VanEck launches tokenized US Treasury fund on BNB, Avalanche, Ethereum, and Solana

- Asset manager, VanEck launches VBILL to offer tokenized U.S. Treasury to institutional investors on Ethereum, Avalanche, Solana, and BNB Chain.

- Minimum investments are set at $100,000 for Avalanche, rising to $1 million for Ethereum-based exposure.

- Securitize oversees the fund tokenization and compliance while Wormhole enables cross-chain interoperability.

VanEck launches VBILL, a tokenized U.S. Treasury fund on Ethereum, Solana, Avalanche, and BNB Chain, targeting institutional crypto investors.

VanEck launches US Treasury funds on BNB, Avalanche, Ethereum and Solana

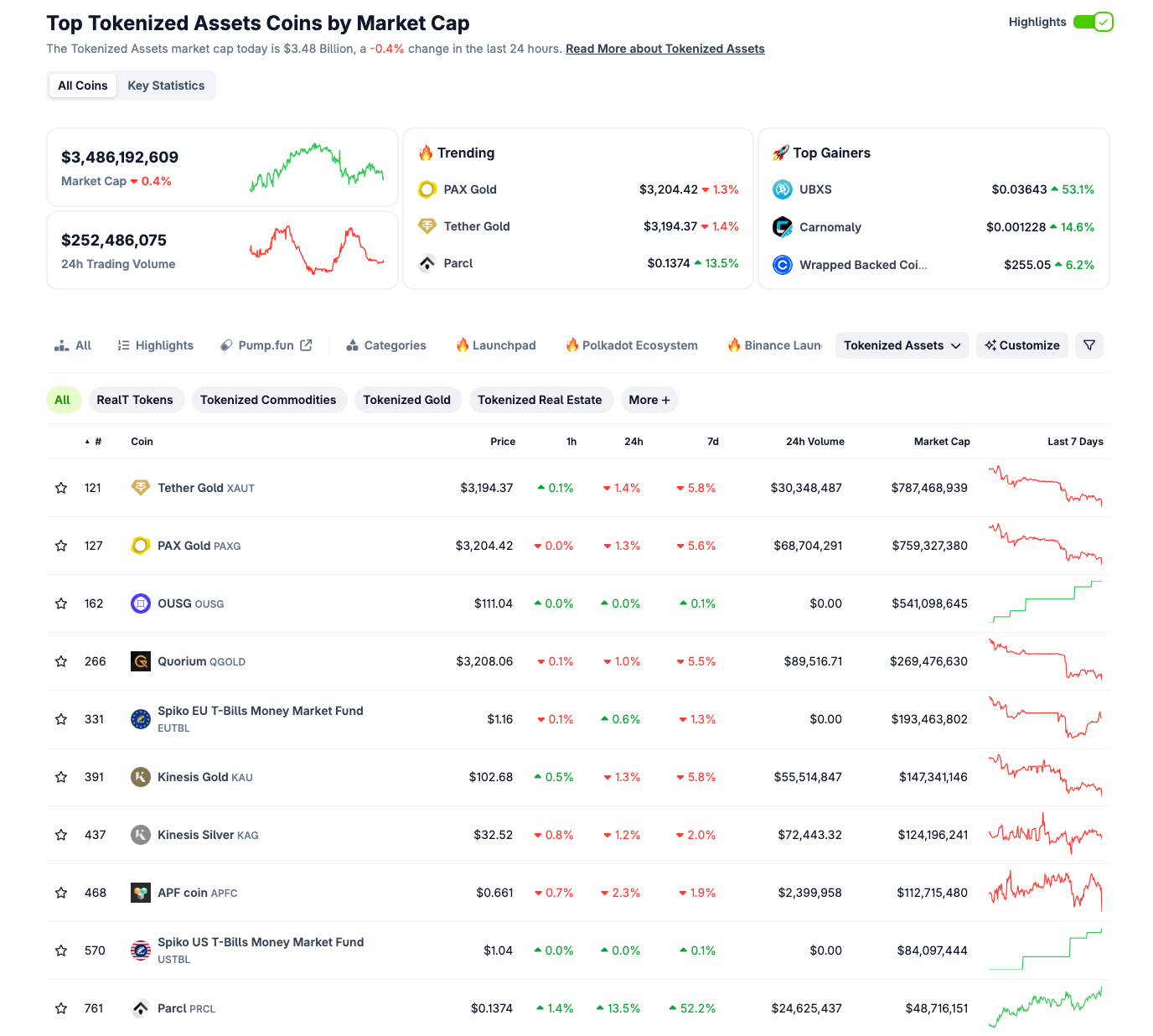

VanEck has launched VBILL, a tokenized U.S. Treasury fund built in partnership with Securitize, marking a bold institutional move into the $3.5 billion crypto tokenization sector.

The announcement comes amid rising institutional interest in real-world asset (RWA) tokenization, despite the sector dipping 0.4% to a $3.5B market cap on Wednesday.

With the launch of VBILL, VanEck aims to bridge the gap between traditional finance and digital assets, especially as stablecoin reserve regulations may push crypto-native institutions to hold critical reserve assets in US Treasuries.

“Tokenized funds like VBILL enhance market liquidity and efficiency,” said Kyle DaCruz, Director of Digital Assets Product at VanEck.

VanEck’s VBILL token is hosted on Ethereum, Solana, Avalanche, and BNB Chain, all of which recorded price gains over the last 24 hours. This move positions the fund as a liquidity and security gateway for institutional crypto firms.

How VanEck is Targeting Crypto Whale Investors

VanEck targets high-net-worth crypto holders and institutional investors with VBILL. The fund’s minimum investment requirements are set at $100,000 on Solana, Avalanche, and BNB Chain, and $1 million on Ethereum. Other key registration requirements are also in place to restrict accessibility only to accredited entities and large fund managers.

VanEck’s multichain deployment of VBILL ensures whales across different ecosystems, enlisting Wormhole for cross-chain interoperability and frictionless movement of VBILL tokens across Avalanche, BNB, Ethereum, and Solana chains.

“With VBILL, our combined efforts demonstrate tokenization’s ability to create new market opportunities with the speed, transparency, and programmability of blockchain technology.”

— Carlos Domingo, CEO and Co-founder of Securitize

According to the statement, a prominent tokenization platform, Securitize will oversee VBILL’s logistics, fund administration, and broker-dealer compliance.

What’s Next for the Asset Tokenization market?

Despite growing institutional traction, the tokenized asset market saw a slight pullback this week. As of Wednesday, the sector fell 0.4% to $3.5 billion, led by real estate, gold, and Treasury-backed assets.

Asset Tokenization Sector Performance, May 15, 2025 | Source: Coingecko

This cooldown comes as crypto traders favored risk-on sentiment following the dovish expectations that greeted US CPI data released on Tuesday.

However, VanEck’s VBILL rollout sparked renewed bullish momentum for its host chains. Ethereum, BNB Chain, Solana, and Avalanche all saw price gains over the last 24 hours,

Aligning with Blackrock’s BUIDL fund initiative, VBILL further emphasizes institutional demand from blockchain-native Treasury products. Multiple stablecoin regulations reviews are ongoing across multiple US states.

With possible requirements for reserves to be held in short-term Treasuries, tokenized funds like VBILL are well-positioned to become foundational infrastructure for the next phase of cryptocurrency adoption.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.