U.S. Government spotted moving 97 BTC and 884 ETH: Sell-off or Stockpile?

- The U.S. government moved $10.23 million worth of BTC and ETH on Friday, sparking debate over potential liquidation.

- The transfer aligns with a key directive in President Trump’s executive order to create the Strategic Bitcoin Reserve on March 18.

- Despite historical sell-offs linked to government transactions, Bitcoin remains stable at $86,600, confirming a neutral market sentiment.

The U.S. government’s recent $10.23 million Bitcoin and Ethereum transfer has sparked speculation about potential liquidation or strategic accumulation under new policies.

US government’s transfers of 97 BTC and 884 ETH sparks market speculations

Citing Arkham Intelligence data, crypto analytics platform Lookonchain has reported a series of transactions linked to the United States government.

According to the post on Friday, the US government transferred 97 Bitcoin (BTC) valued at $8.46 million and 884 Ethereum (ETH) worth $1.77 million on March 28.

The transaction, executed at 5:51 PM EST, has reignited discussions about the Trump administration’s strategy for managing the US crypto holdings, particularly following a recent executive orders.

U.S. Government’s Crypto holdings and market influence

Historically, large government-led transfers have exerted downward pressure on crypto prices.

In December 2024, a $1.9 billion Bitcoin movement to Coinbase Prime triggered a 5% decline over three days, as reported by OneSafe. Similar transactions in

April, June, and August 2024 also caused short-term selloffs, though Bitcoin has consistently rebounded.

Currently, the U.S. government holds 198,012 BTC, valued at $17.22 billion, and 59,965 ETH, worth $119.7 million, making it one of the largest institutional holders of cryptocurrency.

Much of these reserves are from assets seized in criminal investigations, including the notorious 2016 Bitfinex hack, in which authorities recovered 94,000 BTC—now valued at over $8 billion.

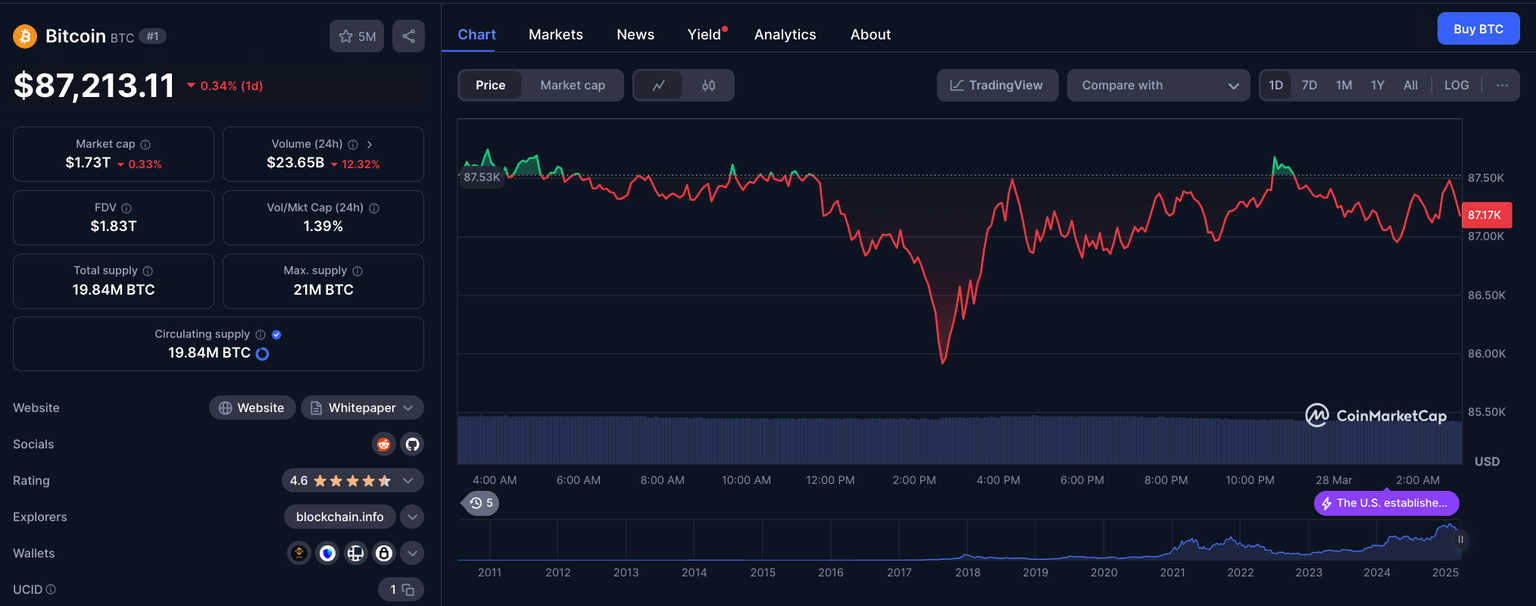

Bitcoin price action (BTCUSD) after US Government’s transfers on March 27 2025 | Source: CoinmarketCap

Bitcoin’s market price on March 28 hovered around $87,200, while Ethereum traded near $2,000, showing that market sentiment remained neutral after the transfer.

Sell-off unlikely due to Trump’s recent executive orders

Historical trends show that US government Bitcoin transactions often introduce short-term volatility, as market participants brace up for potential sell-offs.

However, Bitcoin price continues to hold up around the $86,600 mark at press time on Friday, with recent news events suggesting that a sell-off is unlikely.

Notably on March 18, Donald Trump issued an executive order establishing a Strategic Bitcoin Reserve.

A critical directive in the order mandates federal agencies to report their cryptocurrency holdings within 30 days to the Secretary of the Treasury.

Hence, this move suggests that the $10.3 million BTC and ETH transactions could be part of a broader effort to consolidate crypto holdings in line with the administration’s latest directives, rather than another major sell-off.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.