This is what needs to happen for XRP price to rally 55%

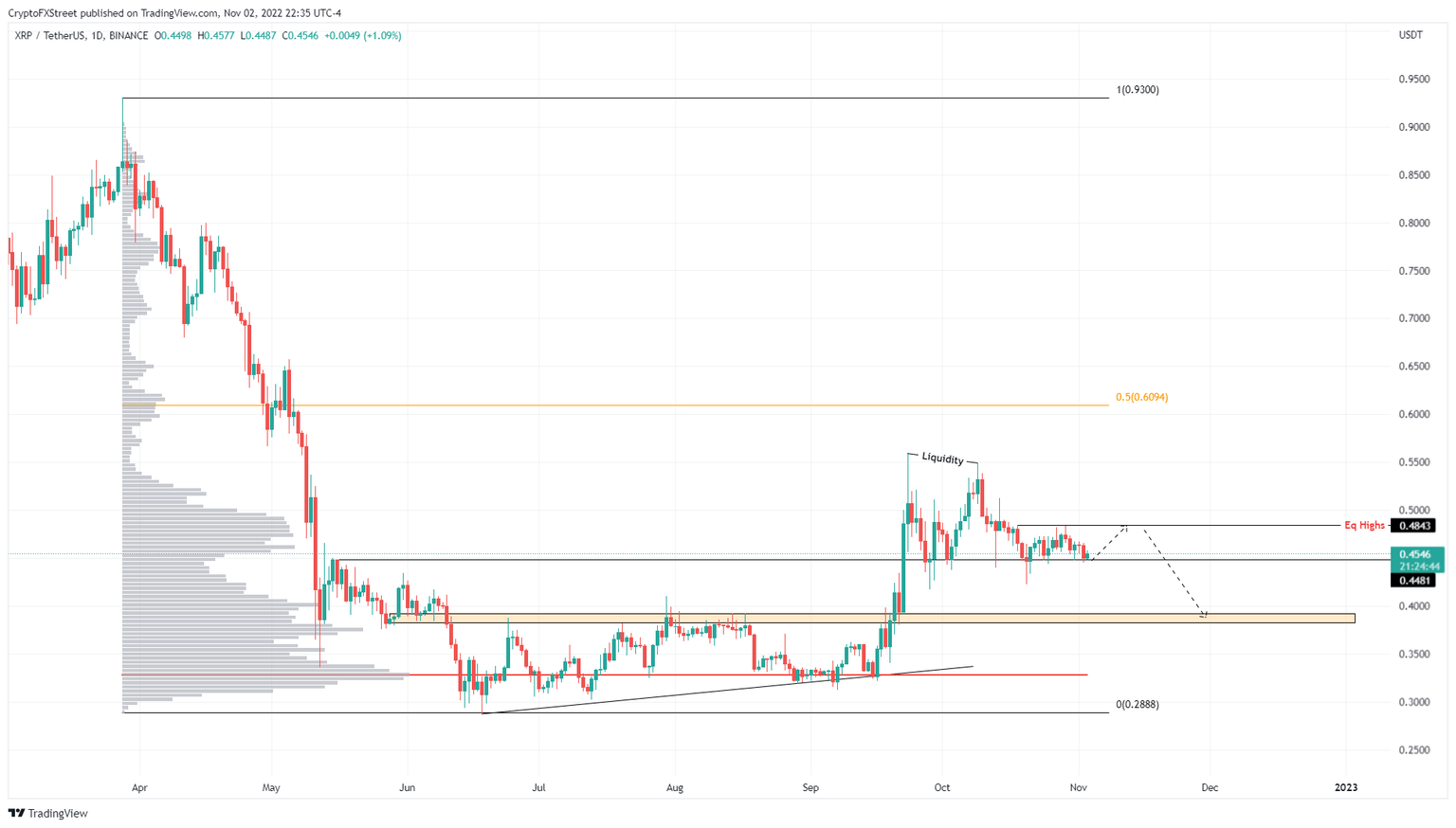

- XRP price shows consolidation above the $0.448 support level after the FOMC meeting.

- Investors can expect a short-term upswing to $0.484, but $0.400 remains a good accumulation level.

- A daily candlestick close below $0.382 will invalidate the bullish thesis for Ripple.

XRP price shows a tight-range formation after the Fed decided on a 75 basis points hike on November 2. This decision triggered a spike in volatility, but Ripple has managed to hold above a stable support barrier. The remittance token is likely to provide an accumulation opportunity for patient holders.

XRP price prepares its game plan

XRP price has been holding above the $0.448 support level since September 22. The remittance token has bounced off this level five times and is likely to aim for the equal highs at $0.484.

If buyers fail to maintain the momentum after this liquidity run, there will be a correction to $0.400, provided the bears mow through the $0.448 support structure. This downswing will be ideal from a market makers’ perspective as it would trap impatient bulls and would blow off steam after the 73% upswing witnessed in late September.

Patient investors can take this opportunity to accumulate XRP tokens around the $0.400 level. A resurgence of buying pressure here could provide holders an opportunity to ride a 55% upswing to $0.609, which is the midpoint of the 69% crash seen in Q2.

This move to $0.609 would complete the mean reversion play of the 69% crash, making it a good place for holders to book profit.

XRPUSDT 1-day chart

While things are looking up for XRP price, a premature move above $0.448 could techncially ruin this bullish outlook. The worst-case scenario would include a breakdown of the $0.382 support level as it would create a lower low and invalidate the optimistic scenario.

This development could see XRP price revisit the $0.330 foothold, where buyers can tend to their wounds and attempt another run-up.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.