Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC shows potential for a recovery rally

- Bitcoin price continues to struggle, but a sweep of $19,511 followed by a quick recovery could trigger a recovery rally to $20,692 and $21,874.

- Ethereum price follows Bitcoin’s footsteps and might drop to $1,471 to fill the imbalance.

- Ripple price shows an ascending triangle formation forecasting a 25% breakout from a long-term perspective.

Bitcoin price reveals a bearish start to the week, which would allow market makers to collect the much-anticipated sell-stop liquidity. This development is extremely important as it may set the base for an upcoming BTC and altcoin-wide recovery rally.

Bitcoin price hints at volatility

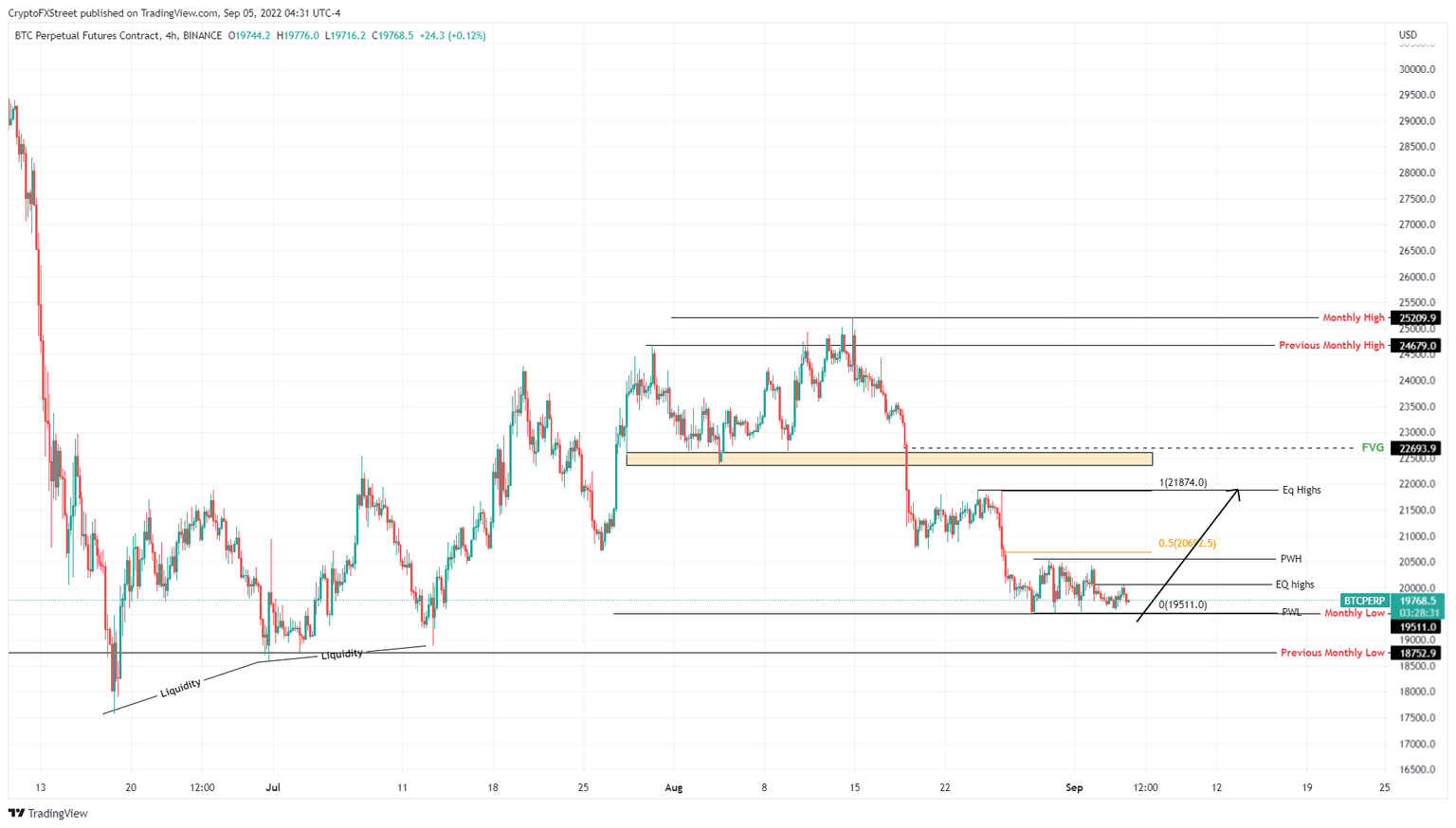

Bitcoin price has created equal lows at $19,511, which also coincides with the August low, making it an extremely important level to watch out for. A sweep of the aforementioned barrier could provide the buy signal for a recovery rally, which will be mainly driven by a reversion to the mean price after a 10% crash.

In such a case, investors can expect Bitcoin price to rally to $20,692, which is the midpoint of the $21,874 to $19,511 range. However, clearing this hurdle will lead to a sweep of the $21,874 level.

BTC/USD 4-hour chart

While things look promising for Bitcoin price, a daily candlestick close below $19,511 could result in the invalidation of the recovery rally. This development will also invalidate the bullish thesis and could further crash to $18,752.

Ethereum price shells out bearish signals

Ethereum price follows Bitcoin price and is attempting to break below the 50% Fibonacci retracement level at $1,563. If successful, it will confirm a bearish breakout and trigger a minor down move to $1,531.

Depending on the selling pressure, Ethereum price could visit $1,505 and fill the imbalance, extending from $1,471 to $1,454.

ETH/USD 4-hour chart

On the other hand, if Ethereum price flips range high at $1,706 into a support floor, it will invalidate the bearish thesis. This development could see ETH revisit $1,730 and, in some cases, $1,800.

Ripple price ready to make a big-time move

Ripple price has produced three distinctive higher lows and five equal highs at $0.381 since June 13. Connecting trend lines to these swing points reveals an ascending triangle. This technical formation forecasts a 25% upswing, determined by adding the distance between the first swing high at swing low to the breakout point at $0.381.

However, Ripple price and its journey north will face a hurdle at $0.439, clearing this level will put the $0.477 target in reach.

XRP/USD 1-day chart

Regardless of the bullish outlook, investors should prepare for a sweep of August 29 lows at $0.318. However, a flip of this level, creating a lower low without a recovery will invalidate the bullish thesis for Ripple price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.