Why analysts believe Bitcoin is going to zero, will BTC price nosedive?

- David Gokhstein, crypto influencer and media personality believes Bitcoin is going to zero.

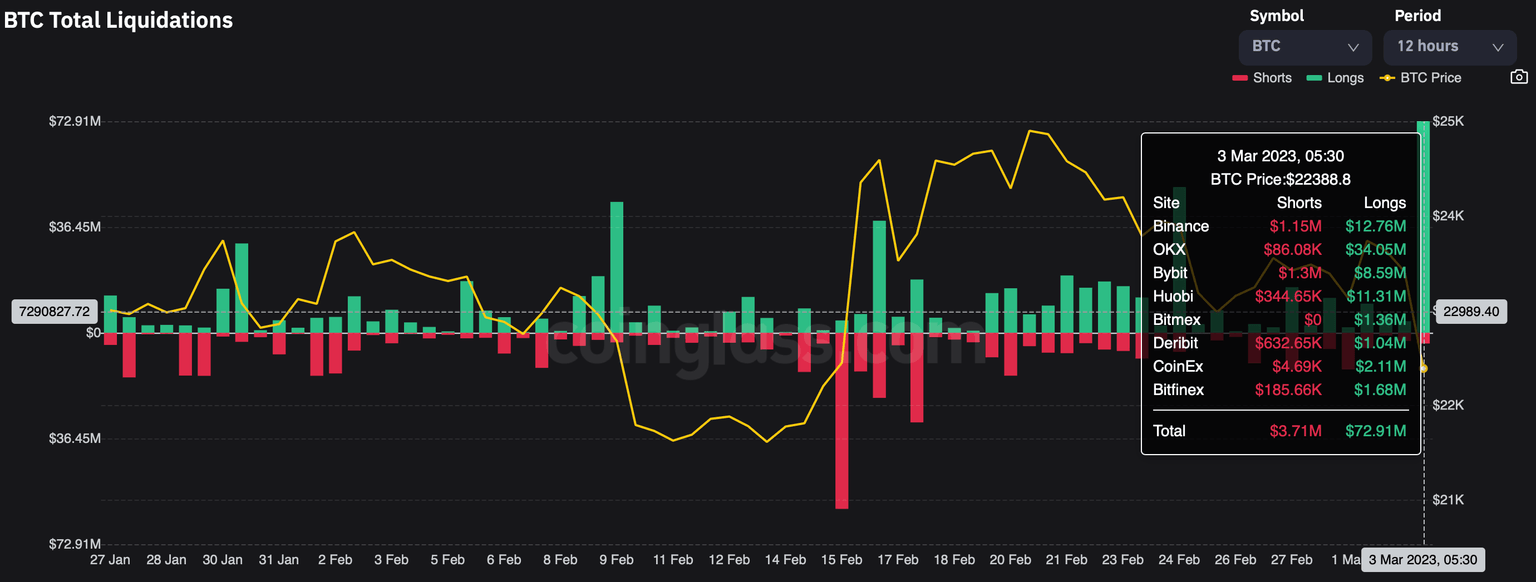

- Over $72.91 million in Bitcoin longs got liquidated earlier today, signaling a shift in sentiment among BTC holders.

- UK financial institutions HSBC and Nationwide have imposed new restrictions on crypto purchases citing warnings from the Financial Conduct Authority.

Crypto analysts note that headwinds are starting to pile up, explaining the recent decline in Bitcoin, Ethereum and cryptocurrency prices. The massive BTC long liquidation and bans imposed by UK financial institutions on crypto spending and purchase by users could dampen the sentiment of Bitcoin holders.

David Gokhstein says Bitcoin is going to zero in new tweet

David Gokhstein, crypto influencer and the founder of Gokhstein media said that Bitcoin is going to zero in a recent tweet.

I think #bitcoin is going to $0.

— David Gokhshtein ®️ (@davidgokhshtein) March 3, 2023

The crypto proponents tweet comes at a time when a large volume of Bitcoin longs were liquidated after a 4.3% decline in BTC price overnight. Over $72.91 million worth of BTC longs were liquidated earlier today, implying that the sentiment among derivatives traders has turned bearish.

BTC Total Liquidations on March 3

The current week has been eventful with HSBC and Nationwide’s newly imposed restrictions on crypto purchases. HSBC is the UK’s largest bank and it has reportedly banned customers from purchasing crypto using credit cards. Nationwide imposed a £5,000 daily limit on crypto purchases using debit cards.

The banks have justified the actions citing warnings from the regulator Financial Conduct Authority (FCA). The shifting attitudes among financial institutions could directly influence the inflow and outflow of capital to and from cryptocurrencies like Bitcoin.

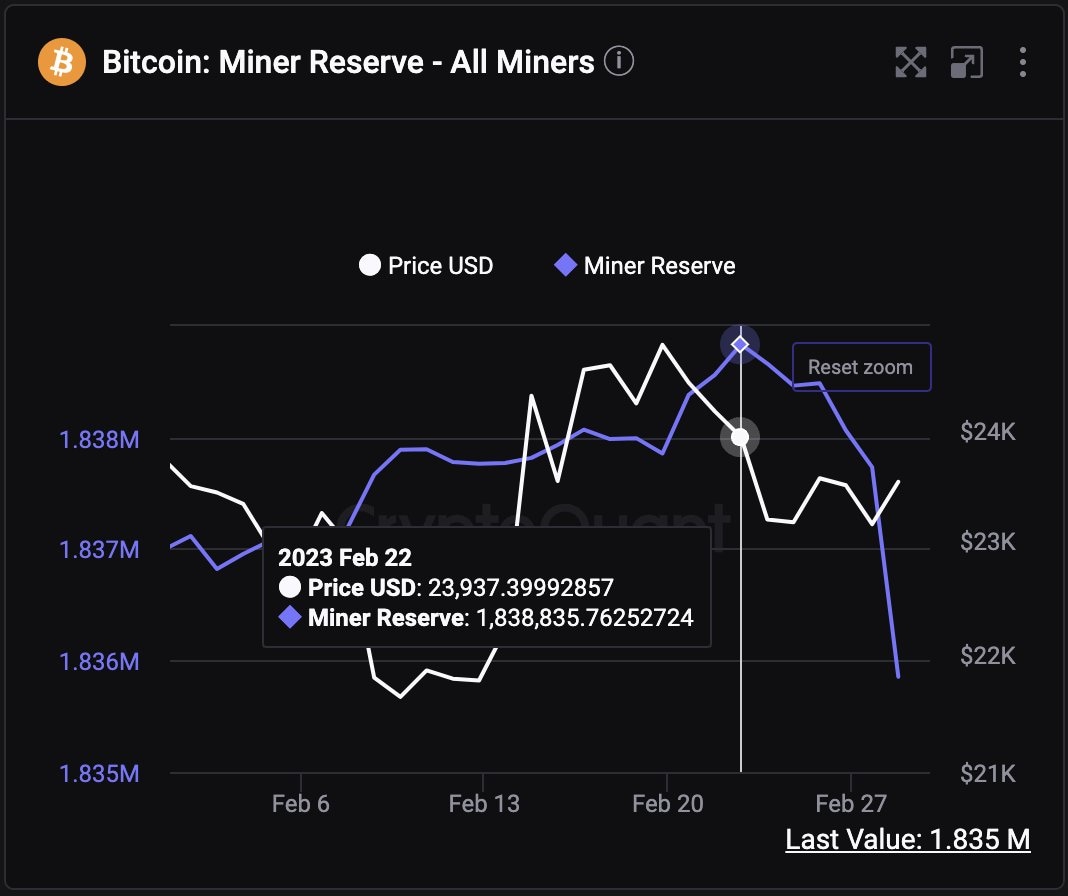

Did Bitcoin miners predict BTC price decline?

Bitcoin miner reserves dropped by 3,835 Bitcoin over the past week, worth $88.2 million.

Bitcoin miner reserve decline

A massive drawdown in miner reserves a week before a 6.5% correction in BTC price makes it likely that miners saw the decline coming and planned their moves accordingly.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.