Whales take profit on WIF holdings, meme coin wipes out nearly 20% gains from May top

- Whale wallets holding WIF have sold their holdings, taking profit while the meme coin is nearly 20% below its monthly high.

- Whales accumulated WIF ahead of the meme coin’s climb to a high of $3.28 on May 22.

- WIF could wipe out gains from Wednesday if profit taking persists.

Dogwifhat (WIF) price wiped out 20% gains since its May peak of $3.6799. The meme coin overcame resistance at $2.90 on May 22, the Solana-based asset could attempt another recovery as the category rallies in the past 24 hours.

Data from crypto price tracker CoinGecko, the market capitalization of Solana-based meme coins has climbed over 5% in the past 24 hours. The market cap is $8.75 billion on Thursday.

Whales book gains in SOL-based meme coin WIF

Crypto intelligence tracker Lookonchain identified whale accumulation of WIF tokens on May 22, prior to the surge in the meme coin’s price. On Wednesday, WIF rallied to a high of $3.28 on Binance.

While Ethereum-based tokens rallied in response to positive developments surrounding optimism of ETF approval, Solana-based meme coins have also reacted positively.

Investors accumulated WIF, per Lookonchain on May 22, whale wallets have started taking profits on Thursday.

Whale wallets identified as “37reKQ” and “8rWUUy” bought WIF worth nearly $2 million on May 22.

WIF is pumping!

— Lookonchain (@lookonchain) May 22, 2024

We noticed 2 whales bought 701,668 $WIF($2.04M).

Wallet"37reKQ" spent 1.31M USDC to buy 453,877 $WIF at $2.89 2 hours ago and has an unrealized profit of $161K.https://t.co/OUYQOKx0tl

Wallet"8rWUUy" spent 4,036 $SOL($730K) to buy 247,791 $WIF at $2.95 in the… pic.twitter.com/up45IEJFgj

Late on Wednesday, a whale sold 2.36 million WIF tokens for nearly 7.44 million USD Coin (USDC) at an average price of $3.155. Following the whale’s token sale, the meme coin wiped out its value by 6%.

A whale sold all 2.36M $WIF for 7.44M $USDC at an average price of $3.155 in the past 2 hours.

— Lookonchain (@lookonchain) May 22, 2024

This caused the price of $WIF to drop from $3.25 to $3.05, a decrease of 6.2%.https://t.co/S9l5fo39L2https://t.co/OQJb6bHLVb pic.twitter.com/VRQ7x8gxXz

Another large wallet investor sold 500,774 WIF for 1.47 million USDC, at an average price of $2.94. The trader sold WIF four times in total and realized profits each time.

A smart money sold all 500,774 $WIF for 1.47M $USDC at $2.94 4 hours ago.

— Lookonchain (@lookonchain) May 23, 2024

This smart money traded $WIF 4 times in total and made money every time.

The win rate is 100% and the total profit is ~$2.3M!

Address:https://t.co/SClk1TrAGwhttps://t.co/mGmyxrVt2A pic.twitter.com/tPM0ZwgNj2

WIF eyes return to May 22 top of $3.28

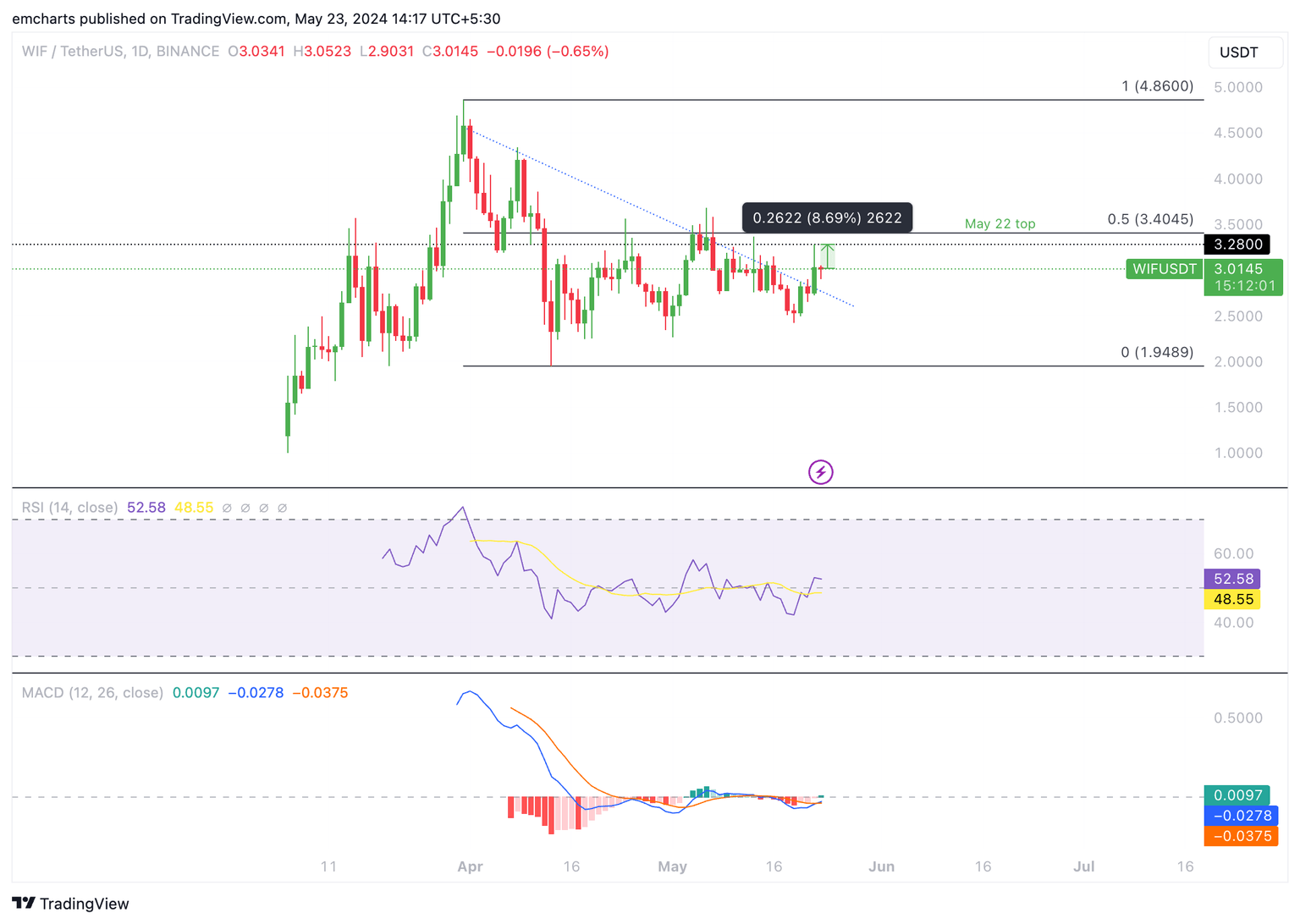

WIF set up its local top, May 2024 peak of $3.6799 on May 6. WIF produced lower highs and lower lows since hitting its monthly peak. There is a notable break in the trend on May 22 as price climbs to a high of $3.28.

The histogram bars of the Moving Average Convergence Divergence indicator have turned green, indicating an underlying positive momentum. On Wednesday May 22, MACD crossed over the signal line, supporting a bullish thesis for WIF.

The Solana-based meme token is likely to rally to its May 22 top and pile nearly 9% gains.

WIF/USDT 1-day chart

In the event of a correction, WIF could sweep liquidity at its May 19 low of $2.42. WIF could find support at its May 1 low of $2.2641, this level has been respected as support since mid-April.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.