Trump Media and Crypto.com team up to launch Bitcoin, Cronos ETFs

- Trump Media inks agreement with Crypto.com and Yorkville to launch digital asset ETFs, including Bitcoin and Cronos.

- ETFs will be distributed globally under TMTG’s fintech platform Truth.Fi, pending regulatory approval.

- Crypto.com aims to file for a Cronos spot ETF in Q4 as part of its 2025 roadmap.

Trump Media and Crypto.com have announced a collaboration to launch Bitcoin and Cronos ETFs under Truth.Fi.

Trump Media expands into fintech through ETF launch

Trump Media & Technology Group (TMTG), operator of Truth Social, has formalized a partnership with Crypto.com and Yorkville America Digital to launch a series of exchange-traded funds (ETFs) focused on digital assets.

Initial products will track Bitcoin (BTC) and Cronos (CRO), and will be distributed through Foris Capital US LLC, Crypto.com’s registered broker-dealer.

The initiative will be managed under Truth.Fi, TMTG’s fintech platform launched in January 2025. At launch, TMTG committed up to $250 million for deployment into ETFs and separately managed accounts (SMAs). Charles Schwab has been named as custodian of the funds.

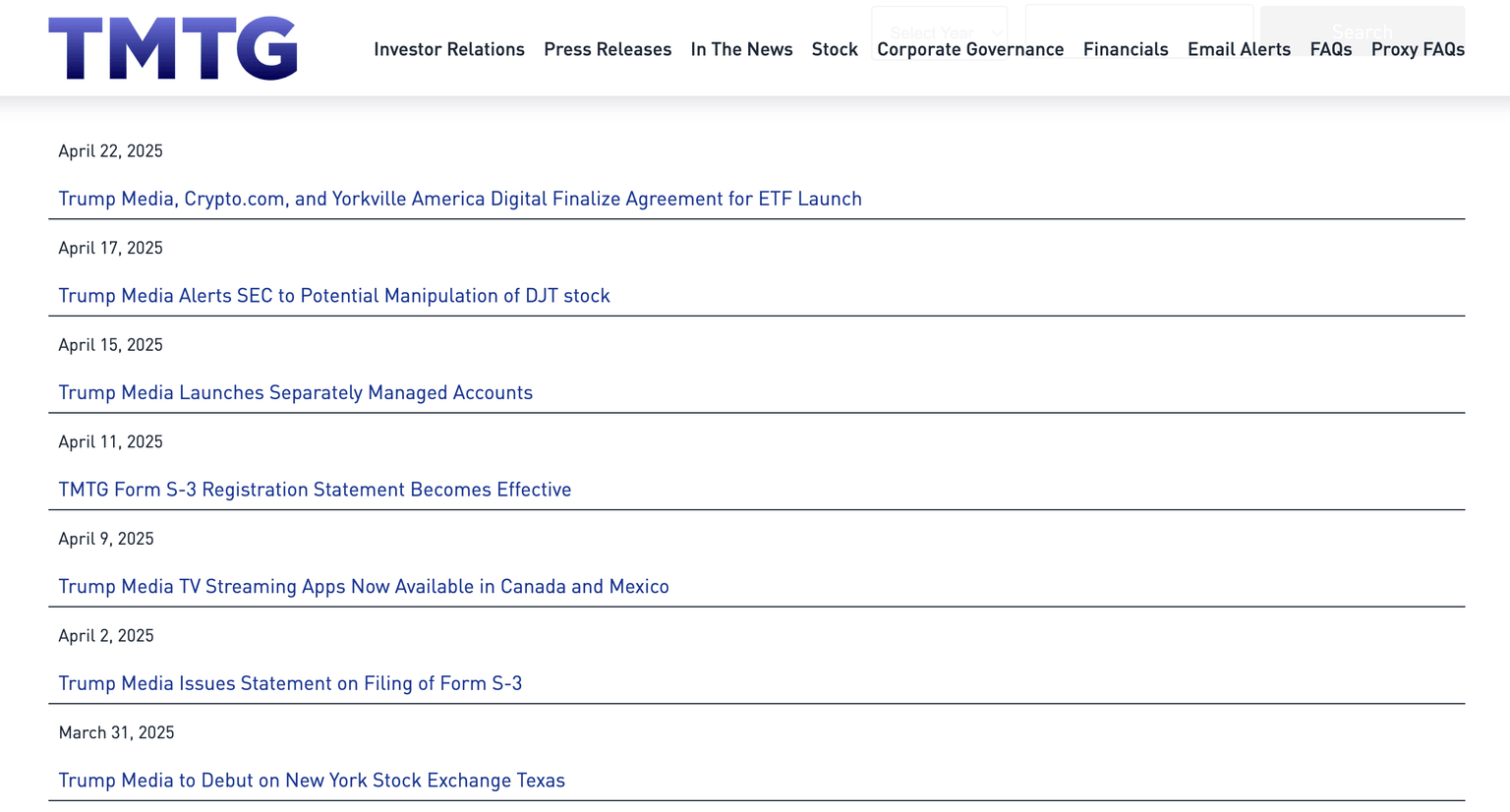

Trump Media Group’s latest updates, April 2025 | tmtgcorp.com

The agreement follows a non-binding announcement made in March. Alongside the ETFs, Trump Media is planning to introduce Truth.Fi-branded SMAs, though no further information was released.

The products will go live globally following regulatory approval, with rollout planned across U.S., European, and Asian markets.

Crypto.com outlines 2025 roadmap with ETF and stablecoin plans

Crypto.com will play a key role in distributing Trump Media’s ETFs internationally. CEO Kris Marszalek described the partnership as aligning with the platform’s broader strategy to integrate traditional and digital finance channels.

As part of its 2025 roadmap, Crypto.com plans to submit a filing for a Cronos (CRO) spot ETF in the fourth quarter.

Additionally, a platform-native stablecoin is scheduled for launch in Q3 2025. While few specifics have been disclosed, the stablecoin is intended to support cross-border transactions, platform liquidity, and decentralized finance (DeFi) integration.

Yorkville America Digital CEO Troy Rillo confirmed the ETF collaboration as a strategic development aimed at aligning new financial products with domestic market interests.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.