Uniswap price on the verge of new all-time highs as key indicator flashes various sell signals

- Uniswap price is ready for new all-time highs as it faces weak resistance ahead.

- A key indicator has presented two strong buy signals in favor of UNI.

- Uniswap continues leading the decentralized exchanges industry.

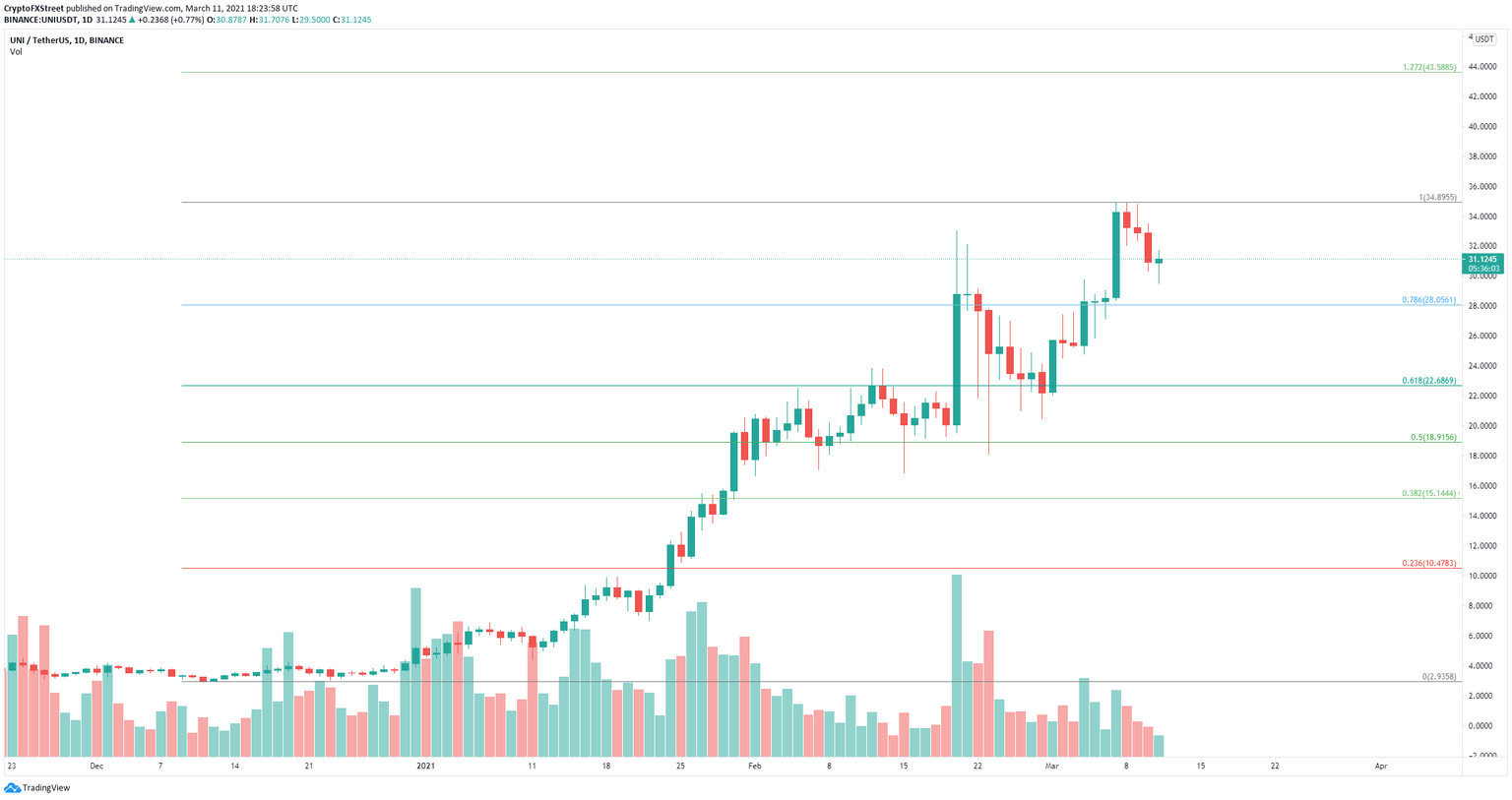

Uniswap has been trading in a robust daily uptrend for months and aims for yet another leg up to new all-time highs. The digital asset faces weak resistance above its current price, and several indicators show it will crack $35 soon.

Uniswap price on the brink of a massive breakout

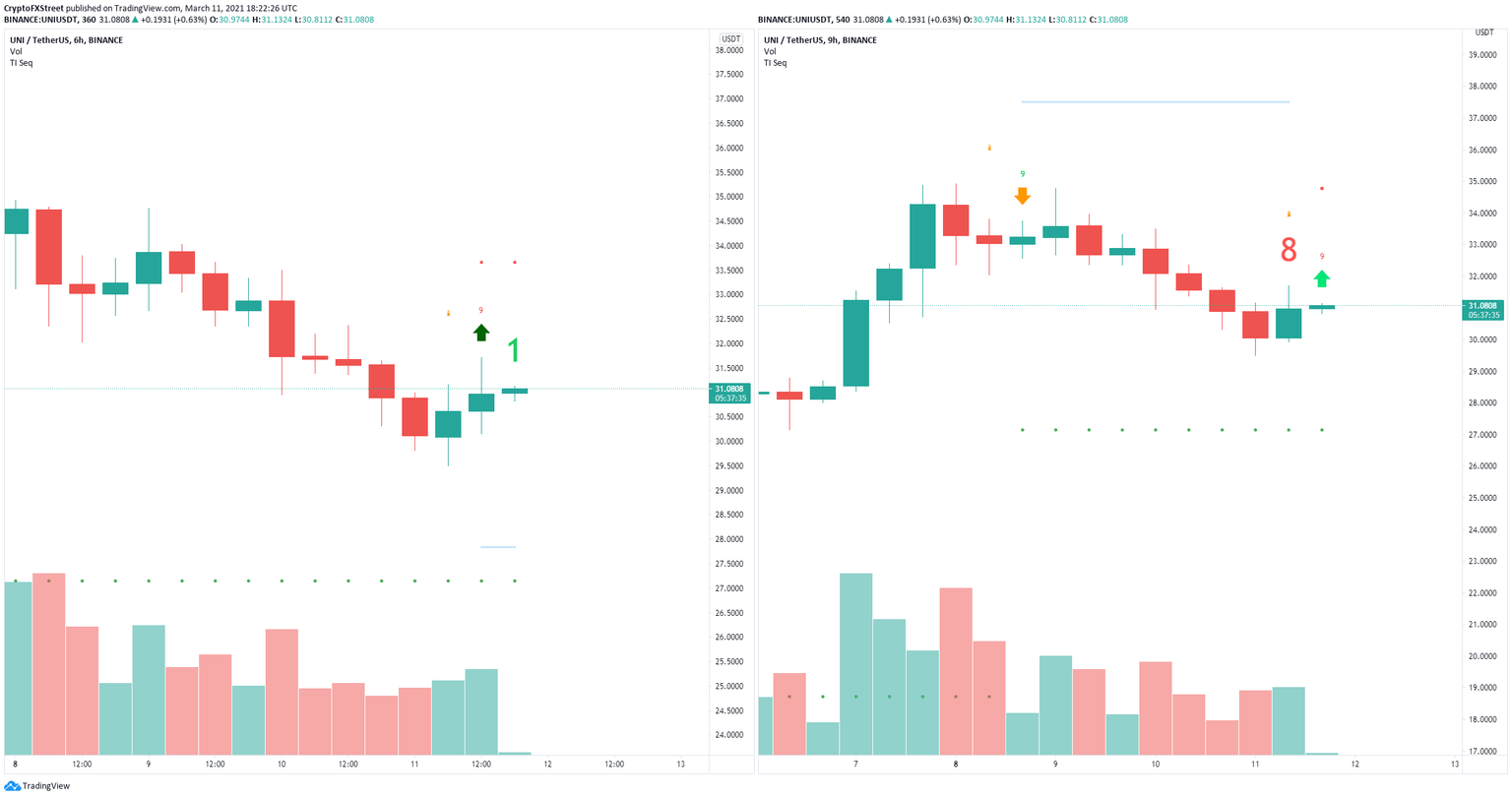

The TD Sequential indicator has presented a buy signal on the 6-hour and 9-hour charts. Considering there is weak resistance above $31, Uniswap price could quickly climb to its previous all-time high at $34.88.

UNI Buy Signals

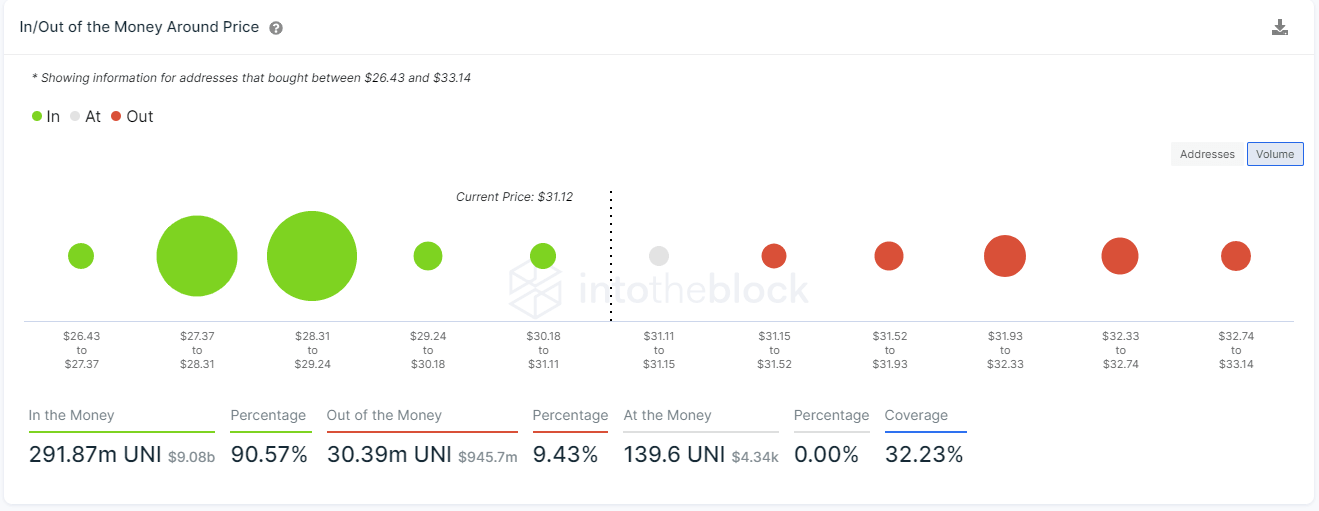

The In/Out of the Money Around Price (IOMAP) chart shows practically no barriers on the way up beside the range between $31.93 and $32.33 with 15 million UNI in volume. A breakout above this point should drive Uniswap price towards $35 and up to $43.58 at the 127.2% Fibonacci level.

UNI IOMAP chart

On the other hand, if the bears somehow manage to push Uniswap below a critical support area between $29.2 and $27.3, the digital asset will most likely fall to new lows.

UNI/USD daily chart

The 78.6% Fibonacci level is located at $28, which coincides with the strong support area indicated by the IOMAP chart. The next support level is located all the way down at $22.7 at the 61.8 Fib level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.