Two AI tokens with potential to rally as Bitcoin leans into September rate cut

- Bitcoin regains bullish momentum, briefly breaks above $113,000 and retreats.

- Bittensor targets a 16% wedge pattern breakout to $375 in the short term.

- Internet Computer is on the verge of a 13% move backed by multiple buy signals.

Bitcoin (BTC) leads the market in recovery on Friday, breaking above resistance at $113,000 before fast-tracking its pullback below $112,000. Interest in the crypto market has been picking up pace this week as select United States (US) economic data support the need for the Federal Reserve (Fed) to cut interest rates in September.

US economic data signal September rate cut

The US Nonfarm Payrolls (NFP) rose by 22,000 in August, below market expectations of 75,000, as reported by the Bureau of Labor Statistics (BLS) on Friday.

Similarly, the Unemployment Rate increased to 4.3% from 4.2% in July, pointing to a cooling labor market.

The Fed Chair, Jerome Powell, had last month hinted at the need for a monetary policy change, but stressed the need to monitor incoming data. Investors will closely monitor data over the coming week, including the Consumer Price Index (CPI) on September 11, to gain insight into the Fed’s monetary policy direction.

An interest rate cut is expected to boost interest in riskier asset classes, such as cryptocurrencies and equities, with investors and crypto enthusiasts looking forward to a bullish fourth quarter.

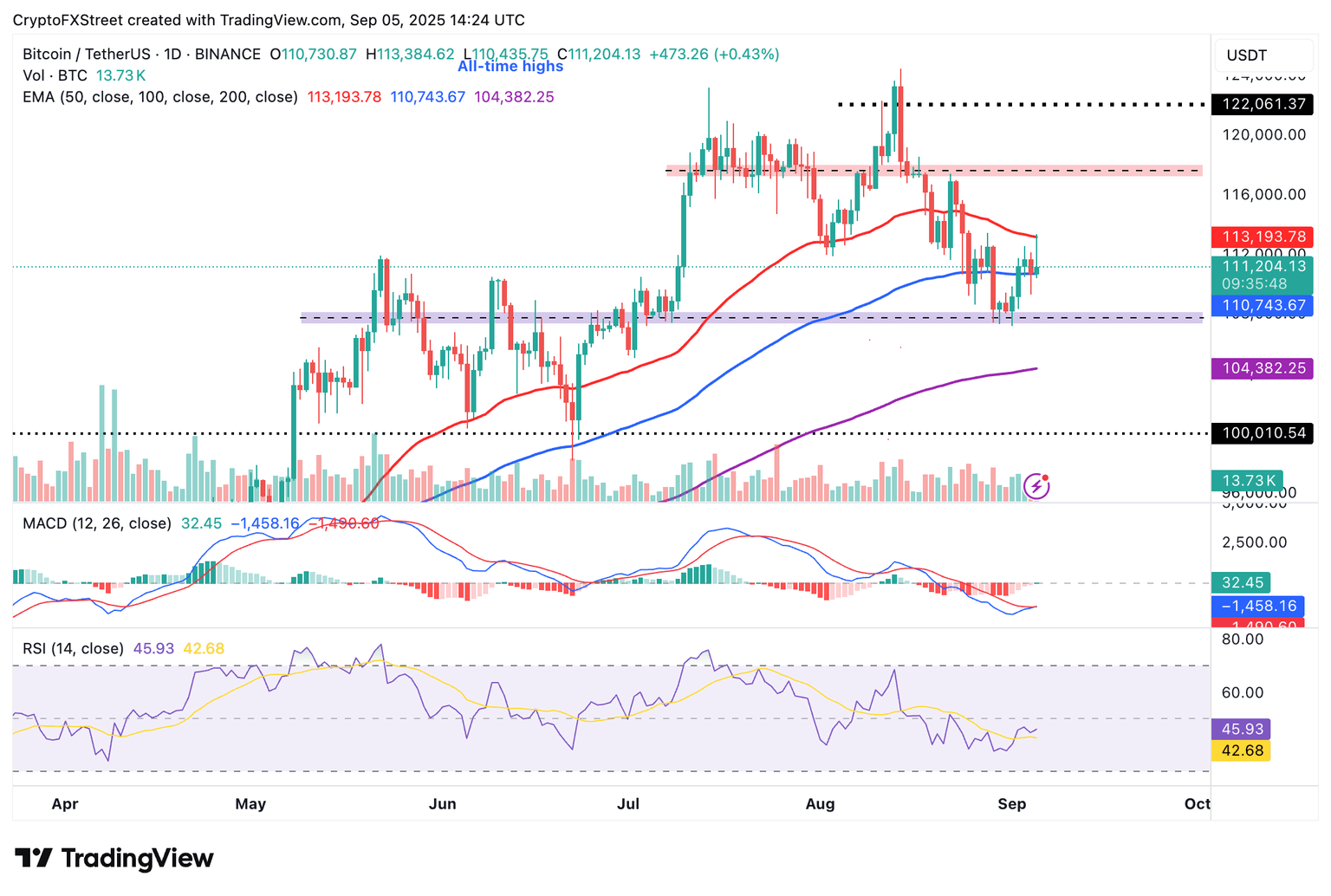

Bitcoin is trading above $111,000 after correcting from a macro-driven intraday swing to $113,384. Interest in BTC picked up pace after the release of US Nonfarm Payrolls and Unemployment Rate data, which pointed to a cooling labor market while increasing the probability of what would be the first interest rate cut this year.

The days leading up to the Federal Open Market Committee (FOMC) meeting will provide insight into the direction the Bitcoin price may take as it heads into the fourth quarter.

A breakout above the $118,000 round-figure resistance could increase the probability of Bitcoin price reclaiming support above $120,000 and later extending the uptrend above the current all-time high of $124,474.

BTC/USDT daily chart

AI tokens update: Bittensor and Internet Computer

Bittensor (TAO), the largest AI token with a market capitalisation of $3.1 billion, is trading above $315 after briefly swinging to $327 on Friday. There was a fake confirmation of a falling wedge pattern breakout, projecting a 16% surge to $375.

However, profit-taking quickly snuffed out part of the intraday gains as TAO retreated below the upper trendline resistance. The falling wedge pattern remains unbroken as it stands, awaiting confirmation.

Meanwhile, the sharp reversal in the Relative Strength Index (RSI) at 45 on the 4-hour chart highlights the importance of risk management. If the pullback develops into a downtrend, traders will shift their attention to the next key support at $300.

TAO/USDT 4-hour chart

As for Internet Computer (ICP), the risk of extending the downtrend remains especially after bulls failed to uphold intraday gains. In addition to the falling wedge pattern’s upper trendline, the 50-period Exponential Moving Average (EMA) at $4.86 contributed to the brief sell-off.

ICP/USDT 4-hour chart

If bulls confirm the falling wedge pattern, the path of least resistance could shift upward, projecting a 13% breakout to $5.45. Key factors traders should monitor include support at $4.67, which was tested on Thursday, and $4.60, tested on Monday.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren