Tezos ready for new all-time high as XTZ grapples with crucial support

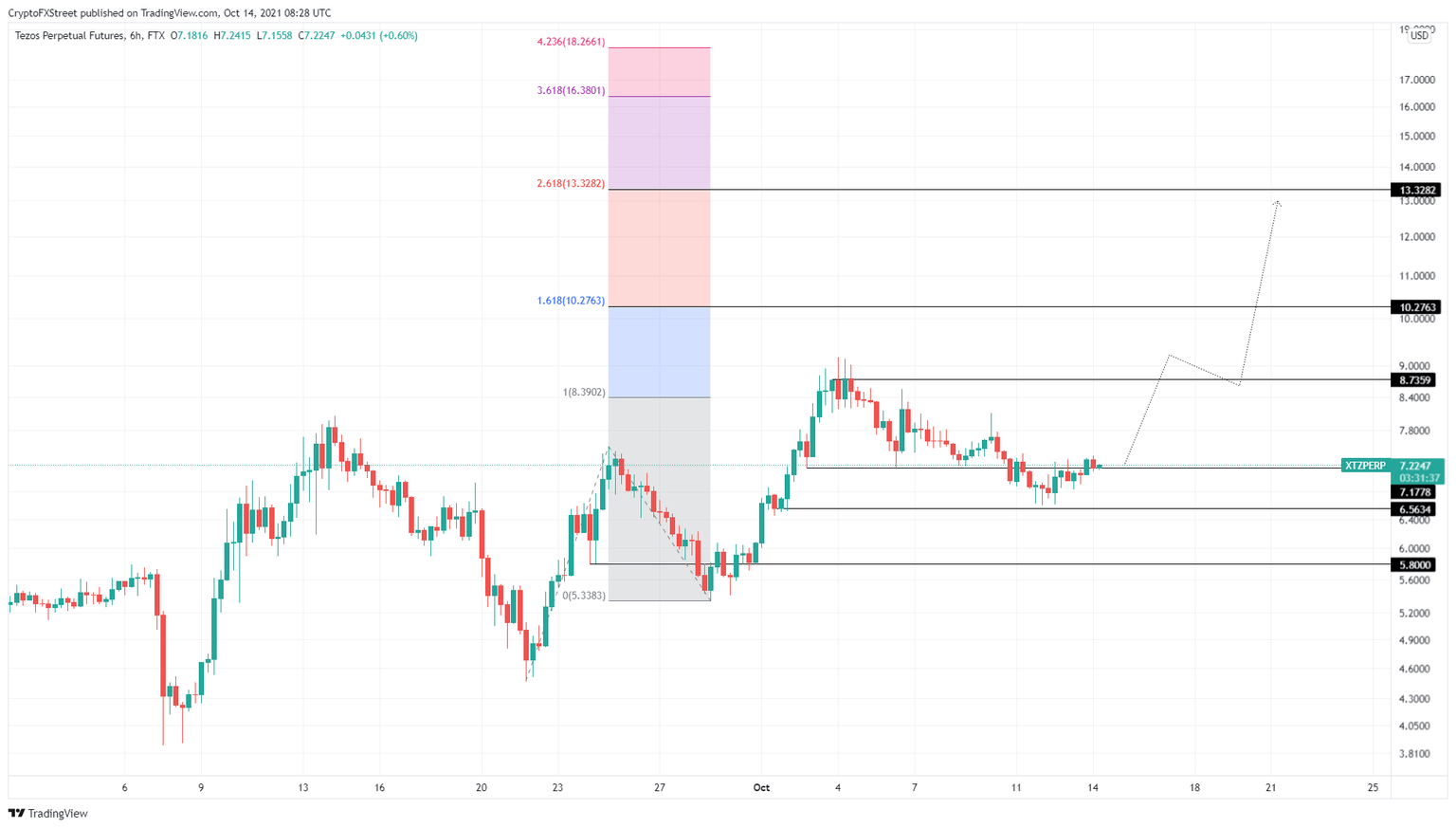

- XTZ price is currently bouncing off the $7.18 support floor.

- A bounce off this barrier will likely propel Tezos by 22% to $8.73.

- A breakdown of the $6.56 demand barrier will invalidate the bullish thesis.

XTZ price has been on a slow downtrend since its all-time high on October 4. This descent has pushed Tezos down to a crucial support floor which will decide its fate going forward.

XTZ price at make or break

XTZ price rose 71% from September 29 to October 4, setting up an all-time high at $9.17. Since this point, Tezos underwent a correction that is stabilizing around the $7.18 support floor. Going forward, it is crucial that XTZ price stays above the $7.18 support barrier to have any shot at an uptrend.

Assuming the buyers step in and win this battle of control, XTZ price will rally 22% to take a jab at $8.73. Clearing the said barrier will allow Tezos to continue its ascent toward the next hurdle at $10.27, a new all-time high.

In special cases, XTZ price could extend toward the 261.8% trend-based Fibonacci extension level at $13.32. This move would represent an 83% climb from the $7.18 demand level.

XTZ/USDT 6-hour chart

While the bullish assumption is plausible, it is based on the assumption that XTZ price wil stay above $7.18. Failing to do so will decrease the chances of a bull rally and knock Tezos down to $6.56.

If the buyers fail to defend this level and produce a lower low below it, it will invalidate the bullish thesis. This development could trigger an 11% descent to $5.8.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.