Vechain price is inside a tightening range awaiting a potential 40% move

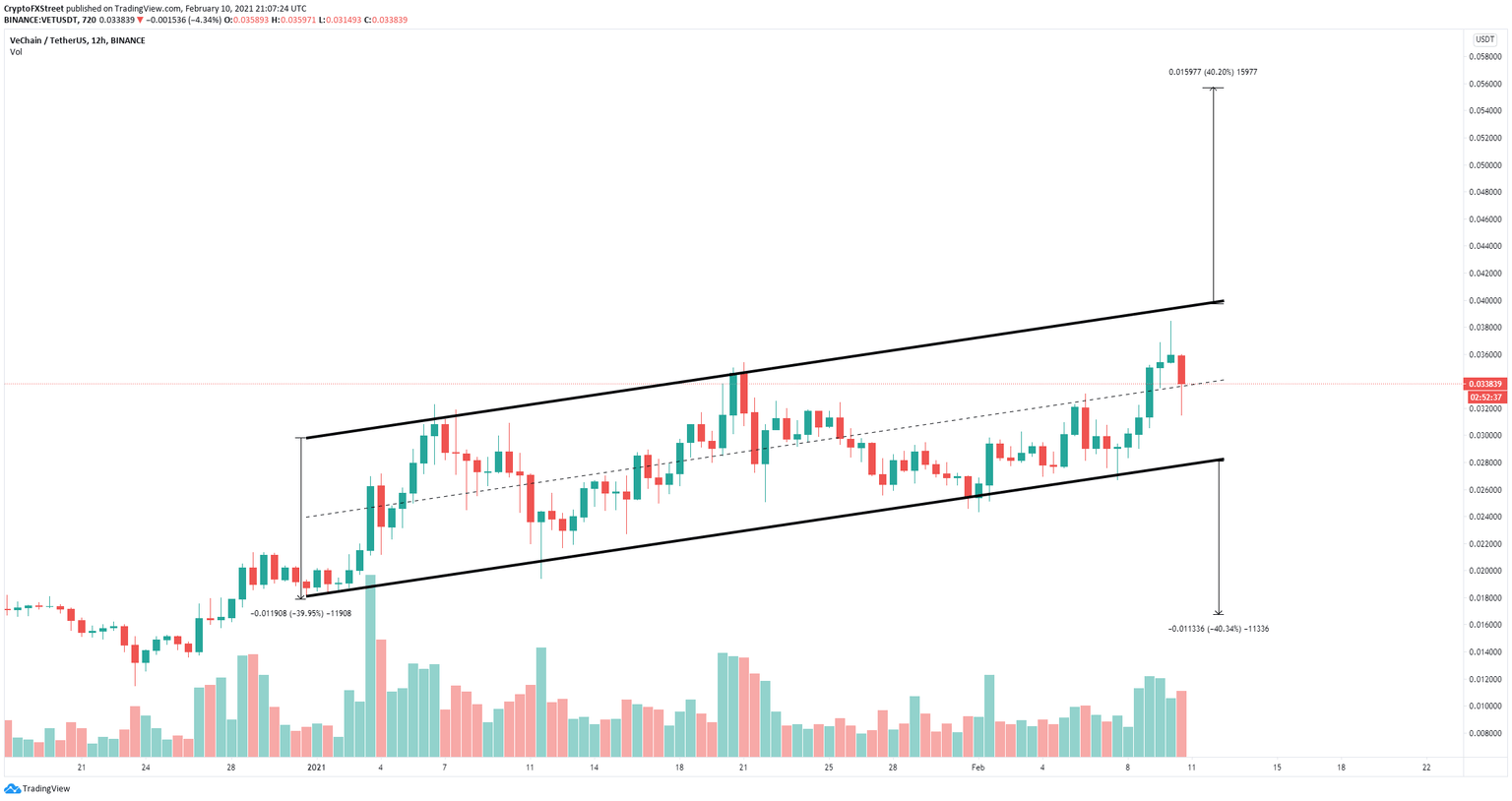

- Vechain price is currently contained inside an ascending parallel channel.

- Bulls have defended a significant support level and aim for a rebound towards $0.04.

- On the other hand, VET bears can drive its price down to $0.028 if the support level breaks.

Vechain has been trading inside a robust uptrend since the beginning of 2021 and has established an ascending parallel channel on the 12-hour chart. The trend seems to favor the bulls which need to crack a key resistance level for a 40% breakout.

Vechain price must climb above this key point to hit $0.055

Vechain has established an ascending parallel channel on the 12-hour chart and bulls have just defended the middle trendline at $0.033. A rebound from this point can drive Vechain price up to the upper boundary at $0.04.

VET/USD 12-hour chart

The most critical resistance level is thye upper trendline of the pattern currently located at $0.04. A breakout above this point will quickly push Vechain price up to $0.055, a 40% move, calculated by using the height of the pattern as a reference point.

On the other hand, losing the middle trendline support would push VET down to the lower trendline at $0.028. Losing this critical level will lead Vechain to a low of $0.017, which is also a 40% move.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.