VeChain listing in one of the largest exchanges in Europe fails to generate bullish momentum

- Bitpanda added VET to the list of tradable assets and launched a giveaway campaign.

- VET/USD attempted a recovery but slipped back inside the range.

Austria-based cryptocurrency exchange Bitpanda added VET, the native token of VeChain, to tradable products. In the announcement made on September 7, the company confirmed that VET was available on the platform. Bitpanda's users can now buy, sell and swap VETs from their accounts and hold the coins on their wallets.

#When @vechainofficial? Now! As of today, you can buy, sell and swap VeChain on Bitpanda. And that’s not all! To celebrate the integration of $VET, we’re giving away €5,000 worth of VeChain.

— Bitpanda (@bitpanda) September 7, 2020

Here you can find out more: https://t.co/Qwu58dXJ2g

To celebrate the listing, Bitpanda launched a competition for all the verified users. To qualify for the prize or a VIP prize, users must trade VET on the Bitpanda Broker. Ten best-performing participants will receive €300 worth of VET each to their cryptocurrency wallet. Ten randomly selected participants who qualify for the BEST VIP level 1 and above will get €200 in VET each. The competition is live until 23:59 CEST on September 14, 2020.

VET traders are not impressed

Following the news, VET/USD jumped to $0.0134, the highest level since September 5, but failed to hold the ground and retreated to $0.0121 by the time of writing. Despite the retreat, VET is still 4.6% higher from this time on Monday. The coin occupies the 26th place in the ConMarketCap's rating with the current market capitalization of $666 million.

On the daily chart, VET/USD topped at $0.0228 on August 9. Since that time, the coin has been losing ground steadily and hit bottom at $0.0110 on September 7. The price has settled down in a range limited by $0.0110 on the downside and $0.0150 in the upside. The long-term charts send no clear reversal signals as of yet; however, the Doji candle on the weekly chart implies that the market is ready to hit the pause button on the way down.

VET/USD weekly chart

If the above-said channel support withstands the breakthrough attempts, VET/USD may resume the upside with the first target at $0.0150. Once it is out of the way, the upside is likely to gain traction and take the price to $0.0170 (daily SMA50) and psychological $0.02.

On the other hand, a sustainable move below $0.0110-$0.01 will knock the bottom out of VET and push the price towards $0.008 (weekly SMA50).

VET/USD daily chart

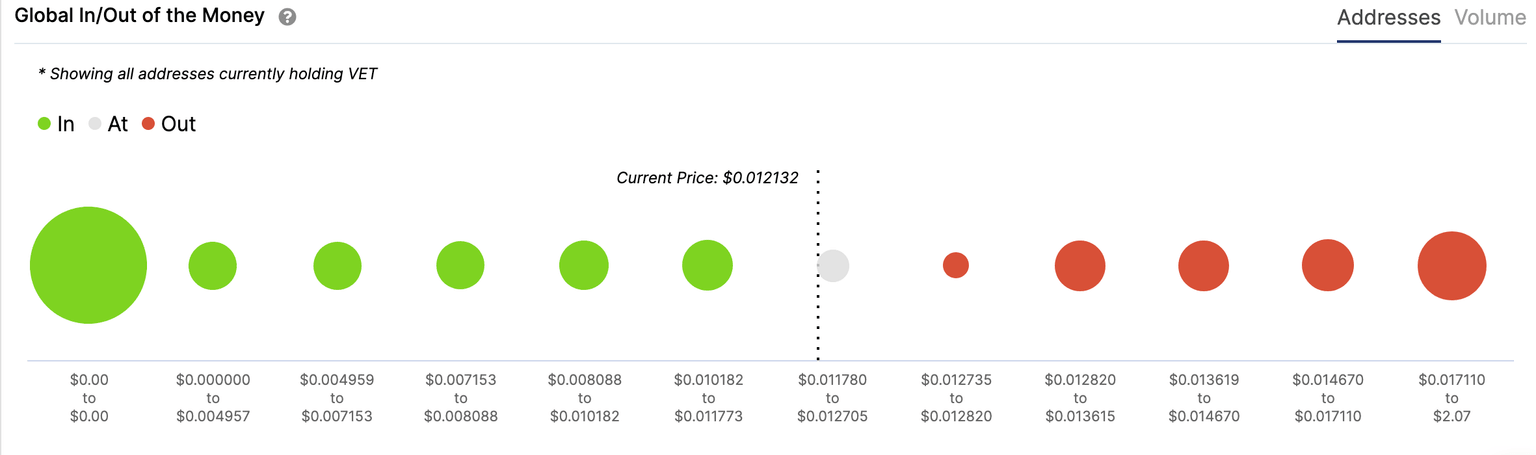

Meanwhile, a cluster of nearly 2 million VET addresses with the breakeven point on the approach to $0.01 adds credibility to the channel support area. Traders are willing to defend this area by strengthening their hand. In this case, the price will rebound towards the local resistance. On the upside, the cohort of $1.8 million addresses is waiting for the chance to breakeven once the price reaches $0.0150. This supply area coincides with the channel resistance and supports the idea of the range-bound trading in the nearest future.

VET's Global In/Out of the Money data

Source: Intotheblock

To conclude: The listing on Bitpanda failed to create a sustainable bullish momentum for VET, which means the coin may spend some more time consolidating around the current levels. The sell-off attempts may be limited by $0.01; however, once this area is broken, the sell-off will start snowballing. On the other hand, a move above $0.0150 will mitigate the initial bearish pressure and improve the short-term technical picture.

Author

Tanya Abrosimova

Independent Analyst

-637351675643917477.png&w=1536&q=95)

%20(1)-637351675856408860.png&w=1536&q=95)