US stimulus checks boost Bitcoin

The US officials have recently unveiled a $1.9 trillion aid package. As a result, the part of this sum will go to individuals in $1400 checks per person. The interesting fact that most Americans tend to invest the money they’ve got from the government. The survey of Mizuho Securities claimed that two out of five stimulus check recipients plan to invest at least some part of this money into Bitcoin and stocks. That means around 10% of total direct payments, equal to $40B, will flow to cryptocurrencies and stocks. Moreover, Mizuho mentioned that nearly 60% will go to Bitcoin: "this represents 2-3% of Bitcoin's current $1.1T market cap". Therefore, the BTC will rise and other cryptocurrencies should follow it as well. Let’s analyze BTC/USD and ETH/USD – the most popular cryptocurrencies.

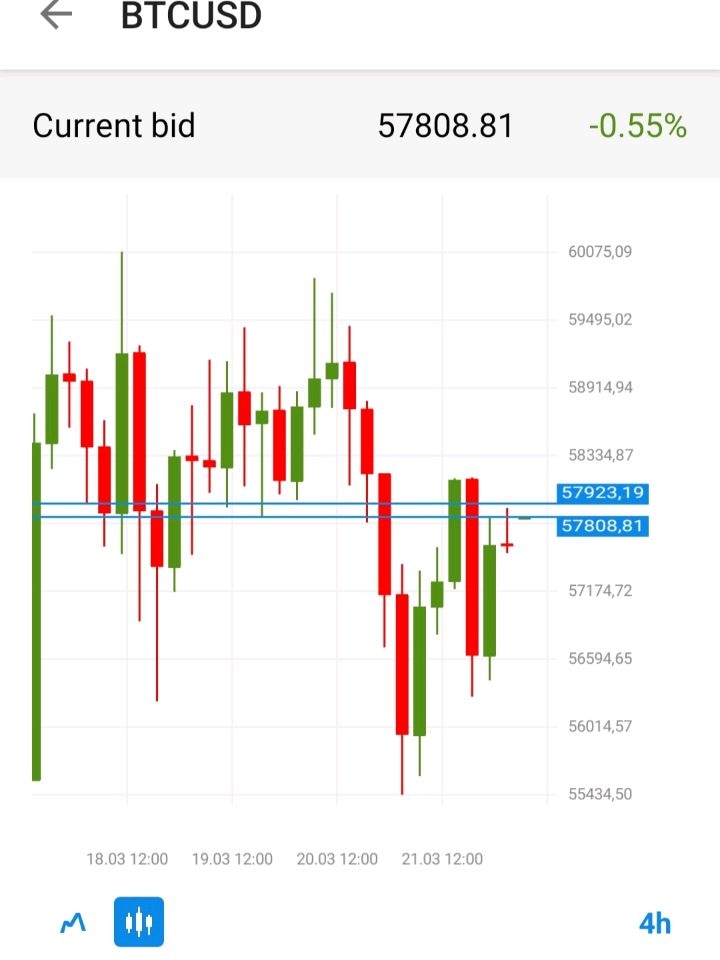

BTC/USD is moving in an ascending channel in the long term. While in the short term, the price has formed a symmetrical triangle pattern. Thus, if the BTC breaks the upper line of this triangle at $59,000, it will skyrocket upward to the all-time high of $61,000. On the flip side, the move below the lower line of the triangle at $55,800 will lead the price to the 200-period moving average of $53,000. It’s worth mentioning, that the 100-period moving average also lies at $55,800, making this support level harder to break.

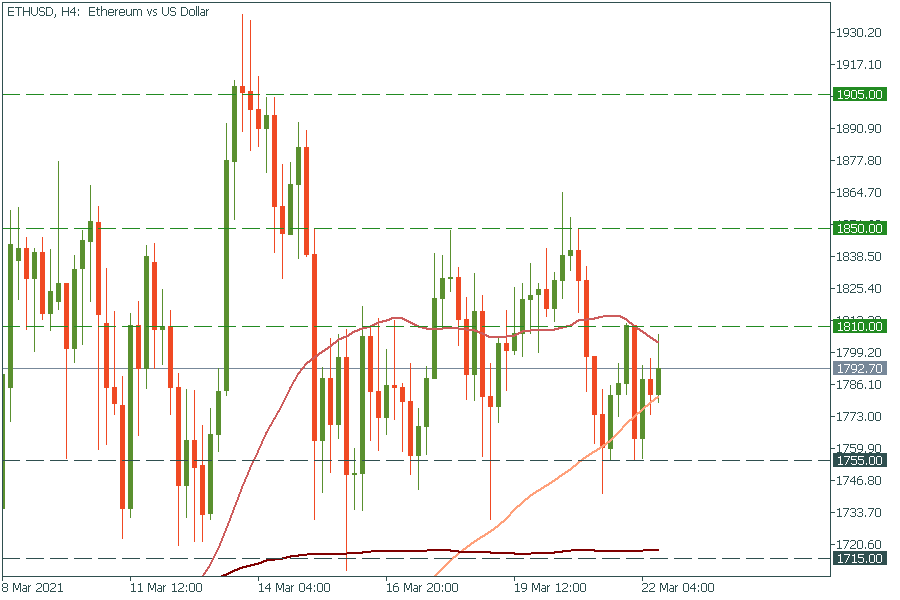

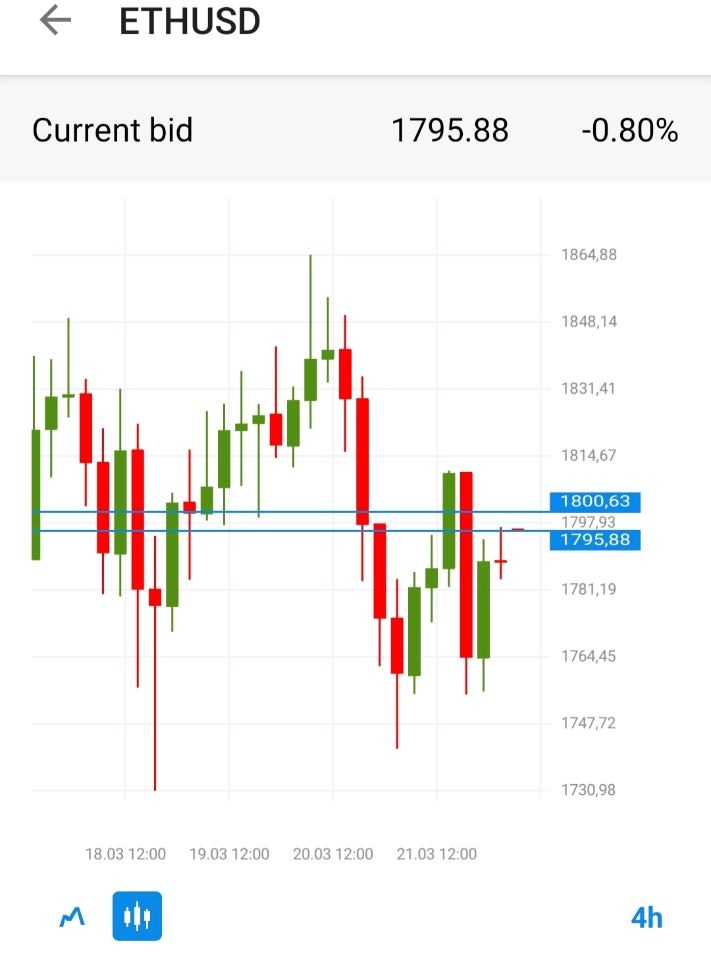

Let’s move on to ETH/USD. It has been moving sideways between $1715 and $1850 since the last week. If it manages to break the 50-period moving average of $1810, the way up to the high of March 20 at $1850 will be open. In the opposite scenario, the move below the intraday low of $1755 will drive the crypto to the 200-period moving average of $1715.

Author

FBS Team

FBS

FBS team is a group of professional analysts focused on Forex, stock, and commodity markets. Each expert possesses a years-long experience in fundamental and technical analysis.