VeChain joins China Animal Health And Food Safety Alliance

- The alliance includes companies like Starbucks, McDonald’s, and Walmart.

- The new active addresses on VET has been on a steady decline.

VeChain Foundation took a huge step towards mainstream adoption by joining the China Animal Health And Food Safety Alliance as a council member. In the process, it became the only blockchain technology provider in the alliance and will be offering technical and infrastructure support. The alliance includes companies like Starbucks, McDonald’s, and Walmart.

VeChain stated that they would be using their platform to create a farm-to-table traceability system” across China by building upon the existing Food Trust system.

All enterprise members of the alliance will be capable of logging key processes of food products onto the blockchain in an immutable and secured way, bridging trust between consumers and the enterprises. Traceability can start from cultivation, processing, packaging, logistics, to retail and more.

VET/USD daily chart

VET/USD strung together five straight bullish days before fumbling at the $0.0145 resistance line. Since then, the price has dropped to $0.014. We don’t think that the price is going to fall below the bullish flag formation. It will probably bounce up from the $0.0135 support line and jump to the flag's upper line. The MACD shows that the market momentum is still bullish, so a break above the flag is expected.

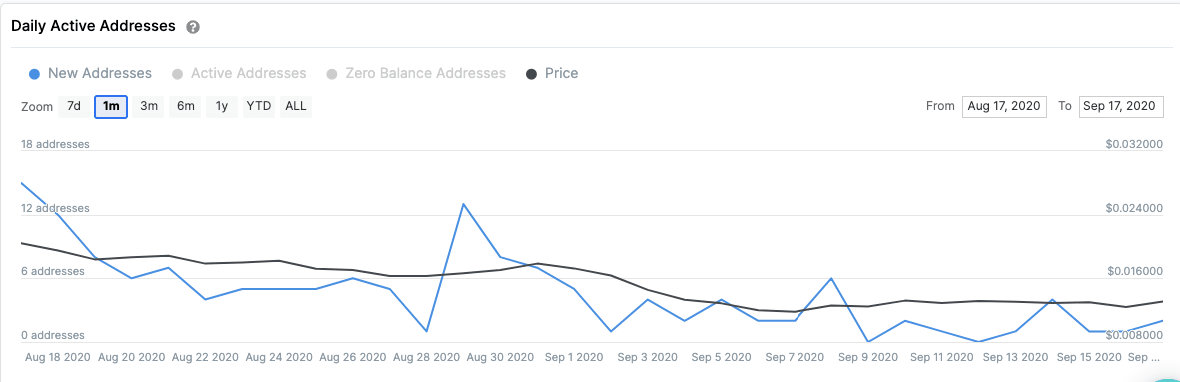

VET new active addresses

The new active addresses on VET have been on a steady decline, which has caused the price to go down. However, becoming a council member will attract more users, which will improve the price in the long-term.

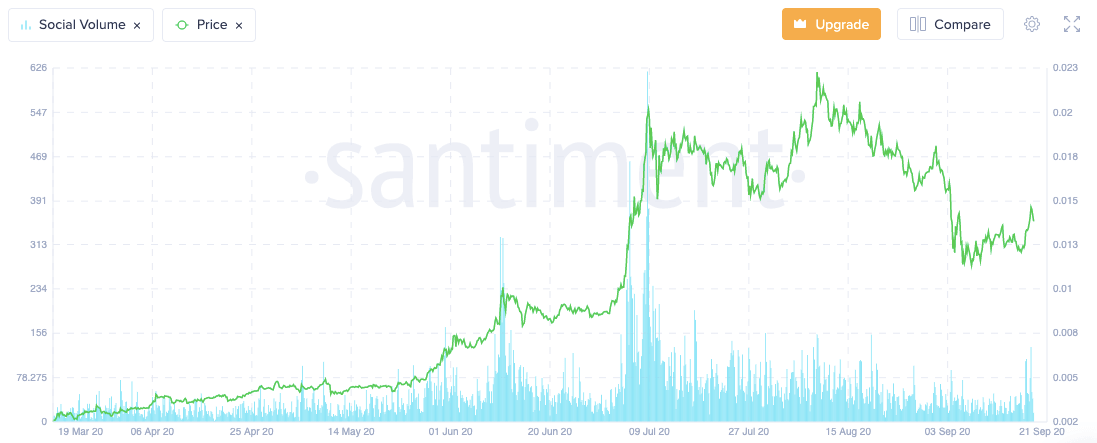

VET social volume

Social volume is another helpful metric that can help predict positive price movement. Usually, a spike in social volume causes a spike in the price. Whether the move is upwards or downwards depends solely on whether the story being circulated is positive or negative. There has been a reasonable spike on social volume, which has prompted the price goes up.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20(2)-637360872292766282.png&w=1536&q=95)