Why Dogecoin and meme coins are crashing even after SEC guidance on memes

- Dogecoin price trades down by 6% on Friday, and Solana meme coins wipe 9% from market capitalization, following SEC guidance.

- SEC says meme coins are generally not securities under federal law but fails to catalyze recovery in the category.

- Bitcoin recovers slightly after a drop below $80,000 ushers market-wide correction, causing extreme fear in traders.

Dogecoin (DOGE) and meme coin prices struggle amidst a crypto market-wide correction on Friday. Two key market movers for the sell-off are Bitcoin’s drop below the $80,000 support and the US financial regulator Securities and Exchange Commission’s (SEC) guidance on meme coins, published on Thursday.

Dogecoin and meme coins face price crash

Dogecoin and meme coins like Shiba Inu (SHIB), Pepe (PEPE), and Official Trump (TRUMP) are hit by a price correction in response to the crypto market crash. Data from CoinGecko shows a nearly 4% decline in the market capitalization of Solana-based meme coins, down to $8.7 billion at the time of writing.

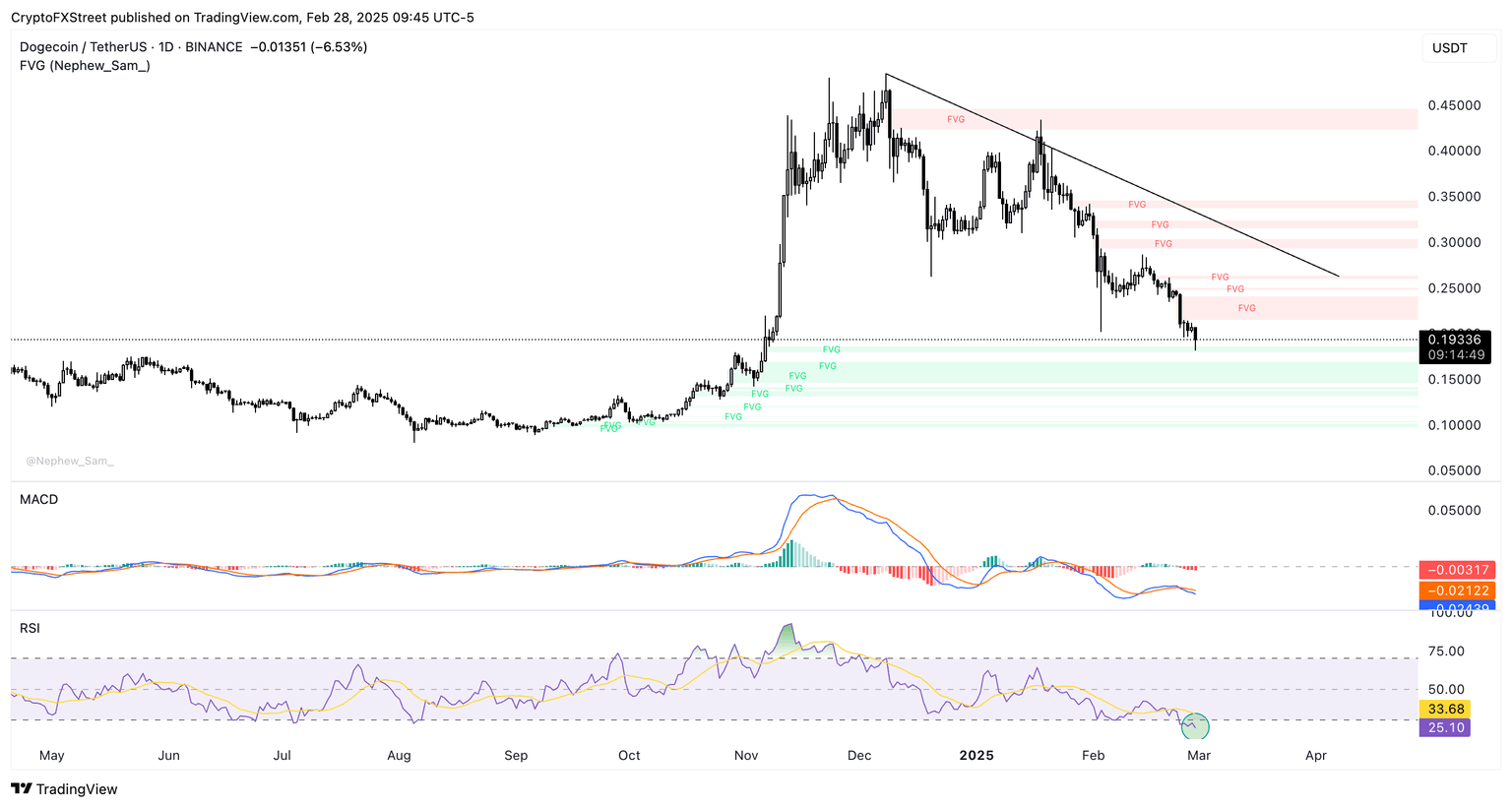

DOGE/USDT daily price chart

The two main drivers of the price crash in meme coins could be Bitcoin’s decline below the $80,000 level early on Friday and the recent Bybit hack, amounting to $1.4 billion.

The US financial regulator issued guidance on meme coins, where the Division of Corporate Finance explained that transactions involving meme coins “do not involve the offer and sale of securities under the federal securities laws.”

Despite the SEC’s guidance, meme coins are struggling to recover. The effects of the market-wide crypto correction are felt in the sentiment among traders.

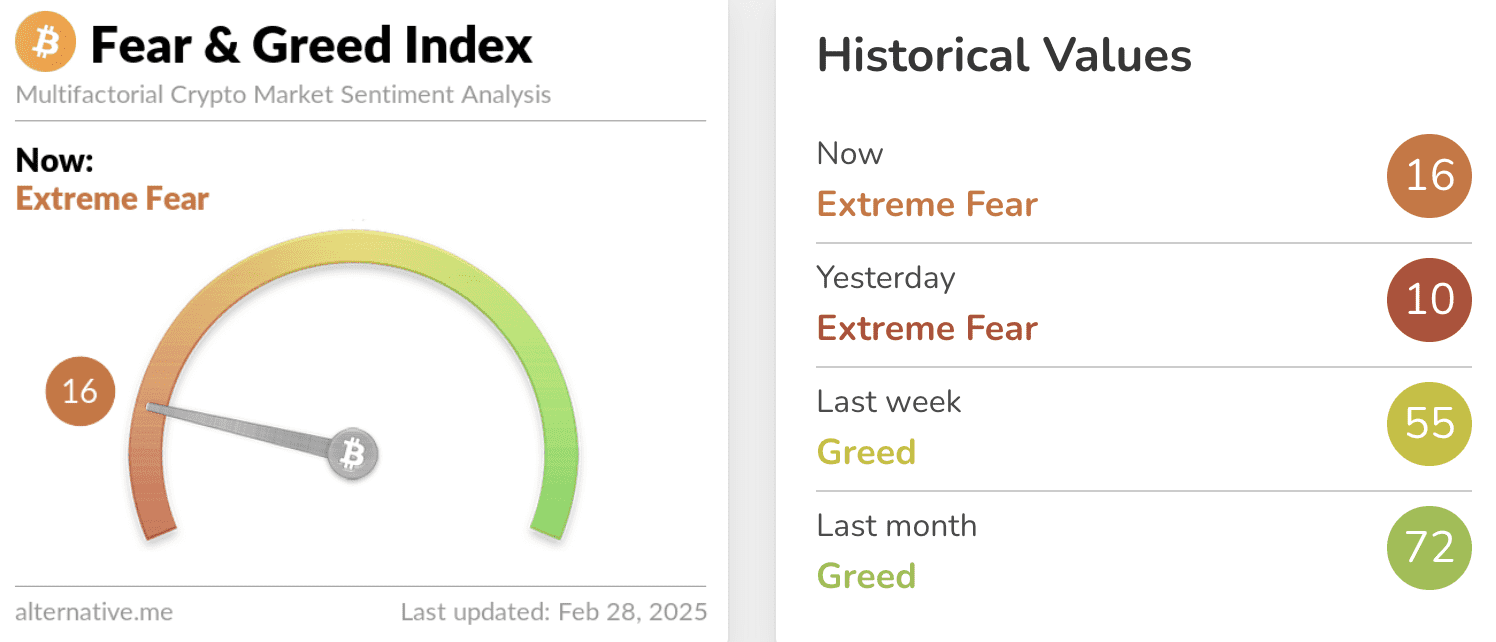

The Crypto Fear & Greed Index reads 16 on a scale of 0 to 100, indicating “Extreme Fear,” for the first time in three years. This signals a heightened risk-off sentiment among crypto traders.

Fear & Greed Index | Source: Alternative.me

In their February 10 report, "Has $TRUMP Killed the Crypto Pump?" 10x Research analysts mentioned that crypto market dynamics have shifted following the launch of the Trump Coin. Analysts highlighted that the market will likely remain in a state of consolidation with continued downside pressure in the near term.

10x Research identified the coinciding launches of TRUMP and the peak of Pump.fun and Solana, marking it as a turning point in the speculative momentum in meme coins.

In their report, analysts say:

“The issue isn’t just price declines—it’s the realization that insiders could accumulate large amounts early, leverage major crypto exchanges for liquidity, and then sell to retail investors at over $60 per token, only for it to trade below $16. This growing awareness may be discouraging further speculative frenzy.”

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.