What Сryptocurrency Exchange Has the Best Liquidity

In a perfect world, if you wanted to sell something, you would go to the market and a buyer would arrive there at the same time as you, wanting the exact amount of the asset you were looking to sell and willing to pay the exact price you thought to be fair. But, unfortunately, we don’t live in that world, and our buying and selling is subject to many things that can work to our disadvantage.

That is why liquidity is so important. Liquidity is the lifeblood of economics. When there is adequate liquidity in a market, the assets are sold at prices that correspond to their inherent or agreed-upon value. Liquidity is the factor that keeps the balance between value and price, and ensures that everyone in the marketplace is getting a fair deal.

It has occurred to us that, even though liquidity is universally acknowledged as essential for the health of an exchange, a surprisingly small amount of press has been devoted to analyzing liquidity across digital asset exchanges. Over the last year or so, the volume metric has become unreliable as a real way to measure trading interest on exchanges. Reports of “fake volume” from some of the largest exchanges raised eyebrows and have made many understand that volume figures can be inflated and manipulated. This is why liquidity is now being considered as the best way to rank market exchanges and a number of big players in the industry are now turning to this metric as a primary source of knowledge.

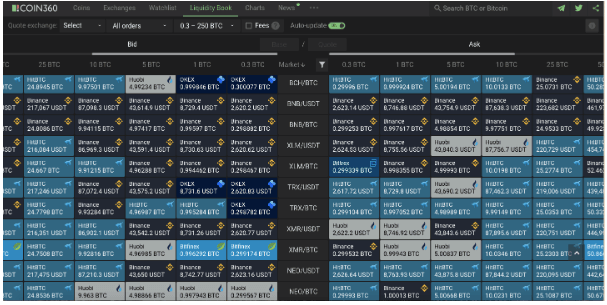

So let’s look at liquidity at some of the major digital asset exchanges, see how they compare, and what advantages some exchanges may have over the others. Because there are too many exchanges out there to analyze in one article, we are going to focus on three of the best, in terms of liquidity rates. These three exchanges are Binance, HitBTC, and Huobi, and the decision to examine them stems from our use of Coin360’s indispensable Liquidity Book, where these three are the most prevalent:

Another liquidity ranking is provided by CoinMarketCap, it calculates liquidity by taking into account a number of different variables from an exchange order book like the distance of the order from the mid-price, the size of the order, the relative liquidity of the market pair in question. It also uses an algorithm to determine the fairest possible result of the average liquidity of any given market pair over a 24 hour period by taking market readings at random intervals.

And you can see that HitBTC is #1 according to CoinMarketCap liquidity ranking at the moment:

Binance

Binance is the market leader in terms of the volume it produces day in, day out. With over a billion dollars worth of cryptocurrency changing hands on the exchange every day, Binance rivals with the biggest exchanges on the market in terms of its daily activity. There have, of course, been minor setbacks with Binance in the past from a trader’s perspective, but that, to some extent, comes with the territory in digital asset trading. But contrary to the expectations, the huge volume ratings do not always translate into the best liquidity rates, and even though most of the exchange’s volume comes from the trade of bitcoin and other major cryptocurrencies, Binance actually scores its highest liquidity marks on some of the smaller trading pairs like XLM/USDT and pairs involving Binance’s own BNB token:

HitBTC

The next exchange we are going to profile is a tiny bit smaller than the others in terms of daily volume, but it makes up for it in liquidity. HitBTC is the best-represented exchange on Coin360’s Liquidity Book, and it has been on top of CoinMarketCap liquidity ranking since its establishment. The Liquidity Book is constantly changing, but at any given time it will likely look something like this:

As you can see, in terms of liquidity, HitBTC looks like an impressive blue wave washing away the other exchanges.

Huobi

Huobi weighs in with a slightly smaller, though still impressive, daily volume, scoring just a but below one billion dollars' worth of crypto trade every day. As you can see in this screenshot:

Huobi runs nose to nose with some of the big guns. Although their market share extends throughout the board, it is especially highly represented at the top. Their biggest pairing is BTC/USDT, although, as you can see, the bids far outweigh the asks in this trading pair. In any case, Huobi does offer competitive liquidity rates on nearly all of the cryptocurrency pairs they offer, even if they aren’t always the best rates on the board.

So what does that say about the current situation at these three exchanges? If you go to any of them, you will likely be looking at liquidity rates that are somewhere near the top for the industry as a whole. If you want to break it down further, it becomes clear that while Binance and Huobi have respectable rates across the board, their numbers come mostly through concentrations of power on select pairings. HitBTC, on the other hand, though with a smaller amount of daily trading volume, has the more diversified and advantageous liquidity.

Author

Julia Gerstein

TradeSanta

Julia Gerstein graduated from The Peoples’ Friendship University of Russia in 2010 as a Bachelor of Arts in Journalism.