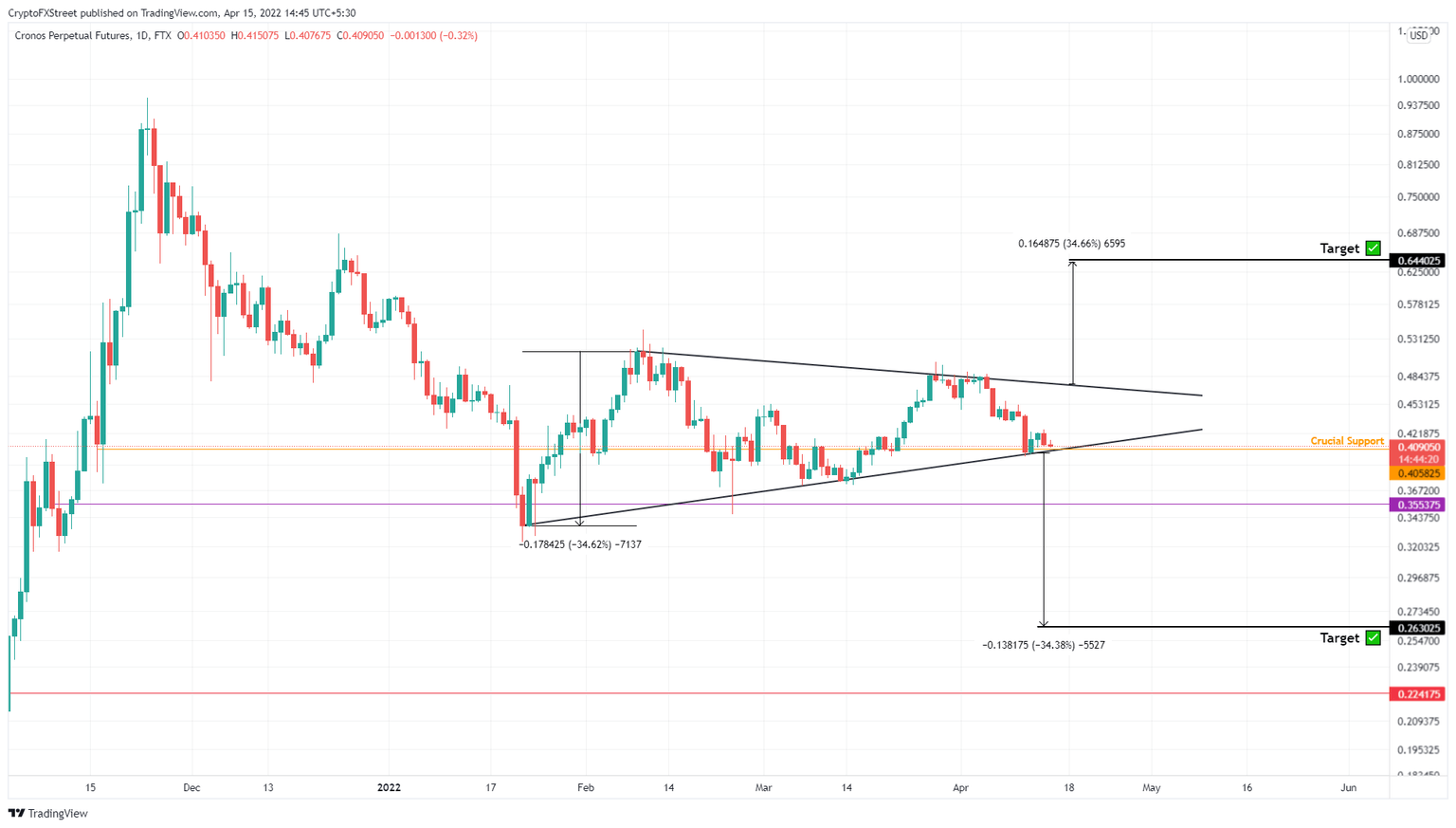

- Crypto.com price coils up inside a symmetrical triangle setup, hinting at a 35% breakout.

- A bounce off the lower trend line could result in a bounce that leads to a bullish move to $0.472.

- If CRO produces a daily candlestick close above $0.47, it will invalidate the bullish thesis.

Crypto.com price is getting squeezed between two converging trend lines, suggesting a lack of volatility. However, the possibility of a bull run-up depends solely on the assumption that CRO bounces off the support level it is currently tagging.

Crypto.com price needs to pull a 180

Crypto.com price is coiling up as the cryptocurrency market loses directional bias due to the recent downswing. CRO, on the other hand, is getting squeezed between two converging trend lines creating lower highs and higher lows.

This price action is known as a symmetrical triangle and the technical formation forecasts a 34% move, determined by adding the distance between the first pivot high and low of the triangle to the breakout point.

Currently, CRO is grappling with the lower trend line that coincides with the support level at $0.405. A resurgence of buyers here could lead to a bounce that will propel it to the upper trend line.

A daily candlestick close above $0.472 will indicate a bullish breakout. In such a case, the $0.644 target can be obtained by adding the 34% distance to $0.472.

CRO/USDT 1-day chart

Regardless of the optimisms, the bullish thesis rests on the assumption that CRO manages to bounce off the symmetrical triangle’s lower trend line. However, a failure to do so could trigger a bearish breakout.

In such a case, Crypto.com price will have the $0.355 support level to cauterize the bleed. If buyers do not step up here, there is a good chance CRO could crash to $0.260.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.