Which coins have accumulated enough effort for a continued rise?

After sharp growth, most of the coins have entered the correction phase.

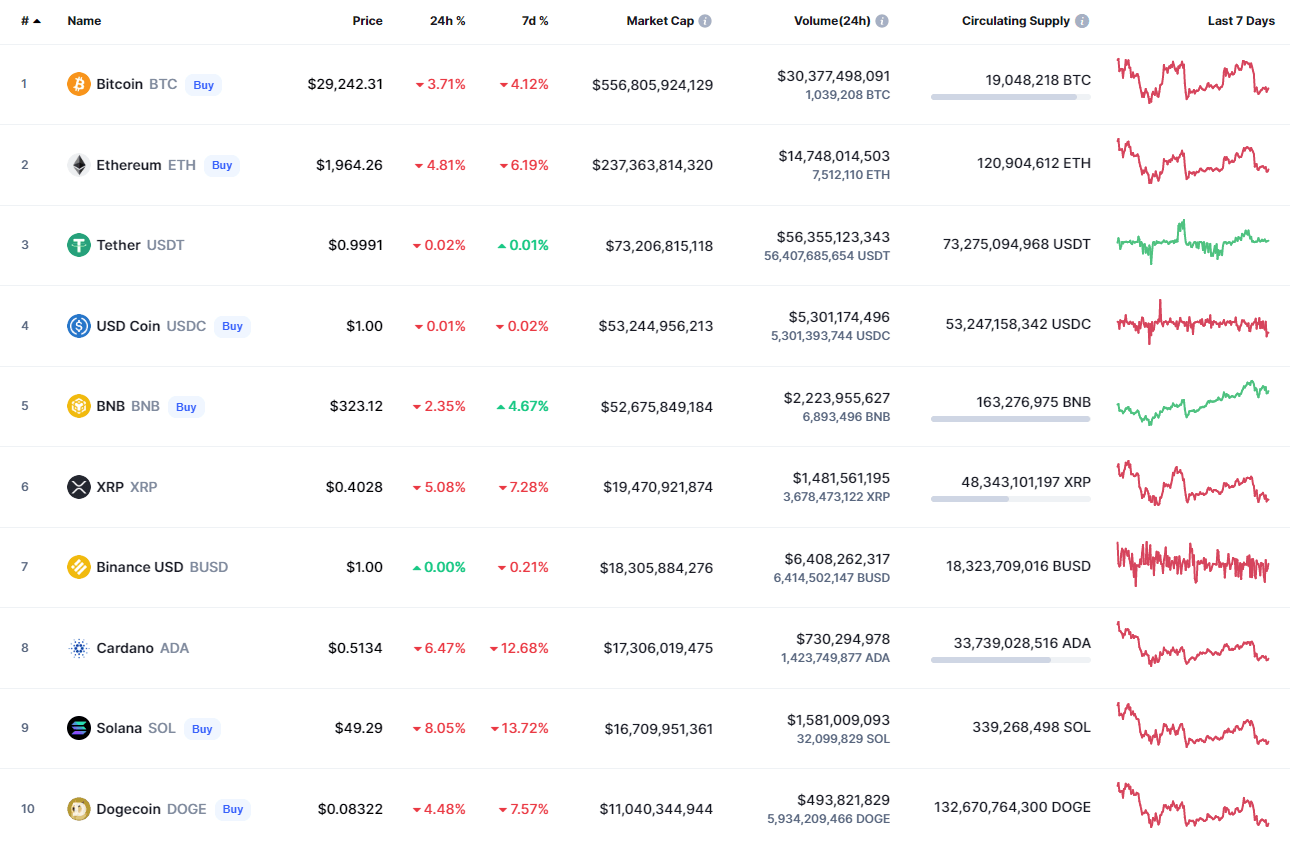

Top coins by CoinMarketCap

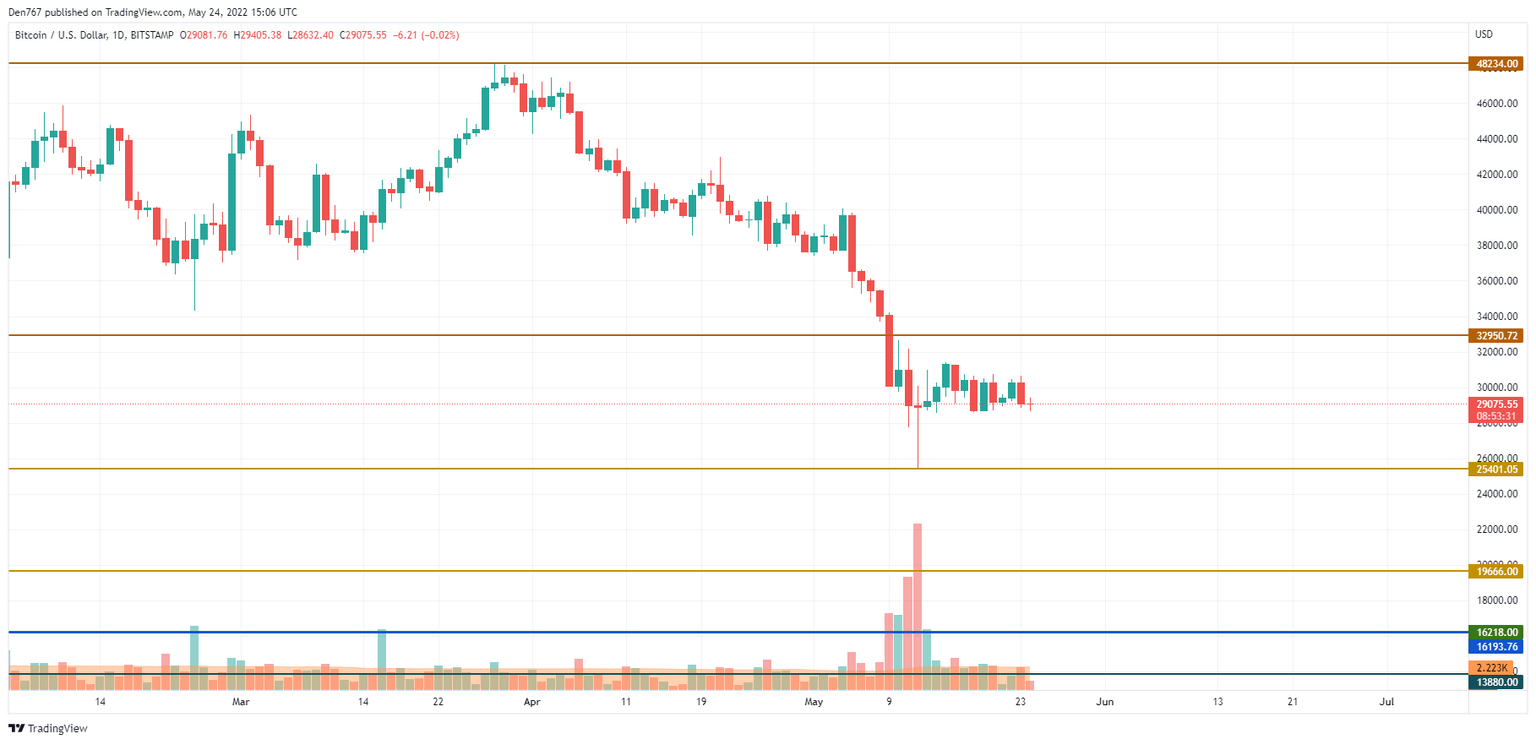

BTC/USD

Bitcoin (BTC) keeps facing trouble, going down by 4% over the last 24 hours.

BTC/USD chart by TradingView

Despite the fall, Bitcoin (BTC) is located in the middle of the channel with neither bullish nor bearish signals. However, the $30,000 mark remains important in terms of a further possible rise. If buyers can return to this area and fix above it, the growth may continue to $31,000 by the end of the week.

Bitcoin is trading at $28,977 at press time.

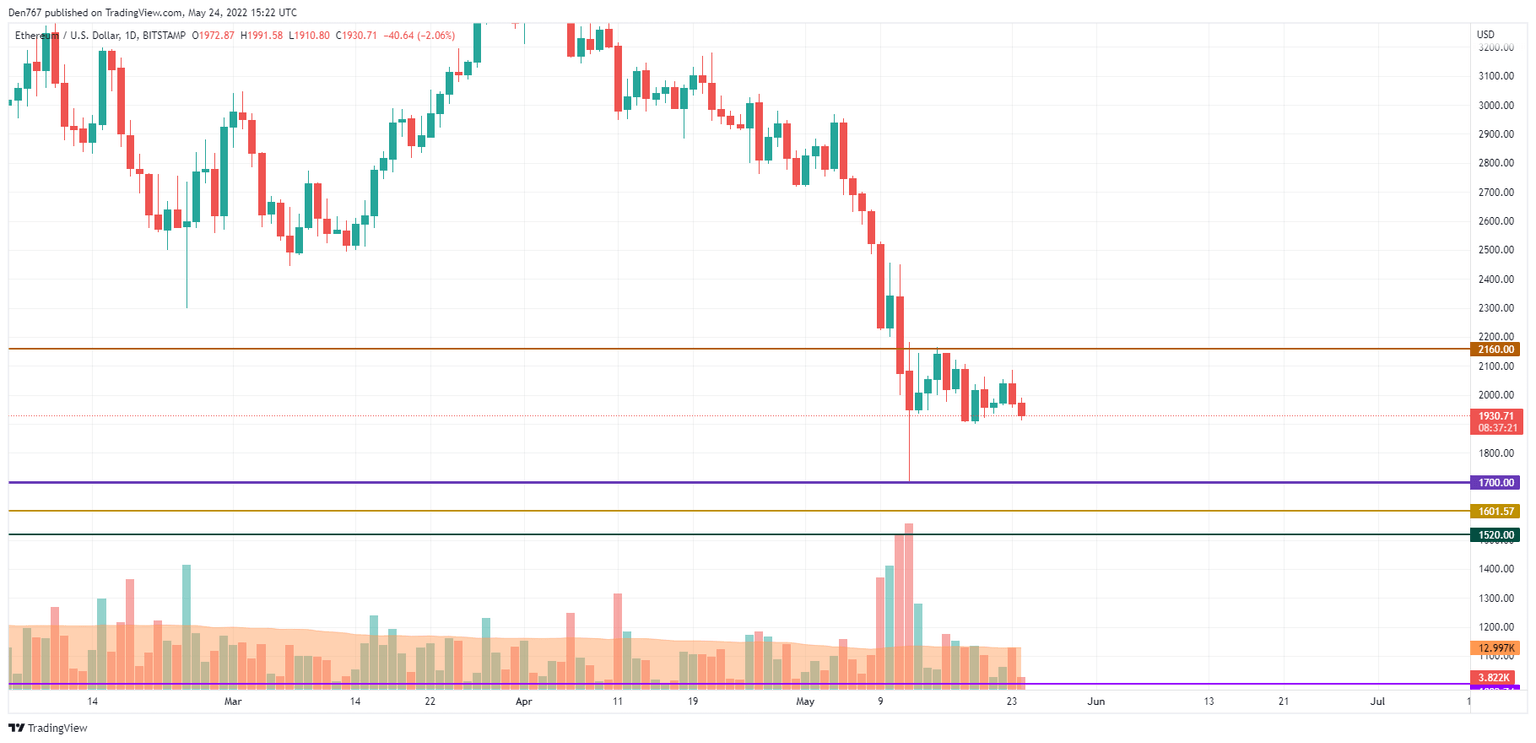

ETH/USD

Ethereum (ETH) is the biggest loser from the list today with a drop of 6.53%.

ETH/USD chart by TradingView

Ethereum (ETH) is showing worse price performance than Bitcoin (BTC) as the rate keeps going down after a failed attempt to fix above $2,000. If buyers cannot seize the initiative, one can expect a sharp decline below $1,900 within the next few days.

Ethereum (ETH) is trading at $1,935 at press time.

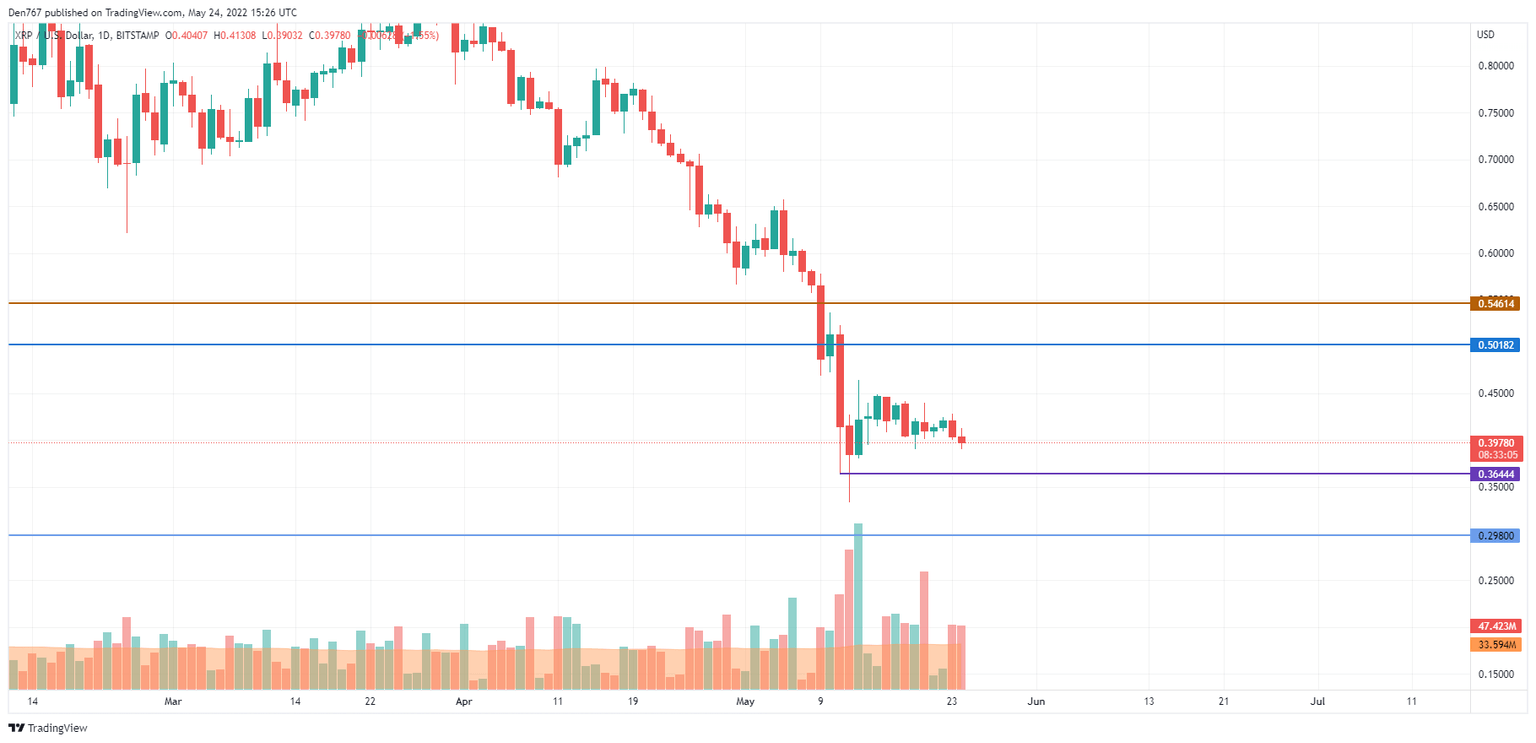

XRP/USD

XRP is following Ehtereum (ETH) with a decline of 6.34%.

XRP/USD chart by TradingView

XRP has lost the $0.40 mark, which means that until the rate is below it, there are good chances to see a continued decrease. In this case, traders might see the test of the support level at $0.37 shortly.

XRP is trading at $0.3979 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.