Trading veteran cashes out 50% of his Bitcoin position, expecting a correction to $12,000

- Peter Brandt, author, and publisher of the Factor Report, has exited around 50% of his Bitcoin position.

- The veteran trader believes Bitcoin might be poised for a correction in the near future.

Peter Brandt has recently stated that he has been taking profits on Bitcoin for the past few days because he met the target he was looking for. Brandt also mentions a potential target of $56,000 for Bitcoin in the long-term if the all-time high is breached.

Bitcoin might be facing a pullback to $12,000

In his latest report, Peter Brandt talks about Bitcoin and his current stance on the digital asset. Brandt states that he sees nothing negative about the flagship cryptocurrency, but he has still taken profits.

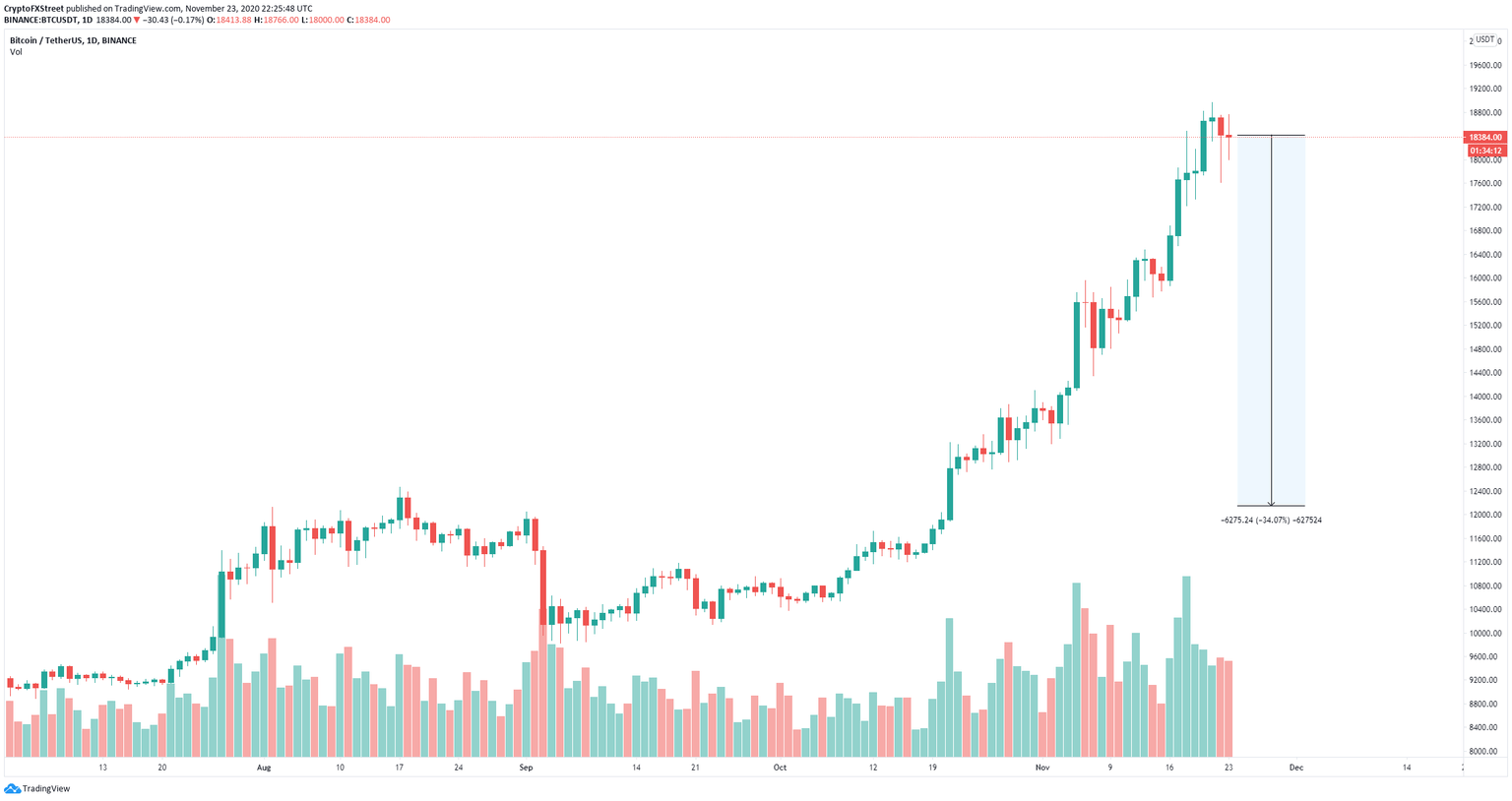

BTC/USD daily chart

Brandt points out nine different corrections that Bitcoin price had throughout 2015-2017, averaging around 34%. No significant corrections have been observed since Bitcoin’s last liftoff from $10,000. It seems that a similar correction would put Bitcoin price at around $12,000. Peter Brandt states:

The weekly moving average is substantially below the market at $12,700. Am I predicting a correction down to $12,700? No, not really, I don’t predict markets, I respond to them.

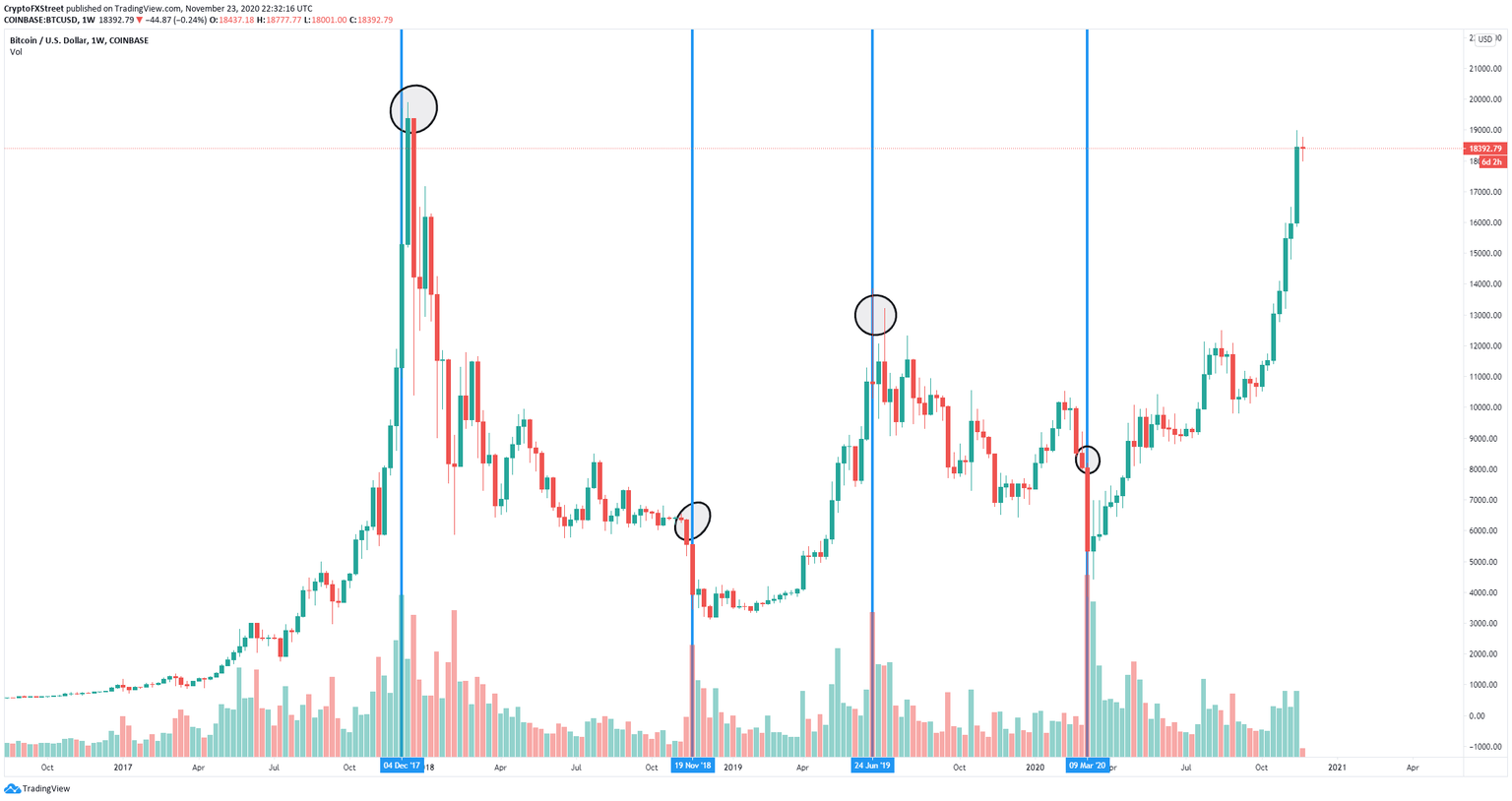

BTC/USD weekly chart

Another interesting factor that Brandt mentions is the lack of trading volume. A lot of investors have been concerned by the flat volume. However, Brandt points out that since December 2017, the four most significant spikes in trading volume marked reversal points in the market, which means that another big spike could be the first sign.

Brandt is looking to re-enter if Bitcoin price re-tests the Moving Average (18) on the daily chart. This MA has been acting as a healthy support level since October 8. It is currently located at $16,750, well above the price of Bitcoin.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.