Toncoin Price Forecast: TON risks further losses below the 50-day EMA as bearish momentum increases

- Toncoin’s double-digit drop in the past two days puts the 50-day EMA support at risk.

- The TON Open Interest falls 10% in 24 hours, signaling increasing doubts among traders.

- The technical outlook indicates significant downside risk as the MACD indicator flashes a sell signal.

Toncoin (TON) hits pause to a two-day pullback of over 10% near the 50-day Exponential Moving Average (EMA) at $3.182, but the near-term outlook remains tilted to the downside. TON Open Interest dropped by 10% in the last 24 hours as doubts increase among traders, while the technical outlook indicates a bearish bias as the MACD indicator flashes a sell signal.

Open Interest drops 10% as investors lose interest

Toncoin investors are on edge as it ranks among the cryptocurrencies with the worst performance over the last 24 hours. Investors are pulling capital out of the Toncoin derivatives market, ignoring the $558 million TON treasury commitment by the recently NASDAQ-listed company Verb Technology.

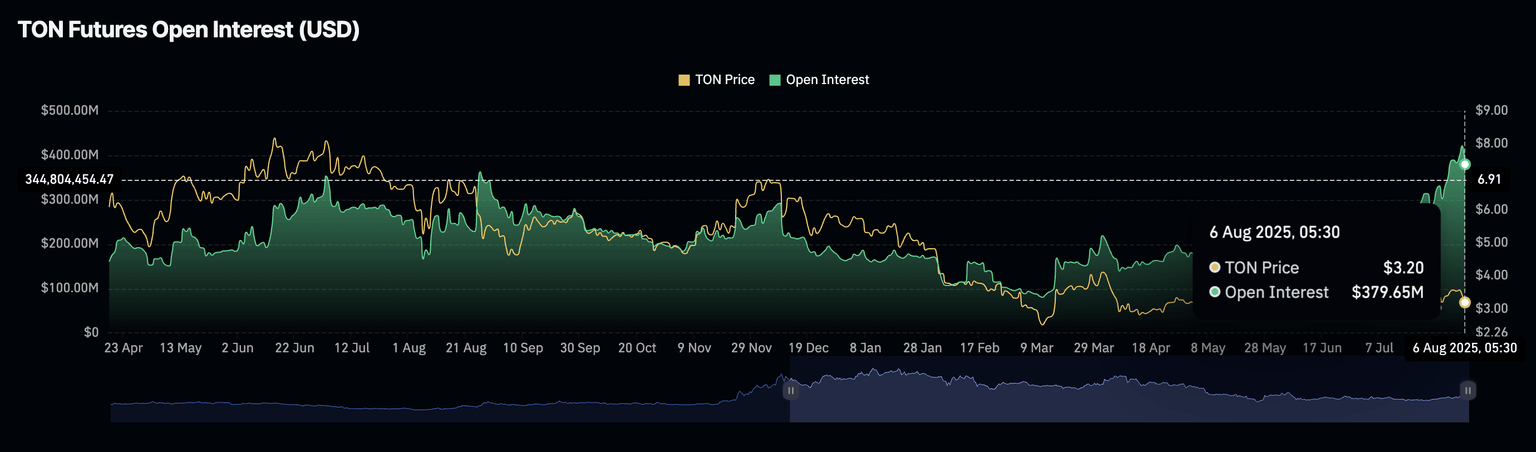

CoinGlass data shows Toncoin futures and options with an Open Interest (OI) drop of 10% to $379.65 million from $421.08 million on Tuesday.

Toncoin Open Interest. Source: Coinglass

Toncoin risks further losses as the MACD sirens sell signal

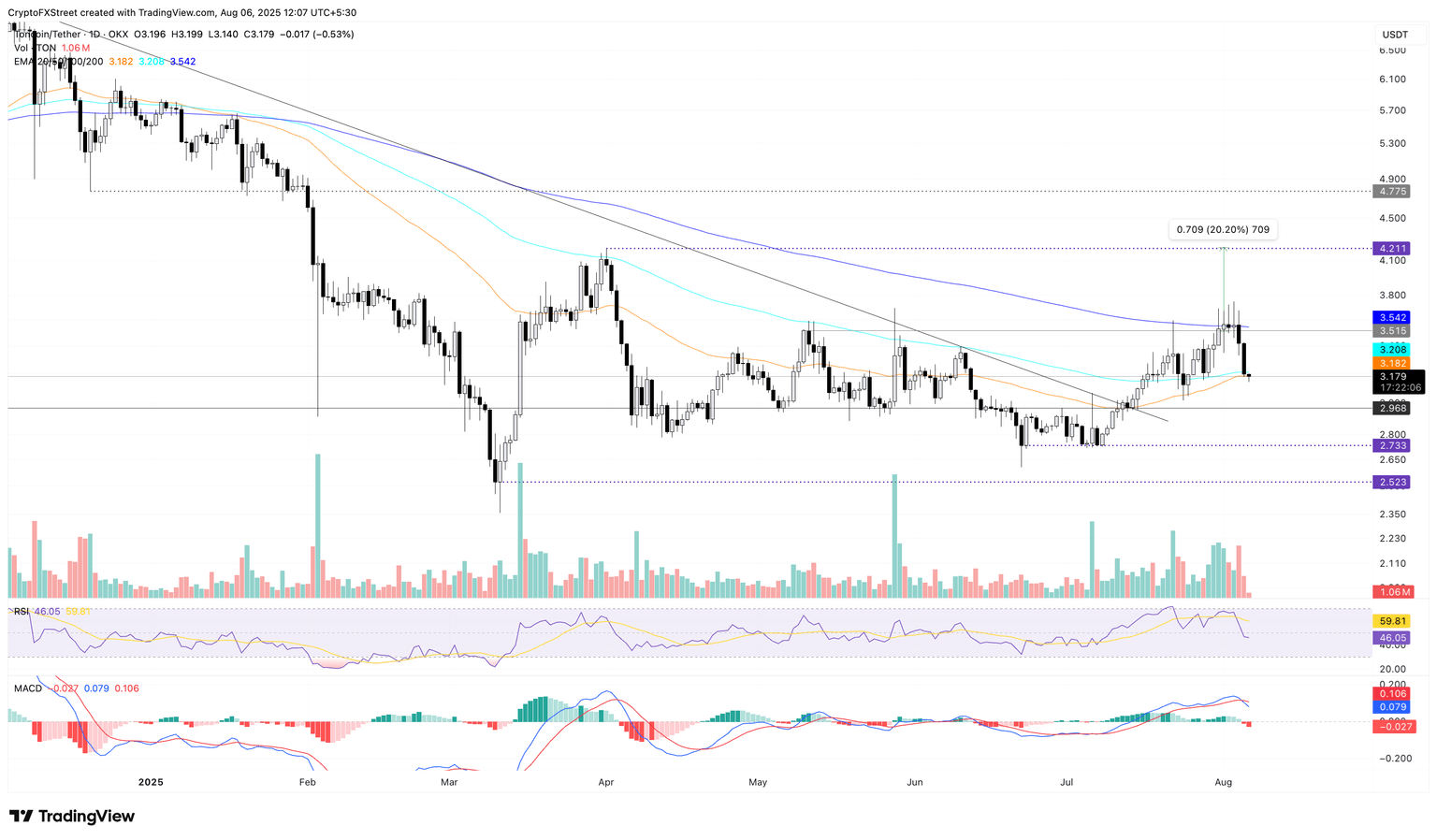

Toncoin prints two consecutive bearish candles for a 10% drop from the 200-day EMA to the 50-day EMA. At the time of writing, TON holds above this dynamic support after visiting a daily low of $3.140 so far on Wednesday.

Toncoin could face further selling pressure as the Moving Average Convergence Divergence (MACD) crossed below its signal line on Tuesday, flashing a sell signal. Adding credence to the declining scenario, the Relative Strength Index (RSI) has fallen to 46, below the halfway line, indicating a decrease in buying pressure.

A decisive close below the 50-day EMA at $3.182 could extend the decline to $2.968, which was last tested on July 15.

TON/USDT daily price chart.

Looking up, if Toncoin bounces off the 50-day EMA, it could rally back to the 200-day EMA at $3.543.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.