Top Crypto Gainers: Hyperliquid, BNB, Monero rise as resistance levels come into play

- Hyperliquid recovery gains traction, approaching the resistance trendline of a descending triangle pattern on the 4-hour chart.

- BNB holds above $1,000 with a bounce back from the 50-day EMA while indicators remain divided.

- Monero eyes a key resistance breakout as selling pressure wanes.

Hyperliquid (HYPE), BNB (previously known as Binance coin), and Monero (XMR) are staging minor recoveries as the broader crypto market trades in the red. Technically, the recovery in HYPE, BNB, and XMR emerges as selling pressure cools down, but overhead resistance poses the risk of bearish turnaround, which could extend the prevailing decline.

Still, a potential breakout could result in the next big jump in Hyperliquid, BNB, or Monero.

Hyperliquid eyes triangle breakout rally

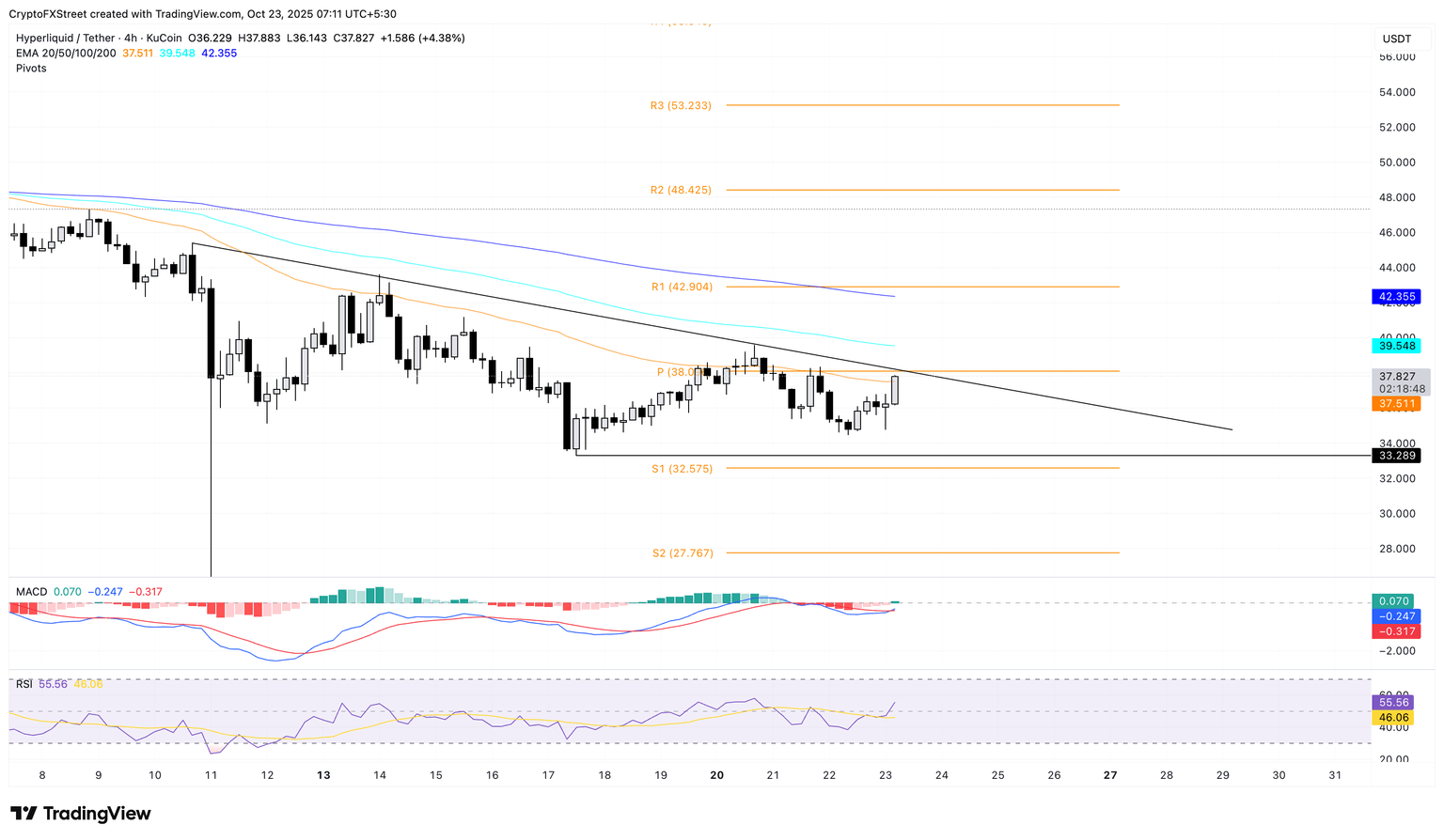

Hyperliquid edges higher by over 4% at press time on Thursday, extending the 2% rise from the previous day. The recovery run in the perpetual-focused Decentralized Exchange (DEX) token approaches a local resistance trendline, which completes a descending triangle pattern with the $33.28 baseline marked by Friday’s low on the 4-hour chart.

The trendline aligns with the centre Pivot Point $38.09 on the same chart, and a successful close above this level could extend the rally to the R1 Pivot Point at $42.90.

Corroborating the HYPE recovery, the technical indicators on the 4-hour chart suggest a decline in selling pressure as the Moving Average Convergence Divergence (MACD) crosses above the signal line, confirming a bullish shift.

Additionally, the Relative Strength Index (RSI) rises to 55 on the same chart, indicating potential for further growth before reaching the overbought zone.

HYPE/USDT 4-hour price chart.

On the flip side, a reversal from $38.09 could retest the $33.28 baseline.

BNB’s rebound lacks conviction

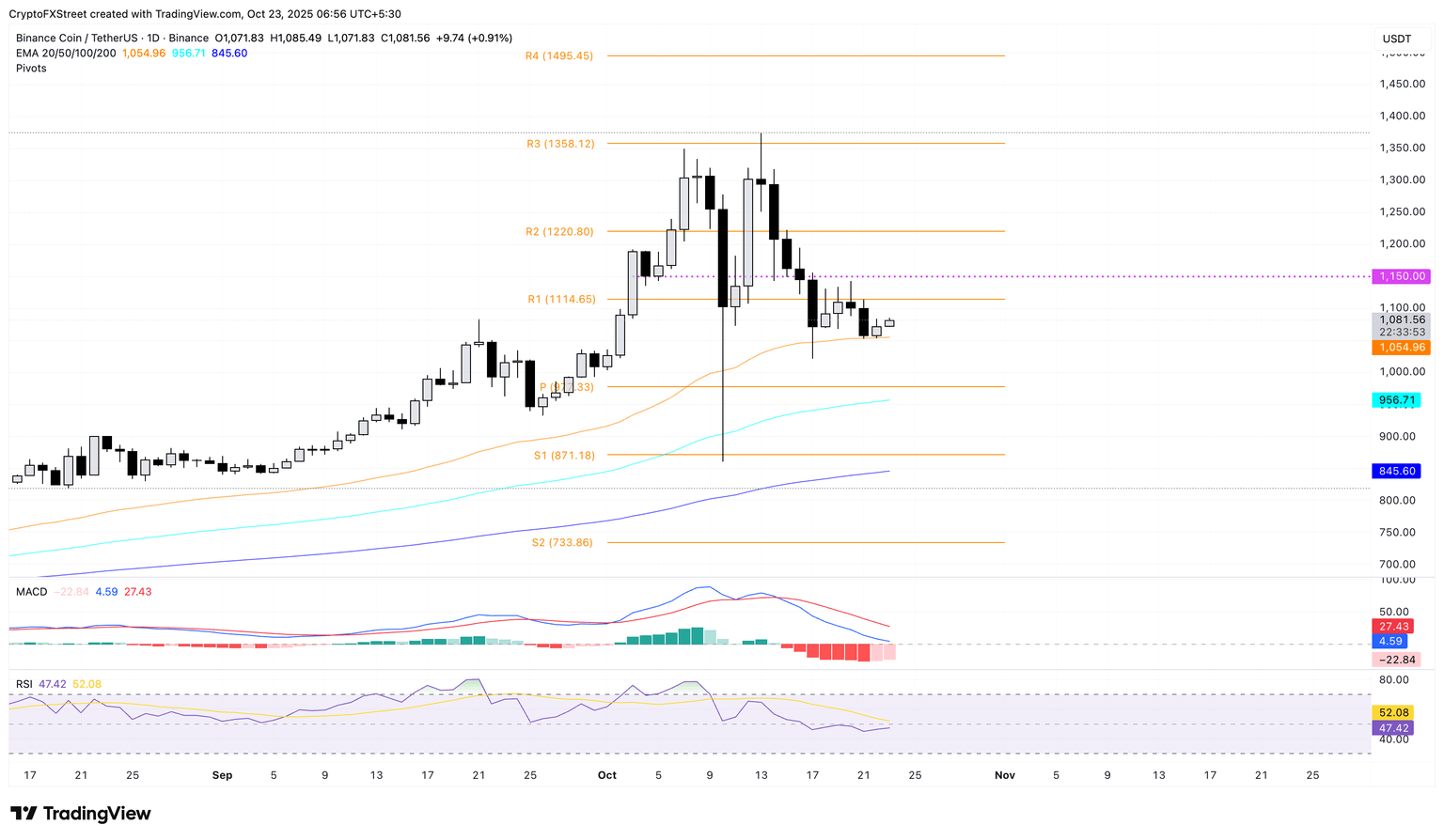

BNB, the native token of the Binance ecosystem, ticks higher for the second consecutive day, extending the bounce back from the 50-day Exponential Moving Average (EMA). At the time of writing, BNB is up 1% on Thursday, trading above the $1,000 mark.

The BNB recovery remains in the shadow of the 4% drop bearish candle formed on Tuesday. A decisive close above the R1 Pivot Point at $1,114 would outgrow Tuesday’s decline, potentially extending the recovery to the R2 Pivot Point at $1,220.

The MACD and signal line take a sideways shift from the downward trendline, suggesting a cooldown in the supply pressure. At the same time, the RSI reads 47, consolidating slightly below the midpoint level, indicating a neutral trend.

BNB/USDT daily price chart.

If BNB drops below the 50-day EMA, it would nullify the recovery run and risk a potential decline to the centre Pivot Point at $977.

Monero eyes further gains as selling pressure declines

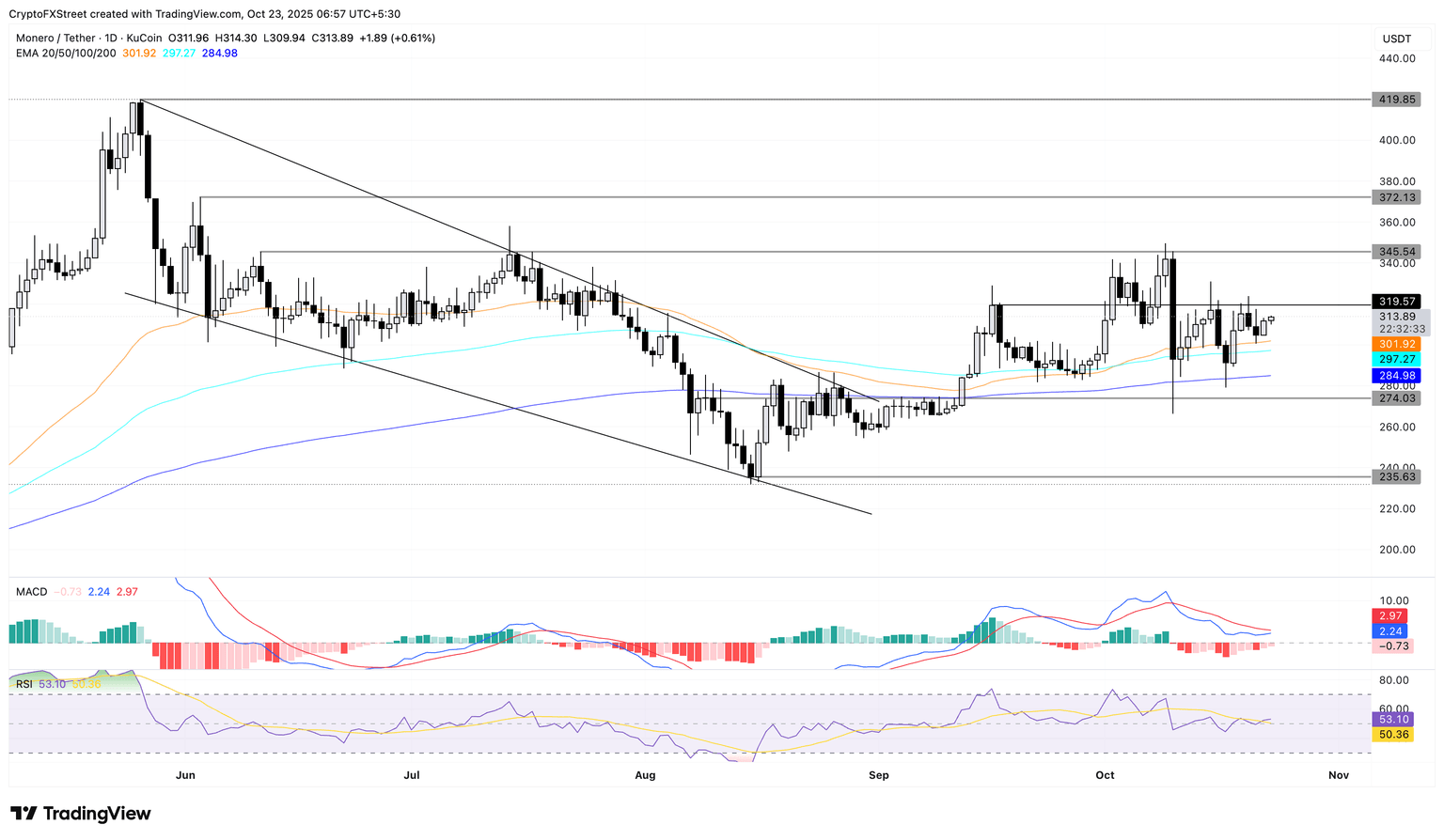

Monero, a privacy coin, trades above $300 at press time on Thursday, approaching the $319 resistance marked by the September 16 close. If XMR marks a successful close above this resistance, it could target the $345 level, previously tested on October 9.

The MACD and signal line are preparing for a crossover, which would signal a rise in bullish pressure. Additionally, the RSI at 53 rises above the halfway line, with space for further gains before reaching the overbought zone.

XMR/USDT daily price chart.

If XMR flips from $319, it could retest the 50-day EMA at $302, followed by the 100-day and 200-day EMAs at $297 and $285, respectively.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.