Which coins can grow in the mid-term scenario?

The cryptocurrency market remains bullish even though some coins are trading in the red zone.

Top coins by CoinMarketCap

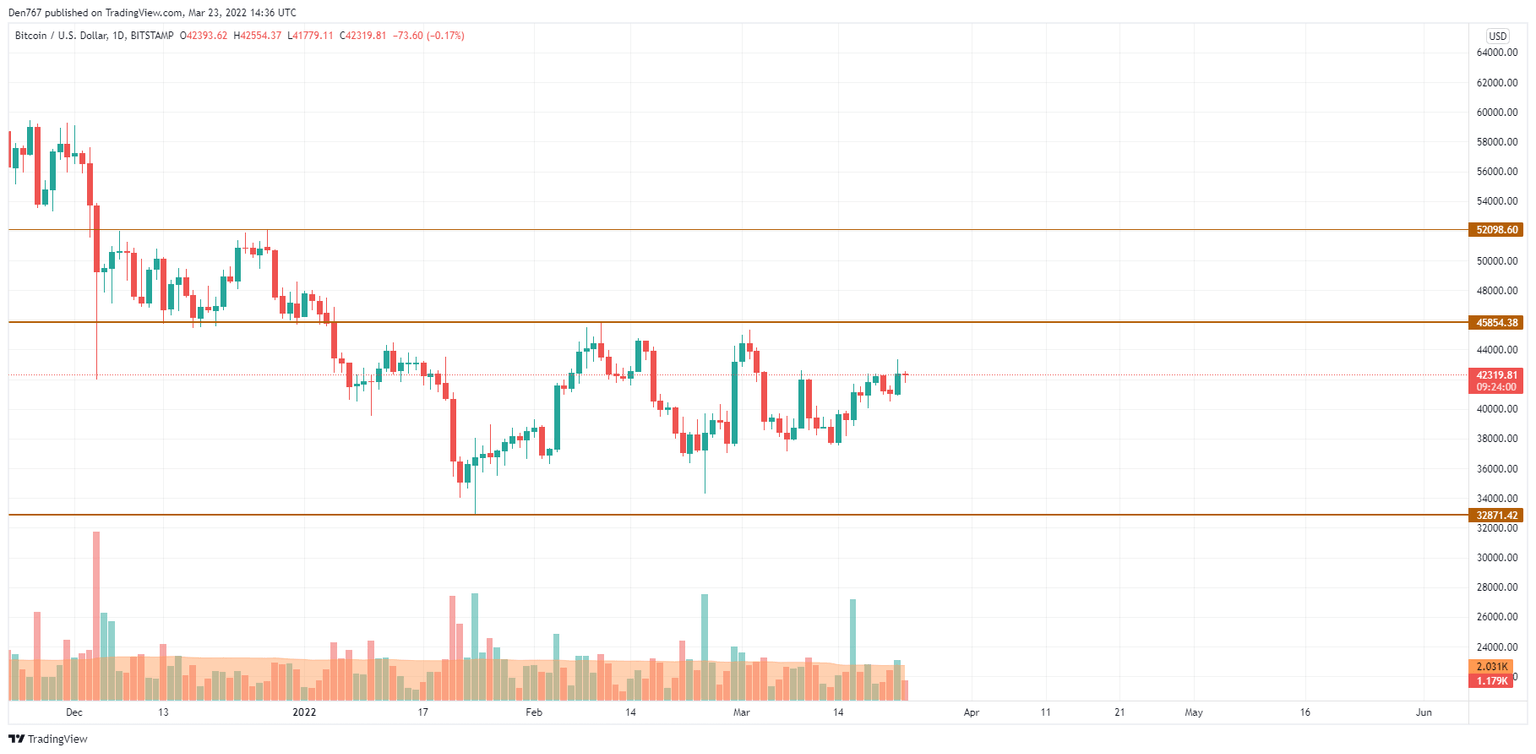

BTC/USD

Bitcoin (BTC) could not follow its rise of yesterday, going down by 1.67%.

BTC/USD chart by TradingView

Despite the fall, Bitcoin (BTC) is slowly approaching the resistance level at $45,854 on the daliy chart. Thus, the buying trading volume is also rising, which means that bulls are ready to return the rate to the previous levels.

However, if bulls fail to hold the $42,000 mark, the fall may continue to $40,000.

Bitcoin is trading at $42,337 at press time.

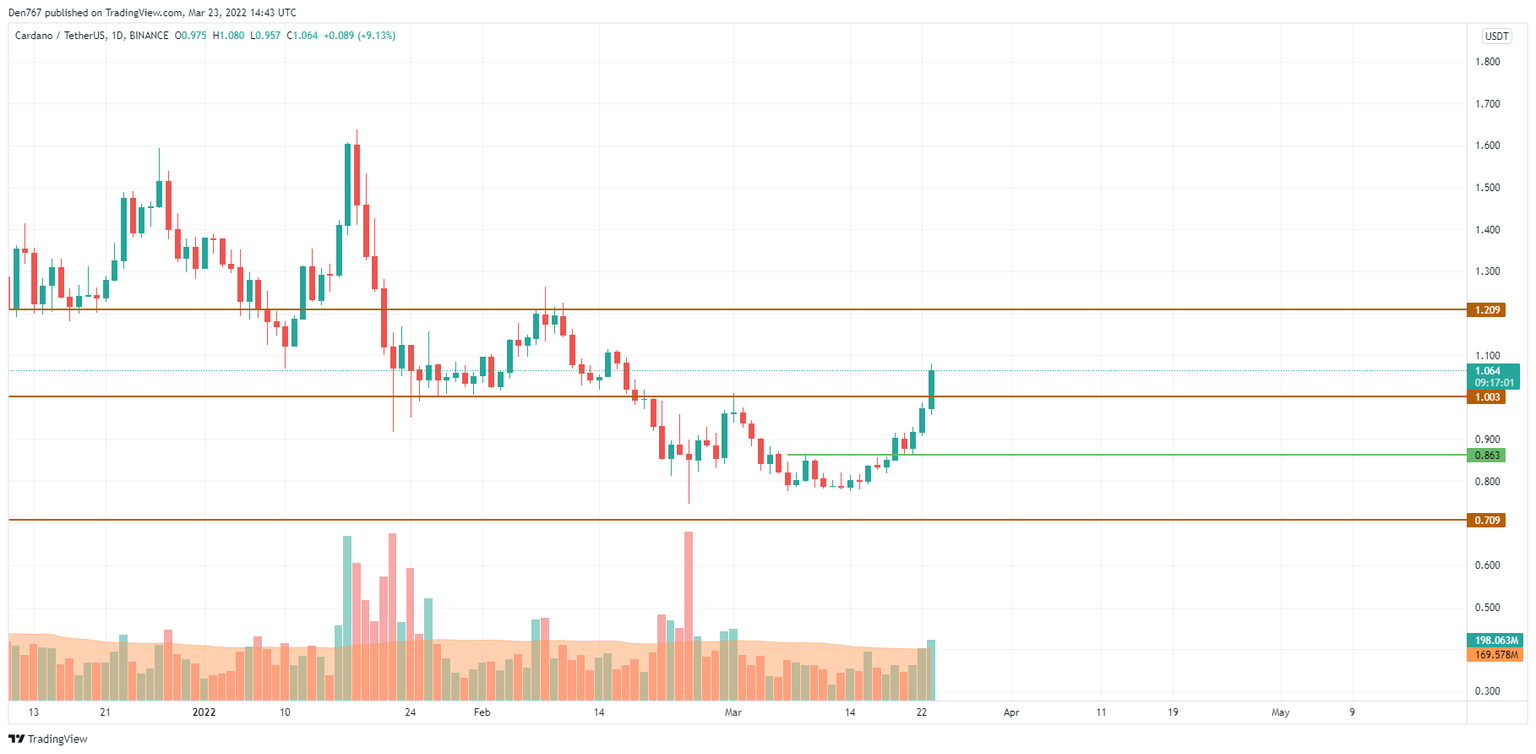

ADA/USD

Cardano (ADA) is the biggest gainer from the list today as rate of the popular altcoin has rocketed by 8%.

ADA/USD chart by Trading View

Cardano (ADA) has confirmed its mid-term bullish trend after the breakout of the $1.003 mark. If the bulls can hold the current level and the daily candle fixes above it, the growth may continue up to the resistance at $1.209 by the end of the month.

ADA is trading at $1.064 at press time.

BNB/USD

Binance Coin (BNB) has followed the decline of Bitcoin (BTC), falling by 1.18%.

BNB/USD chart by TradingView

Despite the fall, the rate of the native exchange coin has broken the vital $400 mark and is currently trading above it.

If nothing changes and bulls can hold the $400 level, the ongoing upward move may lead the price of BNB to the resistance at $441 shortly.

BNB is trading at $406.6 at press time.

SOL/USD

The rate of Solana (SOL) is almost unchanged over the last 24 hours.

SOL/USD chart by TradingView

Solana (SOL) is rising at the moment against the increased trading volume. SOL needs to break the vital $100 for a mid-term rise. If the altcoin can do it by the end of the week, the growth may continue to the resistance at $130 soon.

SOL is trading at $94.86 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.