Wells Fargo, JPMorgan file for Bitcoin fund, BTC price jumps above $47,000

- Wells Fargo and JPMorgan have filed for a Bitcoin fund with the US SEC.

- The fund aims to offer exposure to the bellwether cryptocurrency through a partnership with NYDIG.

- Bitcoin price jumped back above $47,000 following the announcement.

Wells Fargo and JPMorgan are planning to offer their clients exposure to the leading cryptocurrency in partnership with New York Digital Investment Group (NYDIG). The pair of banking giants are broadening their cryptocurrency interests by registering a Bitcoin fund with the United States Securities & Exchange Commission (SEC).

Banking giants to offer Bitcoin exposure to clients

Wells Fargo has partnered with NYDIG to offer Bitcoin exposure to its clients through a BTC fund. The bank will get an unspecified percentage of sales through its subsidiaries Wells Fargo Clearing Services and Wells Fargo Advisors Financial Network.

The recent filings with the SEC revealed that two of the notices name JPMorgan Securities as the recipient of the shares tied to the Bitcoin fund. The multinational investment bank will also receive a percentage of sales through its subsidiaries.

The funds were initially anticipated to be actively managed, however, they were registered as passive. So far, the funds have not completed any sales.

In May, Wells Fargo announced that it was creating cryptocurrency-based investment products for its wealthy clients. The President of the Wells Fargo Investment Institute suggested that the rise in value in the leading digital asset Bitcoin could be a sign of the industry’s maturity.

Bitcoin price bounces back in attempt to target $50,000

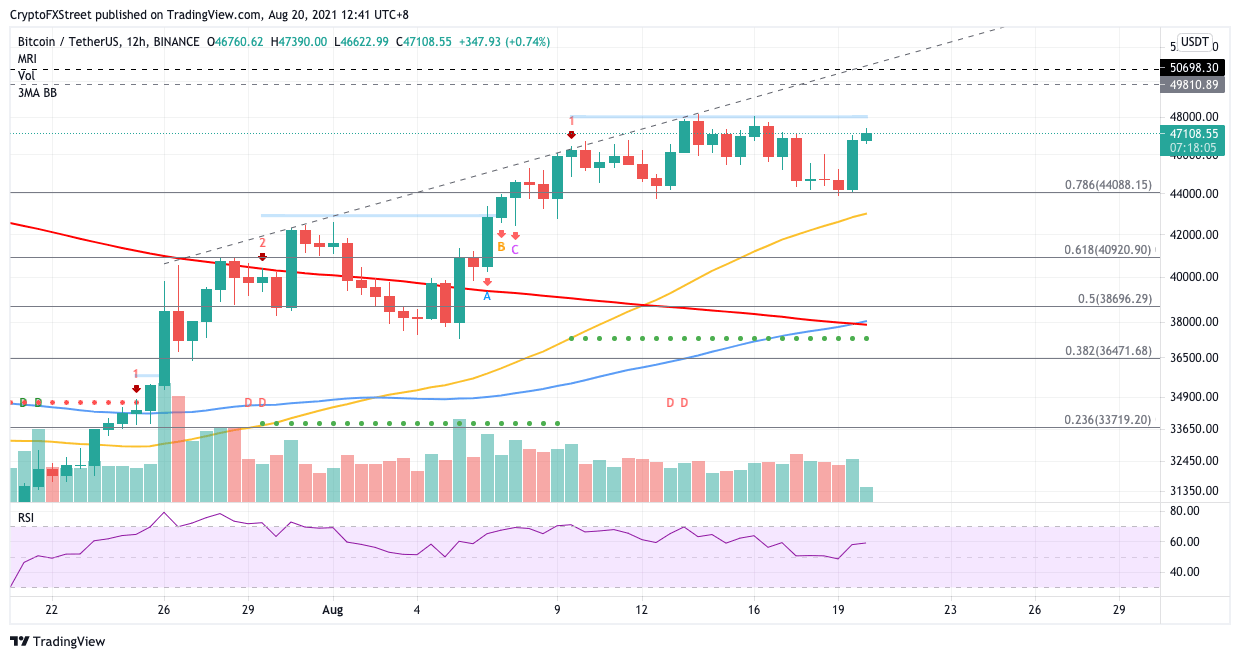

Bitcoin price has climbed over 7% on August 19, back up above the $47,000 territory. Although BTC still has a few hurdles to overcome before continuing its rally, the leading cryptocurrency is back on track to target $50,000.

The Momentum Reversal Indicator (MRI) suggests that there is a stiff obstacle ahead at the resistance line at $48,070. Only a slice above this level could see Bitcoin price head toward $49,810, the May 16 high.

Further buying pressure may push Bitcoin price up toward $50,698, the May 15 high.

However, should the bulls fail to propel BTC above the resistance level at $48,070, indecision could materialize in the market, giving rise to the possibility of Bitcoin price to move sideways.

BTC/USDT 12-hour chart

Bitcoin price is currently being supported by the 78.6% Fibonacci extension level at $44,088 and a dip below this level could open up the chances of BTC dropping lower.

The next line of defense for Bitcoin price is at the 50 twelve-hour Simple Moving Average (SMA) at $42,979, before dropping lower toward the 61.8% Fibonacci extension level at $40,920.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.