Week Ahead: Crypto market likely to rally after the recent flush

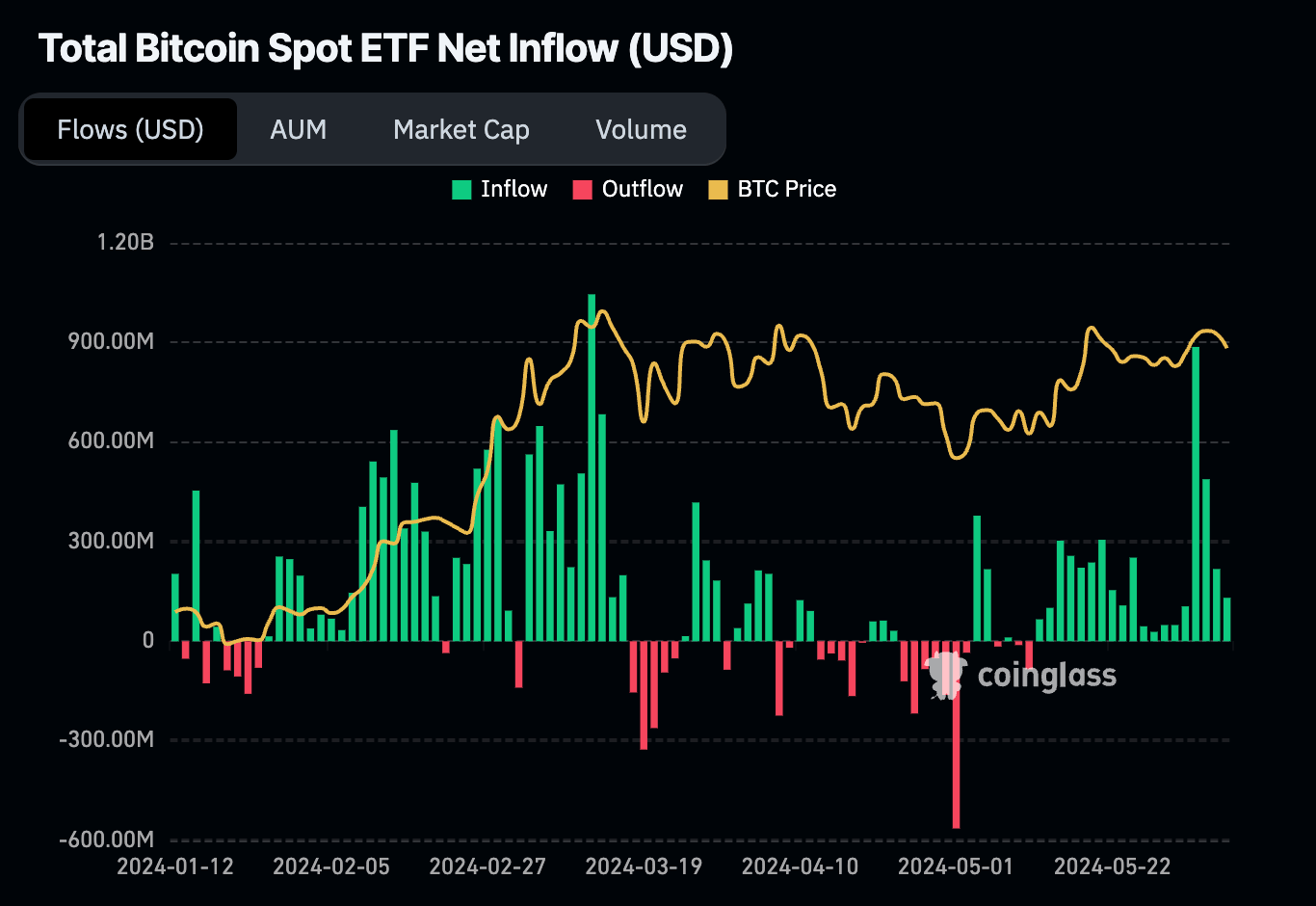

- Bitcoin spot ETF market inflows suggest a shift in market sentiment.

- BTC price needs to clear the $71,000 support level to kickstart the bull run.

- A breakdown of the $61,000 support level will invalidate the bull run and potentially kickstart a correction.

The recent Bitcoin (BTC) price decline wiped out billions in open interest and triggered a few hundred million in liquidations. With the upcoming events in the crypto and the broader stock market, the chances of a reversal are high.

Crypto market resets?

With the uptick in Bitcoin spot ETF hitting $886 million in inflows on June 4, investors expected the market outlook to turn bullish. Just two days later, BTC dropped roughly 2%, wiping out $4.21 billion in open interest and triggering more than $400 million in liquidations. This move showed that the crypto market was highly leveraged and the recent move was a required flush before establishing a directional bias.

Spot BTC ETF net flows

Bitcoin’s bias check

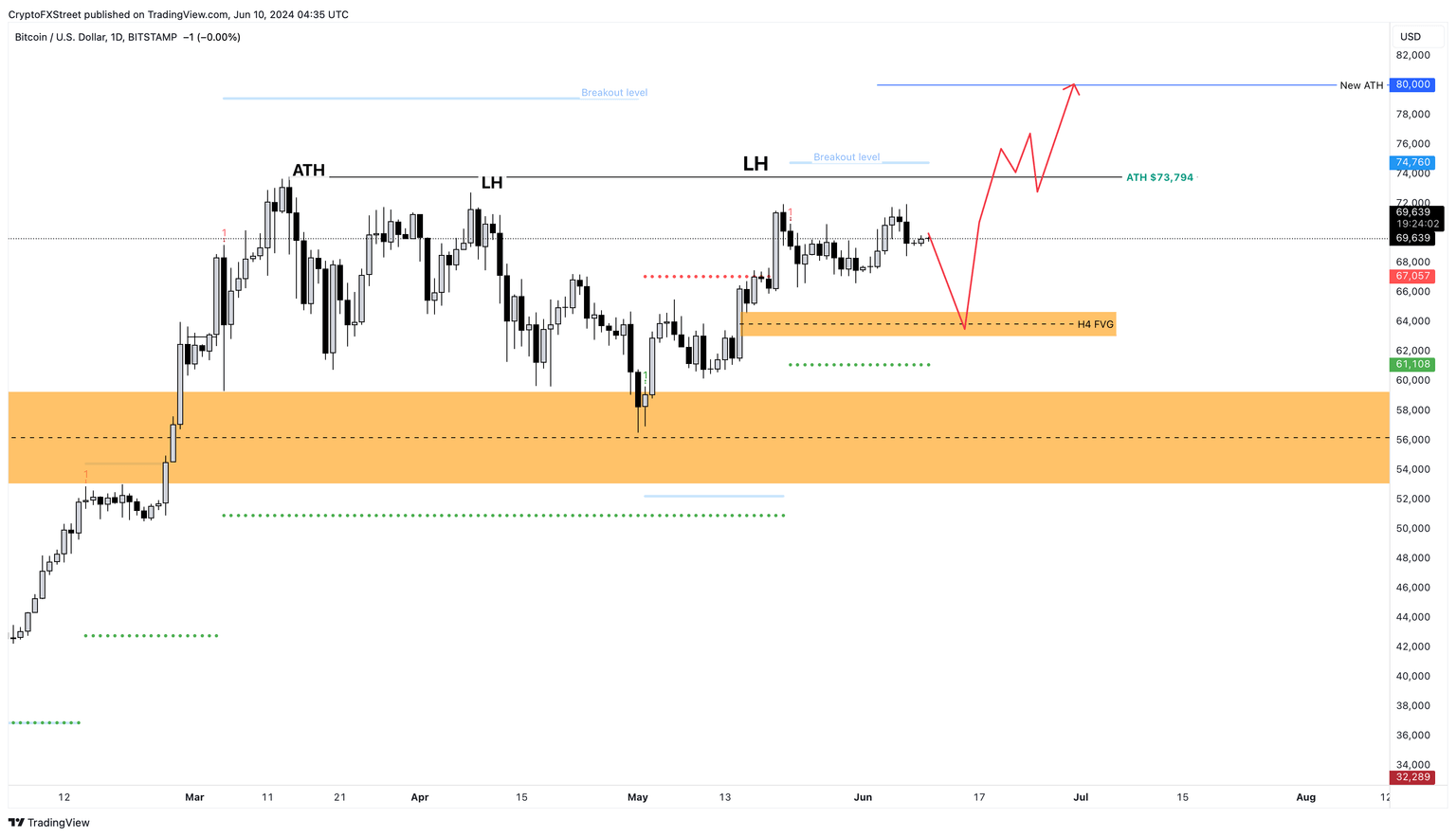

Despite the positive uptick in BTC spot ETF inflows, Bitcoin’s price outlook still remains uncertain. Here are a few key levels to note:

- The 4-hour imbalance, extending from $62,994 to $64,733, is a key zone to accumulate BTC.

- A weekly flip of the $71,000 hurdle will likely kick-start a bullish bias and propel BTC to new all-time highs (ATHs).

- Conversely, a breakdown of $61,000 on the weekly support level will likely kick-start a bearish move for the crypto market.

BTC/USDT 1-day chart

Crypto events this week

Monday, June 10:

- Apple WWDC 2024

Tuesday, June 11:

- Fetch.ai, Ocean Protocol & SingularityNET ASI Merge

Wednesday, June 12:

- US Consumer Price Index (CPI)

Friday, June 14:

- The start of the Euro 2024 tournament could trigger a volatile move in Chiliz (CHZ) price

Hot or not?

In addition to these events, investors need to monitor the following altcoin sectors, as they could see an uptick due to ripple effects.

- In the gaming sector, Gala (GALA) could see an increasing interest due to Euro 2024.

- Meme coins like Shiba Inu (SHIB), Dogecoin (DOGE), and new-generation altcoins like GME could see ripple effects if there is a significant development surrounding Roaring Kitty, aka Keith Gill. Gill gained massive popularity in 2021 due to the Reddit Rally that propelled the GME Stock price by 1,600%, and his recent comeback caused GME to surge.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.