This on-chain metric supports a 50% gain for Dogecoin price

- Dogecoin price hints at a minor retracement to the $0.082 support level before a 50% upswing to $0.125.

- Transaction data shows that bulls have legroom up to $0.133, further supporting the bullish thesis.

- A four-hour candlestick close below $0.073 will invalidate the bullish outlook for DOGE.

Dogecoin price reveals an interesting setup that could trigger massive returns for investors. This uptrend will begin after a minor pullback that will allow market participants to accumulate DOGE at a discount.

Dogecoin price prepares for a launch

Dogecoin price has been consolidating around the $0.087 barrier for nearly three weeks. The May 26 swing low at $0.074 marked the deviation’s end and triggered a recovery above the $0.082 hurdle.

This bounce is currently grappling with the $0.087 hurdle but is likely to retrace soon considering the oversold state of the Bitcoin price. Hence, investors can expect the Dogecoin price to correct to the immediate support floor at $0.082.

While an uptrend could potentially originate here, market participants need to keep an open mind about a further retracement to $0.076.

A bounce from either of these levels would likely catalyze a massive move to the upside that will propel Dogecoin price to the intermediate resistance barrier at $0.101, which also coincides with the 200 four-hour moving average.

However, the bulls are likely to extend this move to the $0.125 ceiling, bringing the total gain to 52%.

DOGE/USDT 4-hour chart

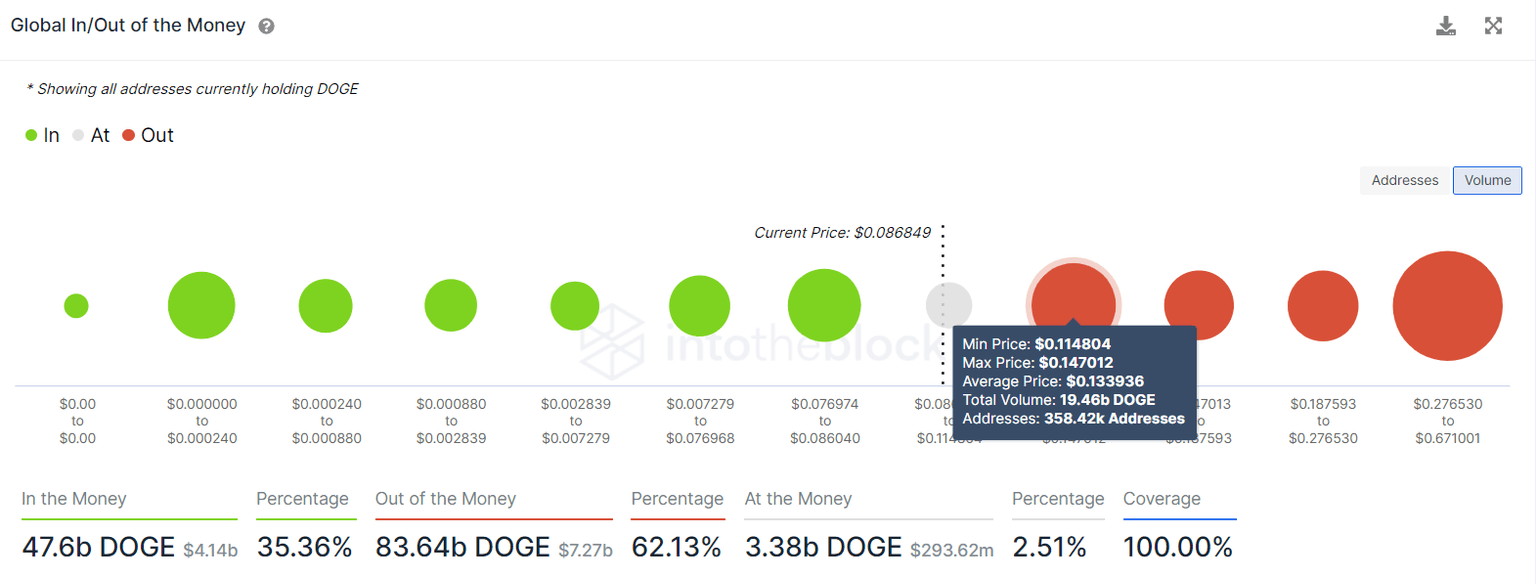

Supporting the optimistic outlook for Dogecoin price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the immediate cluster of underwater investors that purchased roughly 19.46 billion DOGE is present at $0.133.

Roughly 358,000 addresses that bought the meme coin here are “Out of the Money” and are likely to break even and add selling pressure if the Dogecoin price heads into this area. Hence, the upside for DOGE is limited to $0.133.

DOGE GIOM

Regardless of the bullish outlook and the on-chain metrics, if Bitcoin price takes a U-turn, Dogecoin price will promptly follow. In such a case, a four-hour candlestick close below $0.073 will invalidate the bullish outlook for DOGE.

This development could see Dogecoin price revisit the $0.062 support floor, where buyers could regroup and plan another comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.