Uniswap Price Prediction: UNI bulls’ 45% upswing faces a roadblock

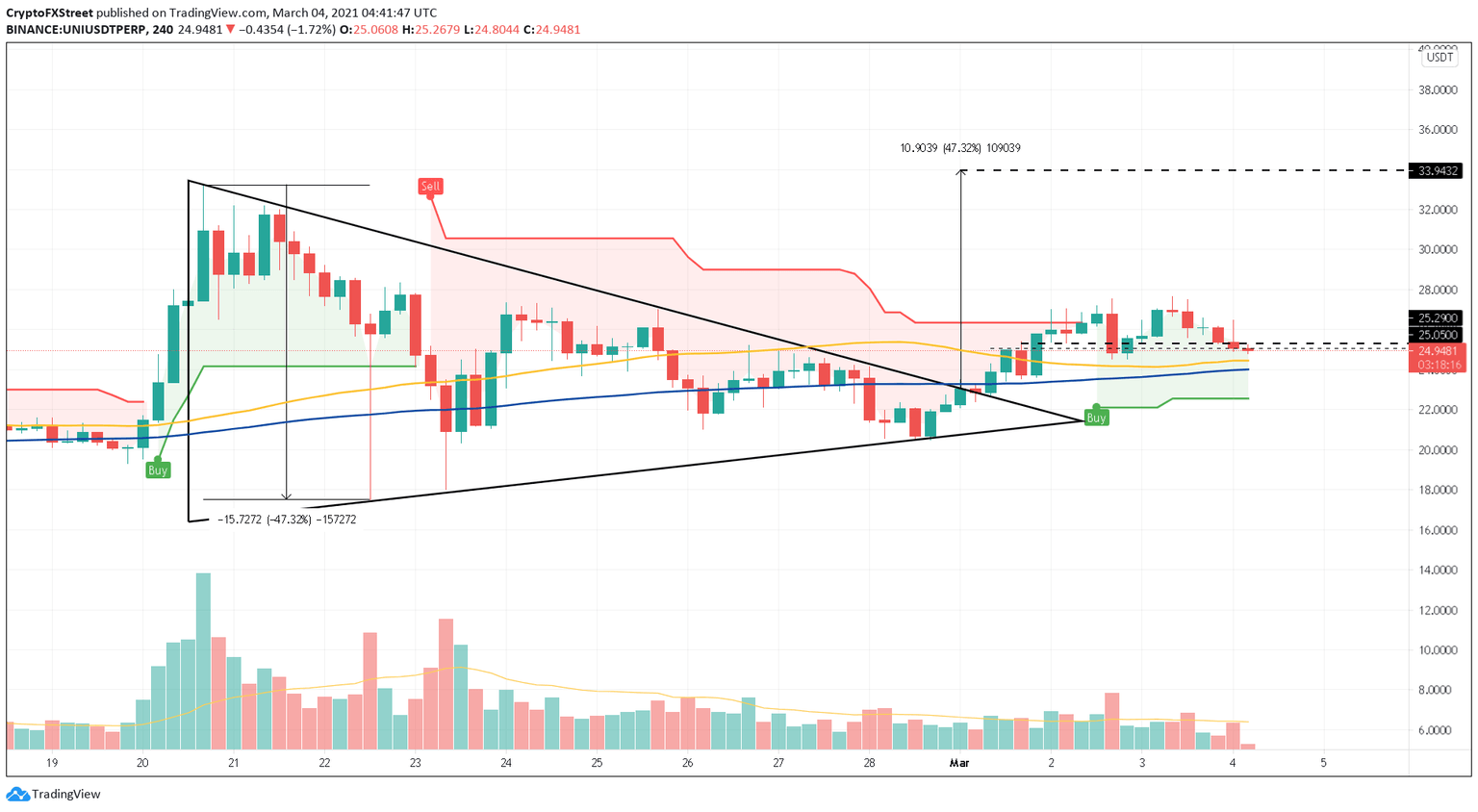

- Uniswap price confirmed a 45% bull rally as it broke out of a symmetrical triangle pattern on March 1.

- Transactional data shows that $25.30 is proving out to be a formidable supply barrier to breach.

- A decisive close above this level will confirm a continuation in the upswing to $33.9.

Uniswap price is meandering around a stiff resistance level after breaking out of a symmetrical triangle consolidation. Hence, UNI’s four-hour candlestick close relative to the supply barrier at $25.3 will make-or-break the DeFi token.

Uniswap price at crossroads

Uniswap price action since February 20 resulted in a symmetrical triangle pattern. In this consolidation phase, the asset tends to form a series of lower highs and higher lows as the price gets squeezed within converging trendlines. Such a movement is a result of aggressive buyers and sellers trying to take control of altcoin. In UNI’s case, the price broke above the upper trendline, confirming the bullish outlook.

Now, UNI could surge 45%, which is determined by measuring the distance between the pivot high and pivot low and adding it to the breakout point at $23.04. This target puts Uniswap price at $33.9.

Despite the recent correction due to the lack of bullish momentum, UNI’s outlook is optimistic due to the perseverance of the SuperTrend indicator’s buy signal. Moreover, the presence of 50 and 100 four-hour moving averages (MA) below the current price level suggests that short-term selling pressure will be rendered useless.

UNI/USDT 4-hour chart

According to IntotheBlock’s In/Out of the Money Around Price (IOMAP) model, nearly 5,000 addresses have purchased 17.6 million UNI at an average price of $25.30, making it a crucial level. Therefore, UNI bulls need to regain this level to continue the upswing to $33.9.

Uniswap IOMAP chart

However, investors need to note that a 4-hour candlestick close below the $25.30 supply barrier will signal a downtrend. In such a case, Uniswap price could drop 15%, which would invalidate the SuperTrend indicator’s buy signal and invalidate UNI’s bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.