Which coins can repeat the rise of DOGE?

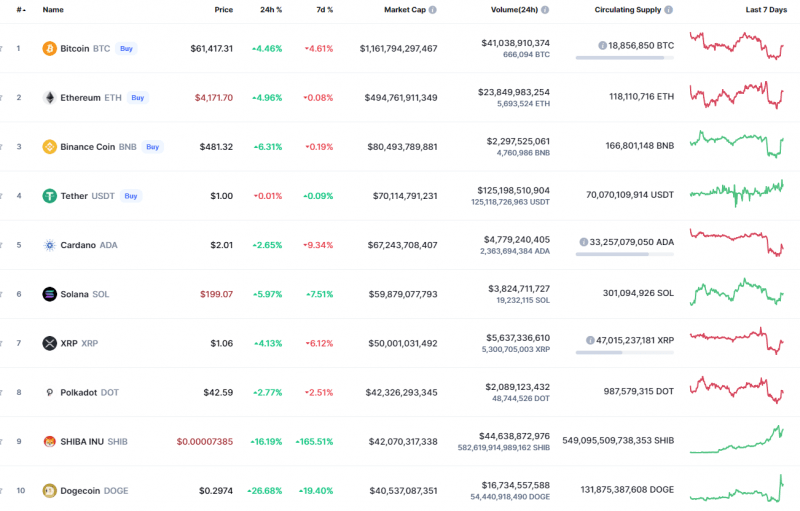

Bulls have recovered after a sharp drop, and all of the top 10 coins have come back to the green zone.

Top coins by CoinMarketCap

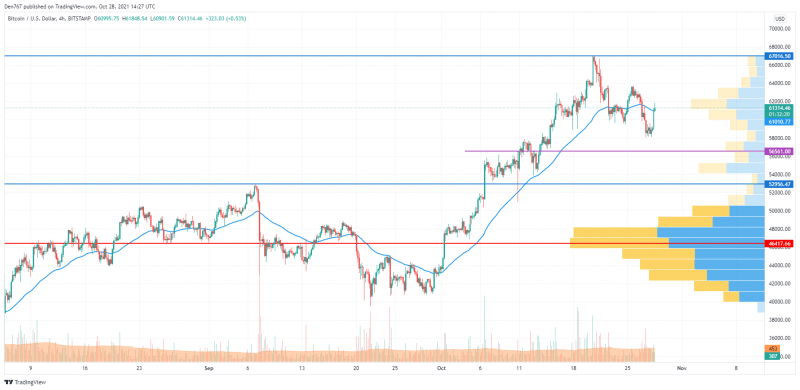

BTC/USD

Yesterday morning, the bearish pressure intensified and the correction continued toward the support of $ 58,000. The daily low was set at $58,100.

BTC/USD chart by TradingView

In the afternoon, sales volumes declined, and the Bitcoin price consolidated sideways. Until this morning, bears did not manage to test the support of $58,000, and the activity of buyers was sharply declining at the level of $59,500. This sideways trend may continue today.

If the bears manage to push through the strong support of $58,000, then the pair may drop to the level of $56,740. If the BTC price fixes above the $58,000 level, then a recovery to $62,000 is possible.

Bitcoin is trading at $61,348 at press time.

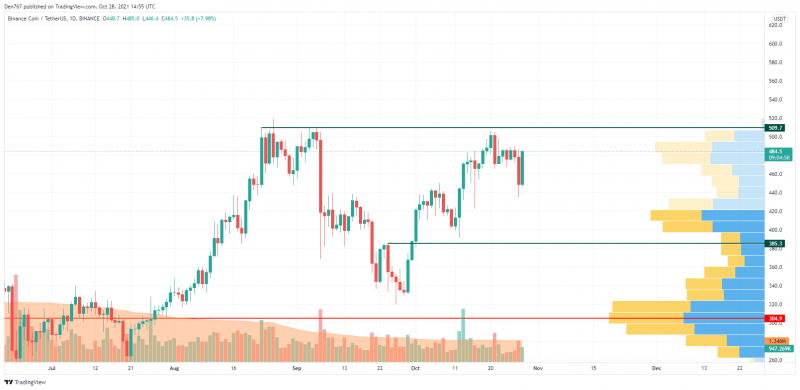

BNB/USD

Binance Coin (BNB) is looking stronger than Bitcoin (BTC) as the rate of the native exchange coin has risen by 6.14% over the past 24 hours.

BNB/USD chart by TradingView

Despite today's sharp rise, the ongoing growth of BNB may continue if the altcoin closes today above the $480 mark that reflects yesterday's open level.

In this case, there is a high chance to see the breakout of the resistance at $509.7. If that happens, the rise may continue to the zone around $550.

Binance Coin is trading at $484.4 at press time.

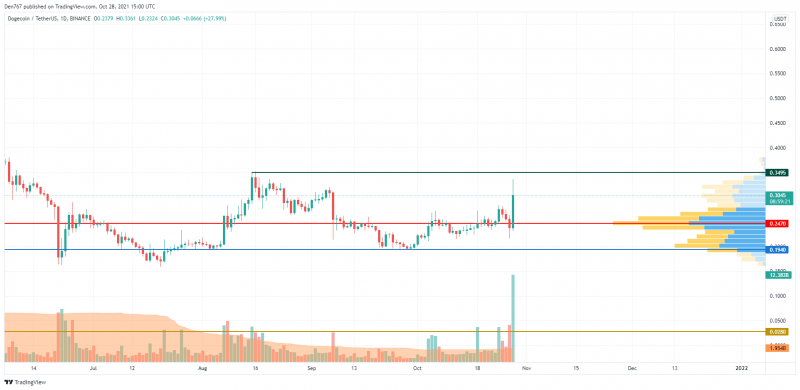

DOGE/USD

DOGE is the biggest gainer today as its rise has constituted 23% since yesterday.

DOGE/USD chart by Trading View

DOGE has almost touched the resistance at $0.3495, accompanied by the high trading volume. If the daily candle closes around this mark, bulls mifht continue the growth tomorrow. In another case, the coin keeps trading in a wide channel between the mentioned resistance and the support at $0.1940.

DOGE is trading at $0.3037 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.